Whether or not you’re simply beginning along with your on-line retailer otherwise you’ve been in enterprise for years, having the proper insurance coverage is important to defending your organization. However with so many choices out there, it may be difficult to know the place to start.

This information will enable you perceive the fundamentals of ecommerce enterprise insurance coverage and what you could do to get began.

What’s Ecommerce Enterprise Insurance coverage?

Enterprise insurance coverage protects you legally and financially if one thing doesn’t go as deliberate. Insuring your online business reduces threat and protects workers and stock in opposition to numerous worst-case situations, together with provide chain issues and work-related accidents. Buying insurance coverage must be a part of your marketing strategy.

Whereas insurance coverage helps with threat administration, private insurance coverage insurance policies received’t cowl issues like your stock. In the event you’re storing your stock in your storage or residence workplace, your house owner’s insurance coverage received’t defend you. In addition to the tax deduction you’ll get to your protection, different causes to hold enterprise insurance coverage embody defending:

- Workers and prospects, if a product causes harm

- Your online business in opposition to information breaches and cyberattacks

- Stock within the occasion of provide chain issues

- Towards damaged or stolen stock

- Towards breach of contract lawsuits with suppliers or shoppers

As soon as your enterprise achieves a sure earnings stage, you need to put money into business insurance coverage to fulfill contractual obligations. Achievement facilities and main retailers like Amazon typically require a minimal quantity of legal responsibility insurance coverage.

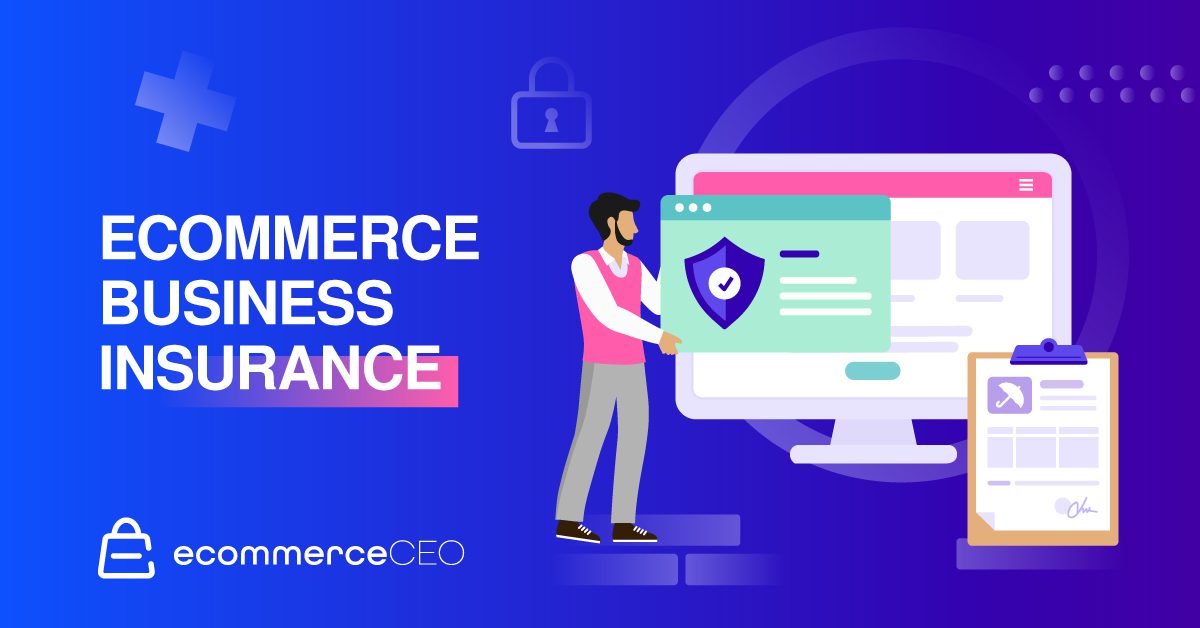

Sorts of Enterprise Insurance coverage and Prices

Relying in your enterprise mannequin, it’s possible you’ll want a number of kinds of insurance coverage to guard your small enterprise.

Normal Legal responsibility Insurance coverage Coverage

Normal legal responsibility insurance coverage will defend your online business if somebody is injured in your property or in the event you’re sued for one thing like negligence or false promoting.

Skilled Legal responsibility (Errors and Omissions Insurance coverage)

This protection protects you from claims arising out of your skilled negligence. In the event you present skilled providers, equivalent to consulting or design work, in your on-line enterprise, it is best to contemplate buying such a protection.

Product Legal responsibility

In the event you promote merchandise on-line, it’s essential to have product legal responsibility insurance coverage to guard you in case your merchandise trigger harm or property injury. Product legal responsibility claims will be very costly, so this protection is important for any ecommerce enterprise.

Enterprise Property

This protection that helps defend enterprise house owners from monetary losses as a consequence of injury to or lack of their enterprise property. This may embody buildings, tools, stock, and different enterprise property. Enterprise property insurance coverage will assist cowl restore or alternative prices and misplaced earnings if the enterprise is pressured to shut as a consequence of injury.

Employees’ Compensation

Employees’ comp insurance coverage is a sort of enterprise interruption insurance coverage that helps to guard companies within the occasion of a work-related harm. This insurance coverage may help cowl medical bills and misplaced wages, in addition to present alternative providers if an worker can’t return to work.

In lots of circumstances, employee’s compensation insurance coverage is required by legislation, and companies should be certain that they’re correctly lined. Employee’s compensation insurance coverage may help guarantee companies can proceed working regardless of an unlucky accident.

Ecommerce companies that don’t have workers aren’t usually required to hold this protection. In the event you’re rising and including workers, converse with an lawyer about your necessities.

Transit

Transit insurance coverage offers protection for damages that happen through the transit of products. This may embody injury that happens whereas the products are being shipped and whereas the products are in transit by rail, highway, or air.

Transit insurance coverage will be bought by companies or people who’re transport items, and it may well defend in opposition to numerous dangers, together with loss, theft, and injury. Transit insurance coverage may give you peace of thoughts when transport your items and enable you keep away from expensive repairs or replacements. If you’re transport items, transit insurance coverage is a crucial consideration.

Cyber Safety Insurance coverage

Given the elevated reliance on know-how for ecommerce companies, it’s no shock that cyber legal responsibility insurance coverage has turn into one of the necessary kinds of protection for these companies. This sort of insurance coverage protects you from monetary losses arising from information breaches, hackers, cybercrime, and so on.

Enterprise Interruption

Enterprise interruption insurance coverage, in any other case referred to as enterprise earnings insurance coverage, may help financially defend a enterprise whether it is pressured to shut or droop enterprise operations as a consequence of an unexpected occasion. Frequent causes of enterprise interruptions embody pure disasters, pandemics, and civil unrest. Enterprise interruption insurance coverage may help to cowl misplaced earnings and bills equivalent to hire and worker salaries.

To be eligible for enterprise interruption insurance coverage, a enterprise should buy a business property insurance coverage coverage. This sort of coverage usually covers bodily injury to enterprise premises and contents. Many enterprise interruption insurance policies have exclusions and limitations, so you will need to learn the wonderful print fastidiously earlier than buying one.

Shopping for Enterprise Insurance coverage

Danger Analysis

To grasp the insurance coverage your online business wants, you need to first conduct a threat evaluation. As your ecommerce firm grows, your online business operations turn into riskier, and you might have completely different insurance coverage necessities as you evolve.

Many dangers are distinctive to your online business and site. As you concentrate on the kinds of insurance policies to hold, contemplate:

- Disasters, pure or unplanned, which will have an effect on your online business

- Accidents which will happen

- The variety of workers you’ve gotten

- Lawsuits it’s possible you’ll face

Understanding the dangers you cope with will higher equip you to decide on the most effective safety for your online business.

Select the Sorts of Insurance coverage

Not all small enterprise house owners require the identical insurance coverage protection. Start with a fundamental normal legal responsibility coverage and add extra protection later as your wants change.

You might buy ecommerce enterprise insurance coverage at a reduced charge by bundling it with different types of protection, equivalent to property insurance coverage, beneath a enterprise proprietor’s coverage (BOP). A BOP is a extra complete answer that features a number of types of ecommerce enterprise insurance coverage. Communicate along with your insurance coverage agent to see if a BOP makes probably the most sense for you.

Get Quotes

As with different kinds of insurance coverage, it’s necessary to buy round and examine insurance coverage merchandise. Attain out to a number of insurance coverage corporations for a free quote, both independently, by means of a web-based market, or by means of a dealer, to get quotes for the insurance policies you want.

Examine Coverage Choices

Examine insurance coverage quotes side-by-side to decide on the one which works greatest for you. Take into account:

- Coverage protection

- Legal responsibility limits

- Cost phrases

- Premium and deductible

- Rankings and critiques

- Firm customer support

The objective is to seek out small enterprise insurance coverage from a good supplier that meets your wants at a worth you may afford.

Buy and Renew Each 12 months

After you select the coverage that makes probably the most sense, buy the coverage or insurance policies you want. Create your on-line account and discover ways to pay, file a declare, contact customer support, and request your certificates of insurance coverage. You are able to do most of this on-line.

Prime 12 Ecommerce Enterprise Insurance coverage Suppliers

Hiscox

Hiscox enterprise insurance coverage is designed to present corporations the safety they should thrive. From property injury to legal responsibility, Hiscox has the protection choices companies want to guard themselves from a variety of dangers. Hiscox additionally provides customizable insurance policies to make making a package deal that meets your wants simpler.

Nationwide

Nationwide provides complete enterprise insurance coverage insurance policies that may be tailor-made to fulfill your particular wants. Bundle reductions make it simple to handle.

The Hartford

As an skilled insurance coverage supplier, The Harford has you’re employed with unbiased brokers to get coverage recommendation. Claims are dealt with in-house, and also you’ll get entry to every little thing through a web-based portal.

You’ll pay $687/12 months for a BOP with $15,000 property safety, $1 million per incidence on the whole legal responsibility, and information breach insurance coverage.

Chubb

Finest suited to enterprise house owners incomes $1 million or much less in annual income, Chubb provides an automatic protection assistant that makes it simple to buy a BPO. You possibly can nonetheless work with Chubb in the event you earn greater than $1 million. You’ll simply must work with an agent.

All insurance policies aren’t out there in all states, and telephone help is just out there if you buy a coverage straight from Chubb as a substitute of an agent.

Geico

Geico provides a wide range of enterprise insurance coverage merchandise to assist defend your organization. From business auto insurance coverage to employees’ compensation, Geico has the protection you could maintain your online business working easily.

Geico provides reductions on sure kinds of enterprise insurance coverage once you bundle them collectively. For instance, it can save you as much as 10% on business auto insurance coverage whereas buying employees’ compensation insurance coverage by means of Geico. And in case you have a number of companies, you may qualify for extra financial savings.

Progressive

Progressive provides a variety of enterprise insurance coverage merchandise, from property and casualty to employees’ compensation and extra. And with versatile protection choices and customised plans, companies can discover the proper safety for his or her particular wants. That stated, most enterprise insurance policies are by means of a 3rd social gathering.

State Farm

State Farm provides a variety of choices to suit the wants of any firm. From property and legal responsibility protection to employees’ compensation and extra, State Farm has a coverage to guard companies of all sizes. And with handy on-line quoting and 24/7 customer support, it’s simple to get the protection you want.

Subsequent

Subsequent Insurance coverage provides numerous insurance policies you should buy individually or bundle collectively for a ten% low cost. In the event you want a specialised sort of insurance coverage, it’s possible you’ll not discover it right here. The net utility makes signing up and getting protection in minutes simple.

biBERK

BiBERK is a division of Berkshire Hathaway, a well known monetary firm. They provide complete enterprise insurance coverage options to suit your particular wants. Whether or not you’re on the lookout for property injury safety, legal responsibility protection, or product legal responsibility insurance coverage, biBERK has you lined. In addition they supply specialised protection for companies in high-risk industries and customizable insurance coverage packages. Not all merchandise can be found in all states.

Allstate

Allstate enterprise insurance coverage is a good way to guard your online business from potential dangers. Whether or not you’re on the lookout for property, legal responsibility, or employees’ compensation insurance coverage, Allstate has you lined. With Allstate, you may customise your protection to suit the precise wants of your online business. They provide handy cost choices and 24/7 customer support.

Vacationers

Vacationers provides a full vary of enterprise insurance coverage merchandise, from property and legal responsibility protection to employees’ compensation and extra. And with over 160 years of expertise, you will be assured that they’ve the data and experience to guard your online business.

USAA

USAA provides a wide range of choices to fulfill the wants of your organization. They will tailor a coverage to suit your enterprise from property and legal responsibility protection to employees’ compensation and enterprise interruption insurance coverage.

FAQs

Now’s the Time to Get Began with Insurance coverage

There is no such thing as a one-size-fits-all reply when shopping for ecommerce enterprise insurance coverage insurance policies to your ecommerce retailer. The easiest way to find out what protection you want is to evaluate your dangers and resolve which kinds of safety are greatest to your firm. Property and legal responsibility insurance coverage are two of the most typical kinds of protection. Nonetheless, many others can be found relying in your wants. When you perceive what you want, purchasing round for quotes from completely different insurers is one of the best ways to seek out the protection that’s proper for your online business at the most effective worth.