These are fairly thrilling occasions for ecommerce. Persons are shopping for by way of on-line buying greater than ever. 22% of retail gross sales are estimated to return from on-line buying. That’s large, contemplating that the quantity was simply 15% in 2019. And it’s nonetheless rising. The ecommerce market is anticipated to be value $5.4 trillion by 2026.

In the event you’re working an ecommerce enterprise, you may get giddy with these prospects. Who wouldn’t need a slice of that candy trillion-dollar pie?

However to benefit from this development, you must arrange your new enterprise for achievement. Reasonably than simply nursing your money stream to be sure you’re earning money, try to be ready to develop and scale. Nevertheless, this may be moderately difficult. Scaling up requires funding. Even when you have deep private pockets to make that funding, you must think about getting exterior financing to fund your corporation’ progress.

Fortuitously, there are a lot of methods to get funding for your corporation lately. Gone are the times when banks and traders are your solely choices for exterior capital. On-line funding platforms have emerged as viable sources for money.

We’ll cowl every part you might want to find out about funding for ecommerce, together with 10 sources you should use to entry funding.

How Your Ecommerce Enterprise Can Profit From Exterior Funding Options

Funding turns into mandatory if you’re seeking to develop and scale to the following degree.

If your corporation is immediately doing nice and demand to your product jumps up, you’ll finally attain some extent the place you’ll be exhausting your capability. Chances are you’ll expertise stockouts or overbookings. These not solely create friction together with your clients. In addition they stall your progress. You don’t wish to be turning clients away.

To beat this, it’s a must to scale your operation. How you must go about it can rely upon the character of your corporation. As an example, stockouts could be averted by having enough stock and environment friendly provide chains.

One factor is for certain – you will want money. Buying extra stock, shopping for tools, renting house, rising your presence and widening attain, and hiring extra individuals all have prices.

As well as, generally, alternatives current themselves immediately. With out prepared capital, you may miss out on the prospect to capitalize, leaving your corporation stunted.

Companies may undergo tough patches. If your corporation focuses on a distinct segment, good gross sales could be seasonal. Having money available additionally serves as some type of insurance coverage that may aid you climate the crunch.

Forms of Funding

Ideally, if your corporation has been booming, you may reinvest your revenue into the corporate. In enterprise communicate, that is referred to as retained earnings. This manner, every part is self-contained. You don’t have to cope with anybody else. You get to proceed rising your corporation in your phrases.

However if you happen to don’t precisely have this functionality, you may think about exterior financing. Conventionally, you will get it both by way of debt or fairness financing with enterprise capital or financial institution loans. These are in any other case often known as loans and investments, respectively. There are additionally rising sorts similar to revenue-based financing and various enterprise financing choices like service provider money advances and bill factoring, that are useful for these with a restricted credit score historical past. Companies may apply for grants or launch crowdsourcing campaigns.

Totally different entities and organizations may give you entry to those methods of funding. You may get loans from banks and lenders. Enterprise capitalists (VCs) and traders can offer you seed and early-stage funding in alternate for fairness.

Ecommerce-specific funding platforms may give you entry to any or a mixture of those funding strategies. They will even present companies with custom-made plans for the expansion space your corporation wants explicitly.

Let’s see how every works.

Debt Financing – Small Enterprise Loans

Debt financing might be the commonest choice on the market. Right here’s how loans work. A lender provides you cash on the situation that it’s a must to pay it again over a time period with curiosity.

For instance, you get a mortgage for $1,000 at 1% easy curiosity and it’s a must to pay it again in a month. That implies that it’s a must to pay the lender again the $1,000 principal and the $10 curiosity after a month. That’s about as primary as loans can get.

Sadly, most loans aren’t as easy. Most debtors want considerably massive sums and an prolonged time period to pay them again. This is the reason typical loans similar to house loans, automotive loans, and enterprise loans are amortized. An amortization schedule maps out how mounted funds are unfold out over a while. A part of every fee is utilized to the principal and the remainder to the curiosity. Amortized loans could seem engaging because you’d know the quantity it’s a must to pay each month.

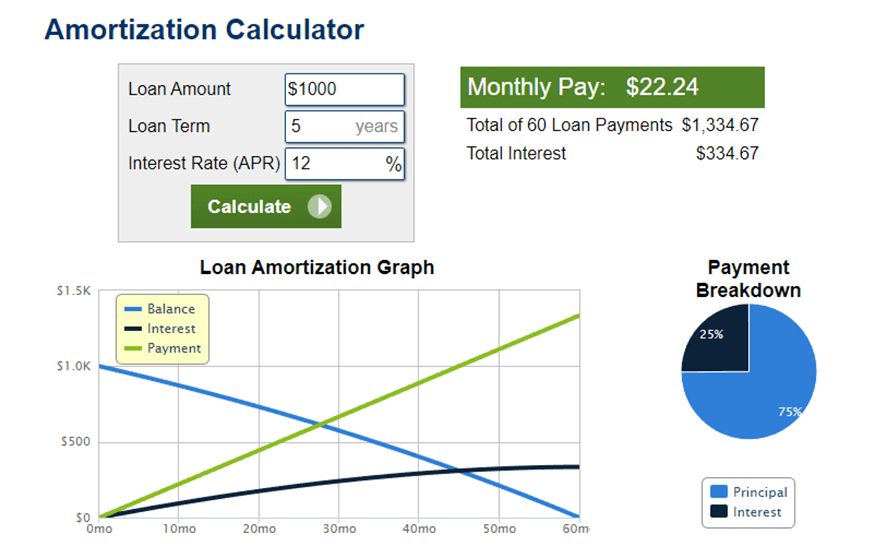

Supply: Calculator.internet

Nevertheless, debtors have to be cautious of how loans work in observe. Lenders often benefit from compounding. Compound curiosity is the sum a lender earns from curiosity. So, when you have a multi-month mortgage, any curiosity that’s left unpaid from the earlier month is included within the following month’s computation for the full quantity.

For instance, you get a mortgage for $1,000 at 1% curiosity a month. That will have a complete value of $1,010. In the event you aren’t in a position to pay any of the mortgage again, all that quantity, together with the $10 curiosity, shall be used to compute the next month’s value. $1,010 at 1% will then have a $1,020.10 whole value. The lender is ready to earn $0.10 extra from the curiosity on curiosity. Take into accout, nevertheless, that that is very simplistic. In actuality, you’ll get penalized must you miss month-to-month funds.

Rates of interest in these amortized loans are often expressed as annual share charges (APR). A 1% month-to-month rate of interest interprets to an APR of 12%. A $1,000 mortgage at an APR of 12% however with a time period of 5 years can have a complete curiosity of $334.67 – a far cry from the $10 further it’s a must to pay if it’s only for a month. However because the month-to-month fee is barely $22.24, it’s comprehensible why some may think about this fairly a gorgeous deal.

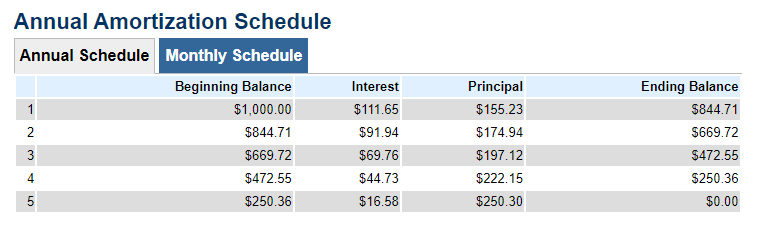

Supply: Calculator.internet

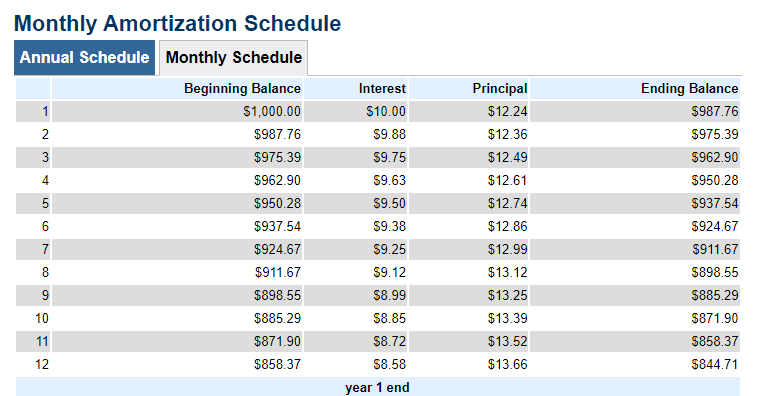

Lenders may use varied amortization strategies. These strategies use particular formulation to compute the month-to-month fee quantity and decide how a lot pays for the curiosity and principal. If we’re going to check out the amortization’s month-to-month schedule, you’ll discover that out of the $22.24 fee, $10 is utilized to the curiosity and the remainder is utilized to the principal.

Supply: Calculator.internet

Funds, particularly within the early a part of the time period, are credited extra in the direction of the curiosity than the principal. By the tip of yr one, you’d nonetheless owe a major quantity on the principal. Over time, the funds in the direction of the principal turns into bigger, which lessens the influence of compounding by the tail finish of the mortgage’s time period.

Supply: Calculator.internet

These mechanisms permit lenders to earn extra from curiosity, particularly for longer mortgage phrases. On prime of this, lenders additionally tack on all types of charges for administration, processing, and documentation. So, the full value of the mortgage can grow to be a lot extra.

Establishments like banks, lending firms, and bank card firms usually present such loans. Different monetary merchandise similar to bank cards, traces of credit score, and money advances are additionally types of debt financing. Solely with these, the cardboard firm or establishment predetermines your most loanable quantity within the type of your credit score or money advance restrict.

You’ll additionally need to qualify earlier than conventional lenders would offer you cash. They’ll typically ask for a lot of paperwork, together with a marketing strategy, to be connected to your utility. Often, you additionally want credit score rating earlier than banks would even entertain your utility.

With bigger loans, it’s possible you’ll even need to put up collateral – a property similar to actual property or different belongings that the lender accepts as types of safety simply in case you may’t pay the mortgage again. In the event you miss funds, you’ll be thought of in default, and the financial institution will have the ability to repossess your property. Lenders are sometimes cautious of lending to startups and small companies with out collateral. They will additionally impose greater rates of interest to debtors that they think about dangerous.

These are why entrepreneurs shrink back from this funding methodology.

Fairness Financing

In fairness financing, an investor would offer you funding in alternate for fairness or half possession of your organization.

You’ll be able to strategy traders and ask for X {dollars} to personal Y % of your organization. These figures shall be primarily based on your corporation valuation. So, if you happen to ask for $100,000 in alternate for 10% of fairness in your organization, you’re basically estimating that your organization is value $1 million.

Sadly, enterprise valuation could be messy. Loads of elements come into the valuation. The method includes counting the enterprise’ belongings and liabilities, money stream, and progress potential. It may possibly additionally think about the individuality of the services or products and precise market demand. The extra optimistic these elements are, the upper the valuation is.

Severe traders will carry out their due diligence. They’ll do background checks on you and the enterprise. They’ll ask to take a look at your books to see how effectively the enterprise really performs. Traders can counter your ask with a unique valuation ought to they’ve their view of how your corporation must be value. Ultimately, you and the investor should agree on all phrases.

Nearly anybody could be an investor in your corporation. However if you happen to’re in search of important funding, you must strategy VCs and angel traders since they usually have the means and sources. Other than getting capital, the benefit of partnering with traders is that they will additionally aid you develop the enterprise. It’s typically within the investor’s greatest curiosity for your corporation to succeed.

A draw back to fairness financing is that you simply’re giving up half possession of your enterprise. Relying on the extent of their buy-in, they will even have a robust affect or management over enterprise objectives and selections. Traders may also count on a return of their funding. They will stress you to generate revenue as quickly as potential.

It’s a must to be certain if you happen to’d wish to go this funding route as a enterprise proprietor. When you tackle fairness funding, it gained’t be your present anymore.

Income-Primarily based Financing

One other type of financing that’s changing into fairly widespread lately is revenue-based financing. Funding from the sort of financing is basically a mortgage. However as a substitute of needing to pay mounted month-to-month installments, companies pay lenders again utilizing a share of their precise earnings or gross sales.

For instance, you get a $1,000 mortgage at 12% curiosity which you comply with pay again utilizing 5% of your month-to-month gross sales. Most revenue-based financing plans work with mounted charges and no compounding. So, it’s a must to pay again $1,120 in whole. Each month, you need to pay 5% of your gross sales. In the event you make $2,000 in gross sales in Month 1, it’s a must to pay $100. If in Month 2, you solely make $1,000 then you definately pay $50. This goes on till you’ve paid off the $1,120 whole.

So, the larger your gross sales grow to be, the faster you may repay your mortgage. However simply in case you endure from poor gross sales, you wouldn’t be as pressured to repay a particular quantity, in contrast to conventional debt-based financing. Your mortgage repayments shall be decrease throughout lean months.

Such a fee scheme does seem extra forgiving in comparison with conventional loans. It’s a actuality that gross sales of companies catering to particular markets and niches fluctuate. This offers companies loads of flexibility and makes taking in exterior financing much less daunting.

As well as, you wouldn’t have to surrender fairness if you go for revenue-based financing since they’re basically loans. You’ll nonetheless personal your corporation.

Service provider Money Advance

By a service provider money advance (MCA), a enterprise can obtain funds in alternate for future credit score or debit card gross sales. It could appear fairly much like revenue-based financing however technically, a service provider money advance isn’t a mortgage. It’s a “sale” of future card transactions. Establishments that supply MCAs typically work with fee processors to instantly get a share of the service provider’s card gross sales till the quantity has been recouped.

Among the many key variations between MCAs and revenue-based financing are the factors for qualification. Income-based financing typically requires a wholesome money stream or a robust gross sales document. Firms that supply MCAs often don’t have such a requirement. Companies with fluctuating gross sales data might discover it simpler to get an MCA than revenue-based financing. They will nonetheless benefit from the flexibility of getting to pay utilizing a share of their gross sales.

Since MCAs aren’t technically loans, they will transcend the rate of interest or payment limits that some lending legal guidelines might have. It’s potential for MCAs to grow to be dearer in comparison with revenue-based financing.

Bill Factoring

Many ecommerce companies have been profitable by establishing outlets in on-line marketplaces like Amazon and Shopify. Nevertheless, among the many frequent complaints of retailers on these platforms is the time it typically takes for the earnings from their gross sales to be launched. Till then, you gained’t have the ability to use the cash for stock or operations.

Much like a service provider money advance, a factoring supplier mainly “buys” your receivables from these platforms. This offers them management over the bill. You’ll obtain round 80% to 90% of the full bill quantity, and also you’ll get the stability as soon as it has been paid by the platform minus the supplier’s charges.

For instance, you have got $10,000 receivables out of your month-to-month gross sales on Amazon. You’ll be able to avail of bill factoring from a supplier and get $9,000 or 90%. The supplier will now have “dibs” in your $10,000 receivables. The supplier will get the receivables as soon as Amazon releases the cash. You’d nonetheless get the remaining quantity minus the payment that’s going to be charged by the supplier. If the supplier fees 3%, it takes $300 from the $1,000 stability, and also you get the remaining $700.

Asset-Primarily based Lending

If your corporation offers with tangible belongings like equipment, tools, or stock, it’s possible you’ll choose to get asset-based loans as a substitute of standard debt financing. Typical loans typically require collateral that may be simply liquidated or bought. Banks and lenders choose actual property, vehicles, shares, and bonds.

Small companies would typically simply have their specialised tools as belongings. With asset-based loans, a enterprise can put up certainly one of these tangible belongings as collateral. For instance, an automotive store can put its tire changer value $1,500 as collateral for a $1,000 mortgage. So, if you happen to don’t make funds, the lender will repossess the tire changer as settlement to your mortgage.

Sadly, since many varieties of tools could be troublesome to promote or liquidate, lenders can demand that you simply put up an asset that’s value considerably greater than the mortgage quantity.

Grants

Grants are basically “free cash” which you could get for your corporation. They’re typically awarded by governments, massive companies, non-profit organizations, and philanthropists as a part of a program they’ve created.

Making use of for grants can contain numerous work. Not solely do it’s a must to persuade the awarding physique that you simply qualify, however you additionally need to show that you simply need to get the cash. Most grants have exact standards. You might have to work on innovation initiatives or help a selected advocacy aligned with the thrust of the grant.

Grant-giving our bodies may additionally impose sure circumstances or require you to ship in your promise.

Crowdfunding

Due to Kickstarter and Indiegogo, crowdfunding has grow to be an appropriate technique of getting companies funded. Mainly, you’ll be counting on the generosity of strangers who’re prepared to simply provide the cash.

Getting your marketing campaign seen could be difficult. Usually, you’d have to vow one thing spectacular to entice donors. For instance, your services or products have to be one thing really thrilling. Other than this, donors must also be the primary ones to come up with your product when it launches, or they need to get early entry and precedence bookings to your service. Most count on bonuses and freebies when changing into a supporter.

Crowdfunding does appear to be too good to be true for companies. You may get funded with little to no strings connected. Nevertheless, many crowdfunding campaigns have turned out to be scams, so individuals have now grow to be much more cautious in selecting which companies or ventures to help.

What to Contemplate When Searching for Ecommerce Financing

We’ve gone over the several types of funding choices out there for ecommerce companies. Now, let’s go over what to contemplate when in search of funding.

Targets

That is maybe crucial factor to contemplate. Why are you in search of funding? If it’s for progress, you must have already got a particular plan on the way you’d scale. Do you want extra stock, tools, or individuals? Are you planning to spend cash on advertising and marketing?

Figuring out that is crucial since it will decide different issues, like how a lot funding you actually need. Some financiers additionally restrict the place you may spend the cash. For instance, some choices would solely assist you to spend funds on one thing bodily or tangible, like stock or tools.

Wants

Primarily based in your plan, you must also know the way a lot you actually need. Other than grants and cash from crowdfunding, most funds should be paid again in some kind and you’ll have to pay curiosity.

You wouldn’t wish to be getting an extreme quantity that you simply’ll wrestle to pay again sooner or later. The precise quantity you want may decide what sort of financing you must get. Most lenders and funders typically have ranges and limits for the cash you will get from them.

Timeline

You must also verify how pressing your want for money is. Banks don’t approve and launch loans inside hours. Offers with traders and VCs don’t shut in a single day. You might have to discover different sources if you happen to’re on a really tight timeline.

Some lenders focus on releasing cash rapidly, however they typically cost extra in curiosity and charges. When you have extra particular necessities like tools or stock, you may go for these specialised lenders and corporations since they will typically act rapidly that will help you resolve your wants.

Funds

Discover phrases that fit your state of affairs. In the event you’re trying into debt financing, try to be weighing what you may afford month-to-month and the full value.

Longer phrases might imply smaller month-to-month funds, however you may find yourself with double or triple the full value. Shorter phrases might imply smaller whole prices, however the month-to-month funds could be steep.

Even if you happen to’re contemplating fairness financing, you must also nonetheless verify when you have what it takes to satisfy your investor’s calls for.

Other than determining these important particulars, there are additionally different issues it’s possible you’ll wish to think about.

Know Who You’re Dealing With

Funders aren’t constructed equally. Some funders deliver one thing further if you cope with them. Traders and a few progress platforms can lend you their experience and networks that will help you obtain your corporation objectives. This help could be extraordinarily priceless if you happen to’re attempting to develop your corporation.

Others might not care about you in any respect. So, it’s a must to be cautious of who you’re taking cash from. Unscrupulous lenders would even wish to see you fail, particularly if you happen to’ve put up collateral that’s extra priceless than your corporation. They could stand to make extra from repossessing your belongings than getting paid.

The Finest Funding Assets for Ecommerce Companies

What’s nice about all of that is that, apart from having many types of funding now out there to small companies at present, the variety of funding outfits can be rising.

Conventional lenders at the moment are seeing competitors from business-focused funding platforms. A lot of them are even specializing in ecommerce. They provide revenue-based financing and different various enterprise funding choices that are extra suited to ecommerce ventures.

In addition they simplify the applying course of and launch funds as rapidly as potential. Other than funding, additionally they provide different value-added providers like progress plans and analytics to assist their funded companies succeed.

Listed here are ten funding sources you may strategy to fund your ecommerce enterprise:

8fig

Beginning the listing is 8fig. It’s an ecommerce funding and analytics platform that appears to assist companies scale by offering custom-made progress plans constructed for fast however sustainable progress.

The platform tries to take the guesswork out of scaling by determining the precise capital you might want to develop your corporation. It integrates together with your ecommerce platform and makes use of AI to research your corporation’ gross sales efficiency, bills, and different monetary information to offer the perfect phrases for funding. Ecommerce companies may use it as a free analytics device for money stream administration even when they select to not obtain funding from 8fig.

Not like most funders, 8fig works with companies with sustainability in thoughts. As a substitute of releasing funds as a lump sum, firms get them in a gentle stream. The platform believes that dropping a big quantity onto a enterprise can disrupt its pure money stream and create problems. It may possibly additionally lead some homeowners to overspend or splurge. These mechanisms assist funded companies transfer in the direction of the best path of their progress journeys.

Companies will need to have a month-to-month income of over $8,000 for 3 months or a yearly income of $100,000 to qualify for funding.

Payability

Payability caters to retailers on ecommerce platforms like Amazon, Shopify, Walmart, and Newegg. It understands that many retailers on these marketplaces might have money stream points because of the time it takes for these platforms to launch cash.

The platform supplies funding choices which are basically service provider money advances and bill factoring. By its Prompt Entry choice, retailers can get a each day advance of 80% of their gross sales from the day past. Payability may buy future receivables by way of the Prompt Advance choice, the place you get 75% to 150% of your month-to-month income. You remit a hard and fast share (12% to 25%) of your gross sales till the advance has been paid.

To qualify for Prompt Entry, you want a minimum of $10,000 in month-to-month gross sales for a minimum of three months. For Prompt Advance, you might want to hit $50,000 common month-to-month gross sales for 9 months.

Wayflyer

Wayflyer helps companies by way of revenue-based financing. The platform supplies versatile funding choices that may be spent on advertising and marketing, stock, and different enterprise wants.

You need to join your market or processor platform like Amazon, Shopify, WooCommerce, or Stripe to Wayflyer. It should then crunch the out there info and offer you funding provides. The platform virtually buys a portion of your whole gross sales and makes funding out there as an advance. Relying on your corporation, you will get funding value $10,000 as much as $20 million.

You’ll want to be in enterprise for a minimum of six months with a mean income of $20,000 a month. The platform solely fees 2% to eight% for every money advance quantity. Wayflyer solely works with companies arrange in choose territories, together with the US, Canada, and the UK.

Shopify Capital

Ecommerce platform Shopify has created a funding program particularly for its retailers. This in-house financing is offered to shops with strong gross sales histories. Shopify hasn’t been public with specifics of how this system works, however if you happen to qualify, you merely get messages containing funding provides.

This system supplies service provider money advances the place you will get $200 as much as $2 million. The quantity could be spent on payroll, stock, and advertising and marketing. The platform deducts a part of your each day gross sales on the platform till the quantity is recouped. It additionally supplies revenue-based financing the place you will get a lump sum which you’ll be able to pay again by way of a share of your gross sales.

PayPal Working Capital

Much like what Shopify has performed for its retailers, PayPal has additionally gotten into the funding house by way of PayPal Working Capital.

This system supplies loans to its enterprise account customers. You’ll be able to avail of loans amounting to 25% of your earlier yr’s gross sales by way of the platform. Nonetheless, the precise quantity relies in your gross sales quantity, account historical past, and previous Working Capital transactions.

It fees one mounted payment and takes a share of every sale as reimbursement for the mortgage. Nevertheless, it requires you to satisfy a minimal reimbursement whole each 90 days, relying in your mortgage quantity. You’ll want to have a PayPal enterprise account for 3 months and course of $15,000 inside the previous yr with no excellent PayPal Working Capital loans to be eligible.

Payoneer Capital Advance

Payoneer is one other fee options supplier that has entered the enterprise financing sport by way of its Capital Advance program.

Capital Advance is geared toward sellers on Amazon, Walmart, and Wayfair. Companies can rise up to 140% of their month-to-month market payouts or as much as $750,000. All it’s a must to do is to attach your market account to Payoneer. The platform will verify your retailer’s gross sales efficiency, and Payoneer will generate funding provides for you.

Payoneer fees a small mounted share of the funding quantity. It takes again a portion of every fee made to your market retailer till the funding whole settlement quantity is collected.

Sellers Funding

Sellers Funding supplies on-line companies with versatile funding choices similar to Working Capital and Day by day Advance. It’s a must to join your market account to the platform, and it’ll verify your eligibility.

It has a few choices for enterprise funding. For Working Capital, you will get anyplace from $5,000 to $5 million with phrases starting from 3 to 24 months with choices to avail of 4 months of interest-only funds. For Day by day Advance, you may rise up to 90% of the day past’s gross sales and get charged a easy price like 1.5%.

For Working Capital, you want a minimum of 6 months of gross sales historical past with $20,000 of internet gross sales per 30 days. For Day by day Advance, you might want to have 3 months of lively gross sales with a minimum of $1,500 internet gross sales per 30 days.

Uncapped

Uncapped is one other on-line business-focused funding supplier. It supplies a number of financing choices, together with revenue-based financing, fixed-term loans, and stock financing.

You may get anyplace from £10,000 to £10 million with charges as little as 2% for revenue-based financing and fixed-term loans. Your on-line enterprise needs to be operational for a minimum of 6 months and generates £10,000 in month-to-month income. For stock financing, Uncapped supplies £10,000 to £10 million or as much as 100% of the stock worth to Amazon sellers.

Uncapped additionally has a selected program for software-as-a-service (SaaS) firms the place they will get loans with charges as little as 0.5% per 30 days with phrases from 6 to 24 months.

Choco Up

Choco-Up supplies funding for ecommerce companies. Firms can get funding primarily based on their efficiency. You’ll be able to join your account to Choco Up and it’ll use your information to compute funding provides.

Funds are robotically deducted out of your checking account and is computed primarily based on a share of the revenues in your related retailer accounts. The speed is mounted and is clearly said within the phrases of your funding. The charges are additionally easy with no compounding curiosity. What’s said on the phrases is what you’ll have to pay.

Your on-line enterprise needs to be up and working for a minimum of six months with a income of greater than $10,000 per 30 days.

Develop into

Develop into matches small-to-medium companies with lenders. By the platform, companies can get related to quite a lot of mortgage merchandise being supplied by completely different lenders. These merchandise can vary from conventional tools loans, startup loans, service provider money advances, bill factoring, and features of credit score.

It does have an ecommerce-specific choice the place on-line companies can get a mortgage of as much as $100,000 by way of the lenders on the Develop into platform. All you might want to do is to attach your Amazon or Shopify retailer account and your advertising and marketing platform account (Fb or Google). From your corporation information, the platform generates a report of your funding viability. You’ll then obtain mortgage provides with various quantities, charges, and reimbursement phrases.

Select the Proper Funding Useful resource for Your Firm

Not like conventional lenders or traders, many of those ecommerce-focused platforms do take a extra proactive and optimistic perspective in the direction of the companies they fund. They already perceive what ecommerce companies undergo. They’ve custom-made their choices to resolve particular funding issues. They know that your success is their success.

Your resolution to get exterior funding shouldn’t be as daunting now that you’ve got choices on how one can go about it. To recap, listed below are some suggestions that will help you select the best useful resource:

- Determine your progress technique. This can aid you decide how a lot capital you’ll have to put your plans into movement.

- Search out the perfect useful resource that gives essentially the most engaging phrases. There’s nothing stopping you from partaking any certainly one of these sources. You’ll be able to think about which form of funding, payment construction, reimbursement methodology, and schedules would work greatest to your state of affairs.

- See what the platform or useful resource has to supply apart from the cash. Some platforms transcend simply offering you with funds. In addition they offer you entry to instruments and insights to information your progress trajectory, they usually may even open up their networks of potential companions.

Finally, this could heat you as much as the concept of getting exterior funding. It simply is perhaps the important thing to your corporation’ progress and success.