ResClub operates within the real-estate MLM area of interest. The corporate seems to have launched in late 2019 and is predicated out of Florida.

ResClub operates within the real-estate MLM area of interest. The corporate seems to have launched in late 2019 and is predicated out of Florida.

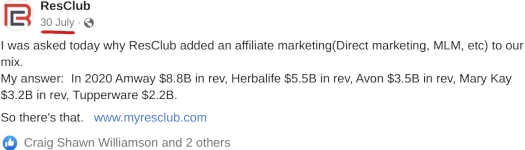

It needs to be famous that, though the corporate has been round since 2019, ResClub as an MLM firm solely launched in mid 2022:

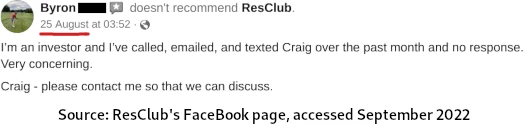

Heading up ResClub is founder and CEO Craig Shawn Williamson.

As per Williamson’s ResClub company bio, he’s

As per Williamson’s ResClub company bio, he’s

been concerned within the Trip Residence Business since 2003 and has over 20 years of expertise within the subject of Branded Funding Luxurious Property by means of positions held with 4 Seasons, Exhausting Rock, Fairfield, AECOM, Nicklaus Company and most just lately with Encore Capital Administration.

So far as I can inform, ResClub is Williamson’s first enterprise as an MLM government.

One other identify I acknowledged on ResClub’s company workforce was VP of International Gross sales, Peter Jensen.

BehindMLM solely just lately got here throughout Jensen in reference to Actual Rise Academy.

We’re assuming Jensen’s government position in ResClub means he’s now not with the corporate.

Jensen has a notable historical past of selling and working MLM pyramid schemes, which ResClub reduces to

over 30 years of profitable international Networking Advertising expertise to the Myresclub Workforce!

PJ has at all times been on the pinnacle of each space in community advertising, constructing a number of the largest gross sales forces within the historical past of the business, producing over 3.5 Billion in international gross sales most notably with YTB Journey!

Jensen did certainly make a reputation for himself as a high promoter of the YTB pyramid scheme.

In 2008 the corporate was sued by California Lawyer Common Jerry Brown.

An out-of-court settlement required modifications to the corporate’s enterprise mannequin, and generated a lower in membership attributed to dangerous publicity.

Jensen left YTB in 2009 and went on to launch AMA Nation in mid 2010.

A yr later in 2011, AMA stole their affiliate’s clients and shut down their MLM operations.

A yr in 2012, Jensen pled responsible to tax evasion. In 2013 he was fined $2.1 million and sentenced to 31 months in jail.

Jensen didn’t serve all the sentence. He was launched early and, in mid 2014, launched RE247365.

RE247365 was a real-estate themed membership pyramid scheme (go determine).

By the top of 2014 RE247365 had collapsed. Reasonably than simply admit he was working a pyramid scheme, Jensen got here up with sob story alleging frozen funds and fraud.

Jensen’s subsequent MLM gig was Grasp Distributor for Direct Cellars in 2016. That lasted till Direct Cellar’s collapse in 2019.

As Direct Cellars was collapsing, Jensen signed on as a “spokesperson/guide” for isXperia in late 2018.

Jensen’s LinkedIn has him in that position till November 2021, after which now we have Actual Rise Academy and, as of mid 2022, ResClub.

Learn on for a full overview of ResClub’s MLM alternative.

ResClub’s Merchandise

ResClub has no retailable services or products.

Associates are solely capable of market ResClub affiliate membership itself.

ResClub affiliate membership offers entry to a passive funding scheme and third-party cashback platform.

ResClub’s Compensation Plan

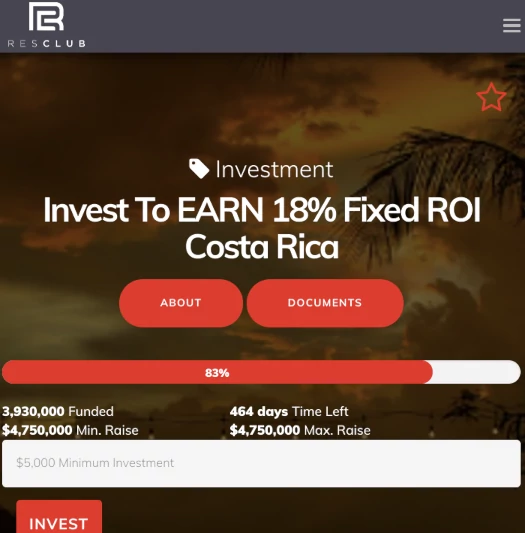

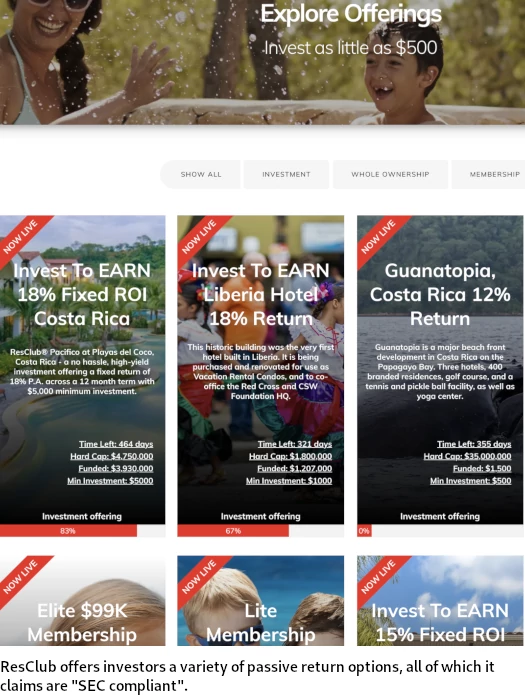

ResClub associates put money into numerous “mounted ROI” real-estate themed alternatives.

Present examples ResClub affords are:

- minimal funding of $5000 paying 15% a yr (pitched as a Florida real-estate funding deal)

- minimal funding of $5000 paying 18% a yr (pitched as a Costa Rica real-estate funding deal)

The MLM aspect of ResClub has nothing to do with its funding scheme. Reasonably, associates earn a proportion of cashback generated by customers they check with ResClub’s cashback platform.

ResClub Affiliate Ranks

There are seven affiliate ranks inside ResClub’s compensation plan.

Together with their respective qualification standards, they’re as follows:

- TA1 – join as a ResClub affiliate and be updated with annual membership charges

- TA2 – recruit an affiliate

- TA3 – one in all your personally recruited associates should recruit an affiliate

- TA4 – one in all your personally recruited associates should recruit an affiliate, who in flip recruits an affiliate

- TA5 – recruit and keep ten associates

- TA6 – have two TA5s or greater in your downline, one every in two seperate unilevel workforce legs

- TA7 – have two TA6s or greater in your downline, one every in two separate unilevel workforce legs, and a TA5 or greater in a 3rd separate unilevel workforce leg

Direct Cashback Referral Commissions

ResClub associates earn 20% of cashback allotted to personally referred customers of ResClub’s cashback platform.

Referred customers may be recruited associates or free retail members.

Recruitment Commissions

ResClub associates pay a $199 annual payment. ResClub makes use of this payment to pay recruitment commissions.

ResClub tracks recruitment commissions by way of a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the high of a unilevel workforce, with each personally recruited affiliate positioned instantly below them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel workforce.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

ResClub caps payable unilevel workforce ranges at six:

- stage 1 (personally recruited associates) – $60

- stage 2 – $40

- stage 3 – $20

- ranges 4 and 5 – $10

- stage 6 – $5

Recruitment Bonus

ResClub associates earn a $100 bonus after they recruit 5 associates.

Journey Commissions

Journey Commissions seems to be a residual fee, paid on booked journey gross sales quantity (that is along with cashback generated by journey bookings).

ResClub pays Journey Commissions by way of the identical unilevel workforce used to pay recruitment commissions (see “Recruitment Commissions” above), capped down seven ranges of recruitment:

- TA1s earn 35% on stage 1

- TA2s earn 35% on stage 1 and 15% on stage 2

- TA3s earn 35% on stage 1, 15% on stage 2 and 10% on stage 3

- TA4s earn 35% on stage 1, 15% on stage 2, 10% on stage 3 and 5% on stage 4

- TA5s earn 35% on stage 1, 15% on stage 2, 10% on stage 3 and 5% on ranges 4 and 5

- TA6s earn 35% on stage 1, 15% on stage 2, 10% on stage 3 and 5% on ranges 4 to six

- TA7s earn 35% on stage 1, 15% on stage 2, 10% on stage 3 and 5% on ranges 4 to 7

Matching Bonus

ResClub pays a Matching Bonus on Journey Commissions, once more paid out by way of the unilevel workforce:

- TA1 to TA3 ranked associates earn a 5% match on stage 1

- TA4 to TA6 ranked associates earn a ten% match on stage 1 and 5% on stage 2

- TA7 ranked associates earn a 15% match on stage 1, 10% on stage 2 and 5% on stage 3

Referral Charge (?)

ResClub’s compensation plan particulars a 5% referral payment.

No clarification is supplied. In mild of the recruitment commissions already detailed, it’s unclear what this referral payment pertains to.

Becoming a member of ResClub

ResClub affiliate membership is $199 yearly.

This payment is waived if a ResClub affiliate participates within the firm’s funding scheme.

ResClub Conclusion

There are mainly two parts of ResClub, the low cost reserving engine and real-estate funding scheme.

The MLM alternative primarily pertains to the low cost reserving engine.

Usually in low cost platform MLM firms we both see commissions paid on use of the platform, or on charges charged to entry the platform.

ResClub does each.

Non-affiliates signup without cost and, in the event that they use the platform, obtain 50% of cashback ResClub receives from the third-party that really owns the platform.

ResClub associates obtain 20% of the 50% cashback quantity, presumably taken out of ResClub’s 50% cashback share.

Journey reserving has its personal fee construction, though it needs to be famous that sometimes journey fee margins are razor-thin to start with.

In a nutshell a ResClub affiliate has to earn greater than $199 yearly to make again their charges.

Observe I did see a barely costlier month-to-month choice in ResClub’s compensation plan. After I ran by means of the signup course of on ResClub’s web site nonetheless, solely the $199 annual choice got here up.

In any occasion, making again $199 in cashback and journey reserving commissions will seemingly show tough for almost all of ResClub associates.

That’s the place recruitment commissions kick in. Join, pay $199 and recruit others who do the identical. Commissions earned by means of this are prone to properly exceed something earned by way of the low cost platform (together with cashback).

The hazard right here is that if nearly all of commissions ResClub are paying our tied to affiliate membership charges, that may make it a pyramid scheme.

I think that’s the case. And this primarily comes right down to retail members not paying to entry the platform.

It’s a catch 22. If ResClub tied rank development to retail membership, they run the chance of not producing income if free members don’t truly use the platform.

If ResClub costs non-affiliates to make use of the platform, such is competitors within the cashback area of interest as of late that advertising it to non-affiliates seemingly wouldn’t be viable.

And so now we have each retail cashback commissions combined with straight recruitment commissions, with the latter seemingly making up nearly all of commissions paid out.

Shifting on, ResClub’s funding scheme is clearly a securities providing.

ResClub associates join and make investments $5000 (generally $1000 is quoted), on the promise of a set annual ROI.

Make investments To EARN 18% Mounted ROI Costa Rica

ResClub Pacifico at Playas del Coco, Costa Rica – a no trouble, high-yield funding providing a set return of 18% P.A. throughout a 12 month time period with $5,000 minimal funding.

This return is totally passive and is predicated on the efforts of others (ResClub), making it a securities providing as per the Howey Take a look at (used to determine funding contracts for the aim of securities regulation).

Being primarily based out Florida, it follows that almost all of ResClub associates are additionally US residents.

With the intention to legally supply securities to US residents, MLM firms must be registered with the SEC.

A search of the SEC’s Edgar database reveals neither ResClub or Craig Shawn Williamson are registered.

This can be a clear-cut case of securities fraud.

Regardless of not being registered with the SEC and providing US residents passive annual returns, ResClub maintains its funding scheme is “SEC compliant”.

Securities fraud is a violation of the Securities and Change Act. Pretending securities fraud is “SEC compliant” is ridiculous.

Along with its “short-term” annual ROI funding scheme, ResClub additionally affords long term funding plans.

These price much more, $49,500 to $198,000 and final for as much as 30 years.

I didn’t actually cowl this as most buyers are most likely going to go for the 15% to 18% annual short-term returns, over the far costlier 5% to eight% long-term funding returns.

Mathematically it doesn’t make a lot sense to trouble with ResClub’s long-term investments. Simply roll over the short-term yearly.

Given ResClub has been advertising its real-estate funding scheme (with out MLM) since 2019, and Williamson does seem to have a historical past in real-estate, I don’t assume there’s a Ponzi scheme at play right here. No less than not a full-blown one.

Nevertheless it does beg the query why ResClub haven’t registered with the SEC.

Each day return MLM Ponzi schemes can final just a few months in the event that they take off. Month-to-month ROI MLM Ponzi schemes can final just a few years.

ResClub are paying annual returns. With out audited monetary reviews filed with the SEC, one can’t rule out ResClub shuffling new funding round to pay earlier buyers.

In lieu of audited monetary reviews filed with the SEC, ResClub claims buyers are protected by means of a “$50 million steadiness sheet”.

The sources of revenue for ResClub are Trip Rental and Rental Bookings. The worth of the membership funding is held within the minimal 30% fairness we keep in every Membership property.

5 years is the common scheduled maintain for many properties inside the ResClub portfolio. Buyback is achieved by reserves from revenue and fairness held in properties.

Moreover, we supply a $50 million steadiness sheet reserve for emergencies.

With out audited monetary reviews, such assurances are meaningless.

One thing else to think about is that if ResClub has been round since 2019, why then hasn’t its 15% to 18% annual ROI scheme taken off?

Site visitors to ResClub’s numerous web sites is under SimilarWeb’s monitoring threshold. If this picks up we will attribute development to the brand new MLM mannequin.

However the query stays, why hasn’t ResClub taken off by itself within the virtually three years it’s been round?

Securities fraud is a red-flag showstopper on the subject of MLM due-diligence. Strategy with excessive warning.