Estimated learn time: 19 minutes, 29 seconds

For those who’re presently utilizing 2Checkout or Stripe to promote digital items or SaaS however are contemplating switching — to the opposite, or to different choices resembling FastSpring — it’s possible you’ll be questioning whether or not there are substantial variations between the platforms and their providers.

In reality, there are some main variations when evaluating 2Checkout vs. Stripe vs. FastSpring.

TL;DR: Stripe markets themselves as a cost providers supplier (PSP), 2Checkout is a cost service supplier with an improve choice to make them your service provider of report (MoR), and FastSpring is a complete service provider of report from the outset.

What does all of that imply?

On this article, we’ll break down key variations between cost service suppliers and retailers of report, then we’ll clarify what every of the above firms are and what essential options they provide.

For those who’re on the lookout for a cost providers supplier and service provider of report that can assist you develop your online business internationally, we will help. FastSpring gives an all-in-one cost platform for SaaS, software program, video video games, and digital merchandise companies, together with VAT and gross sales tax administration, cost localization, and client assist. ? Arrange a demo or attempt it out for your self.

Cost Gateways, Cost Processing, PSPs, MoRs — What’s the Distinction?

A number of clarifying definitions can be useful for understanding the variations between 2Checkout vs. Stripe vs. FastSpring.

Cost Providers Supplier

A cost providers supplier (PSP) is a platform that serves as a bridge between companies desirous to promote a product, and the extra specialised providers and networks you want on the again finish, like cost gateways, cost processors, and a service provider account.

A PSP makes it simpler for these companies to promote their merchandise on-line as a result of the companies don’t need to straight interface with cost gateways and cost processors — the companies can simply use the PSP, and the PSP will deal with cost connections within the background.

TL;DR: What’s occurring behind the scenes is all fairly sophisticated. A cost gateway acts as a safe tremendous freeway to attach companies to cost processors. It collects, encrypts, and transmits the delicate data wanted for a transaction. A cost processor is the piece on the again finish that connects the cost gateway with the service provider’s account and card affiliation networks. The issuing and buying banks can then authorize or deny the transaction request. A service provider account is a business-specific checking account that means that you can settle for and course of funds from credit score and debit playing cards; it’s the place the funds are held till the transaction is accomplished.

If all of that sounds actually sophisticated to you, it’s — that’s the enchantment of a cost providers supplier that may deal with all of that for you.

Service provider of Document

A service provider of report (MoR) consists of the providers of a cost providers supplier, however far more — it turns into the entity technically promoting the product.

This implies the MoR turns into the entity worrying about card model guidelines, regulatory guidelines in lots of geographies, danger, and even taxes — which suggests you don’t need to. FastSpring’s specialists will use the most recent instruments and strategies to handle danger, and we’ll even be answerable for calculating, accumulating, and remitting taxes.

Service provider of report and cost providers supplier platforms could every supply various ranges of further options, resembling integrations and API connections, subscription administration performance, buyer assist, and extra.

For those who’re on the lookout for a cost providers supplier and service provider of report that can assist you develop your online business internationally, we will help. FastSpring gives an all-in-one cost platform for SaaS, software program, video video games, and digital merchandise companies, together with VAT and gross sales tax administration, cost localization, and client assist. ? Arrange a demo or attempt it out for your self.

What Is Stripe and Who Is It For?

Stripe is a cost providers supplier that focuses on funds, payouts, and managing enterprise on-line.

The various merchandise on Stripe’s menu are typically bundled and typically separate for an extra price, which may get slightly complicated as you click on by way of varied product pages.

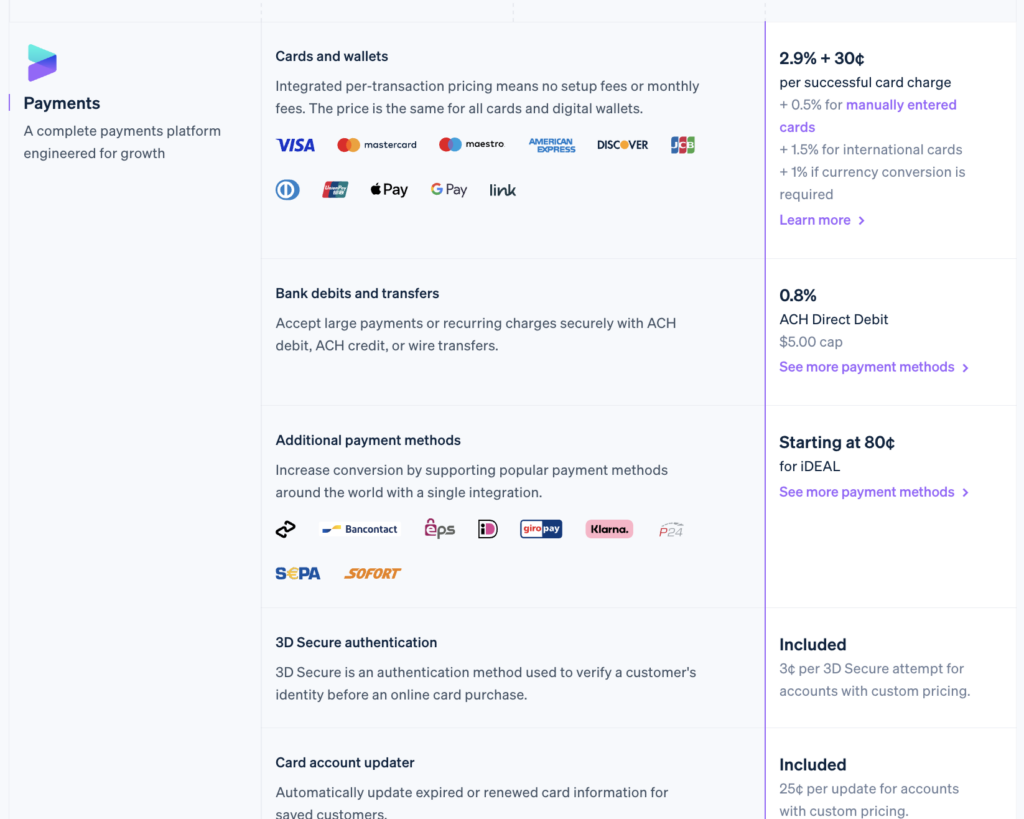

The core providing for funds is their Funds product, which incorporates the merchandise Checkout, Cost Hyperlinks, and Join, however there are lots of options even inside these merchandise which are further prices, resembling further cost strategies, financial institution debits and transfers, and post-payment invoices.

Pricing begins low per transaction, however it can add up rapidly in the event you’re on the lookout for a extra strong service.

No. Stripe as a PSP doesn’t assume the identical tasks an MoR does, resembling managing danger, helping with chargebacks, and dealing with taxes. When guidelines change in anyplace the place your product is being offered, you’re answerable for updating your checkout to conform.

Stripe does supply Radar, a product with two completely different ranges of fraud and danger administration instruments, however if you would like the superior instruments, it can price further per transaction.

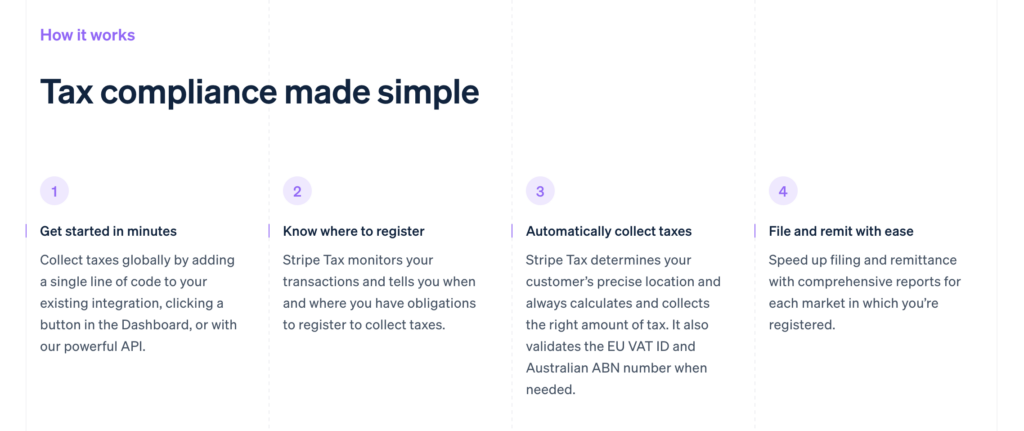

Stripe additionally gives a Tax product that may calculate, accumulate, and report taxes in 40+ nations, however you continue to need to register in every jurisdiction your self, export the tax transaction information, after which file the tax returns and remit the taxes your self.

As a result of Stripe is not a service provider of report, it may be used for promoting bodily items, however its platform and providers will not be as tailor-made to companies that had been constructed to promote solely digital items, software program, SaaS, and comparable.

What Is 2Checkout and Who Is It For?

2Checkout (now Verifone) payments themselves as a monetization platform for each digital items and retail companies. The pricing web page at 2checkout.com reveals that with their 2Sell base product, you may “promote any kind of product.”

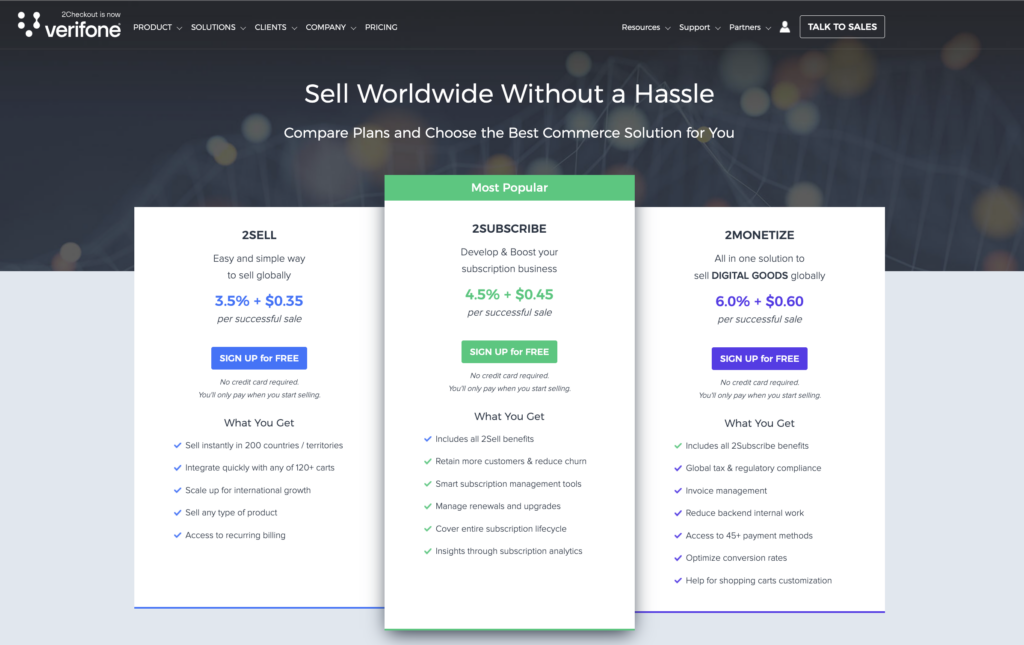

They provide three completely different ranges of merchandise: 2Sell for cell and on-line funds worldwide, 2Subscribe so as to add on subscription administration options, and 2Monetize to additional add options resembling world tax and regulatory compliance, bill administration, and extra cost strategies.

Additionally they have further add-ons for renewal restoration, premium assist, and for 2Monetize, affiliate partnering. Additionally they have an enterprise pricing bundle referred to as 4Enterprise.

Is 2Checkout a service provider of report?

2Checkout gives each a cost providers supplier mannequin and a service provider of report mannequin. Whereas their 2Monetize web page and MoR information web page don’t reference one another, 2Monetize is seemingly 2Checkout’s MoR product.

What Is FastSpring and Who Is It For?

FastSpring is a service provider of report that for nearly twenty years has been serving B2B and B2C companies that supply digital merchandise, SaaS, and downloadable software program.

Our funds options assist companies go world immediately, however as a result of we’re inherently an MoR, we additionally assist companies improve profitability whereas mitigating danger — all whereas decreasing your funds, gross sales tax, and subscription administration tech stack down to 1 resolution.

FastSpring gives world funds, a number of sorts of checkouts, subscription administration instruments for each stage of the subscription life cycle, fraud prevention, chargeback administration, tax compliance, and extra — all of that are included.

We’re related to a number of cost gateways, growing cost authorization probability, and we’re laser targeted on making it tremendous simple to make sure you’re following all the principles — as a result of our specialists are answerable for danger and chargebacks.

FastSpring’s pricing is an easy, single-package pricing mannequin, not a base plan that requires a number of costly add-ons. Our workforce will work with you to determine a charge based mostly in your transaction kind and quantity. Word that there isn’t any minimal transaction quantity to make use of FastSpring, as we need to be the digital commerce accomplice that helps your online business develop.

For extra pricing data, attain out to our workforce.

Is FastSpring a service provider of report?

Sure! FastSpring is a service provider of report, which implies that we’ll deal with cost providers, however we’ll additionally change into the occasion really promoting the product, so we’ll handle danger, chargebacks, and world VAT and taxes — so that you don’t need to.

For those who’re on the lookout for a cost providers supplier and service provider of report that can assist you develop your online business internationally, we will help. FastSpring gives an all-in-one cost platform for SaaS, software program, video video games, and digital merchandise companies, together with VAT and gross sales tax administration, cost localization, and client assist. ? Arrange a demo or attempt it out for your self.

Key Options

For those who’re contemplating implementing a cost providers supplier or service provider of report for your online business — or contemplating switching suppliers — there are lots of options it’s possible you’ll have to find out about earlier than making a call.

Listed here are some necessary choices to assessment and the way 2Checkout, Stripe, and FastSpring deal with every of them.

2Checkout vs. Stripe vs. FastSpring: Cost Processing Options

Every supplier’s primary cost capabilities embody some mixture of debit and bank card funds, different cost varieties, localized currencies, chargeback dealing with, fraud detection, and extra to assist guarantee a profitable sale.

Stripe

Stripe accepts round 9 completely different playing cards, together with world manufacturers like Visa and Mastercard, U.S. and Canada’s Uncover, Europe’s Cartes Bancaires, and Asia’s China Union Pay. Additionally they take varied financial institution debits resembling ACH and SEPA, redirects, and transfers that join on to financial institution accounts, and so they work with many standard pockets cost techniques (however not PayPal). To be taught extra, go to their documentation web page on cost strategies.

Stripe additionally helps processing costs in over 135 currencies. Forex conversions get slightly sophisticated, so take a look at their documentation on foreign money conversions for all the main points.

Further charges are utilized for foreign money conversion and cross-border transactions.

Chargeback safety and fraud safety are additionally obtainable, each for added charges per transaction.

2Checkout

2Checkout accepts main worldwide credit score and debit playing cards resembling Visa and Mastercard, in addition to varied different regional playing cards throughout Europe, Asia, Brazil, and India. Varied main digital wallets are additionally accepted, as are some on-line banking and direct debit cost choices. For offline cost strategies, 2Checkout additionally facilitates wire/financial institution transfers, buy orders, and some region-specific choices; go to the Verifone documentation web page on cost strategies for extra particulars.

On their documentation web page for pricing localization, it particulars that pricing localization settings could be enabled to show completely different costs based mostly on geolocation by IP handle, however that this function is just obtainable to 2Checkout Enterprise Version accounts. 2Checkout gives round 100 billing currencies.

Danger and fraud safety are included in all three packages, 2Sell, 2Subscribe, and 2Monetize. 2Checkout states that whereas banks deal with chargebacks straight, 2Checkout continues to be concerned within the decision of the dispute, performing as a mediator between the financial institution/PayPal, the customer, and also you.

FastSpring

FastSpring accepts many main worldwide bank cards and debit playing cards resembling Visa, Mastercard, American Specific, Uncover, JCB, and UnionPay, in addition to ACH direct debit and SEPA direct debit. Wire availability is obtainable in choose nations and currencies, in addition to PayPal, Apple Pay, SOFORT, and varied different standard cost choices that are detailed on FastSpring’s documentation web page for cost strategies.

FastSpring allows its customers to arrange their shops to show foreign money localization in many alternative methods, based mostly on what’s finest for your online business. FastSpring could make the conversion, or you may set a set value in every foreign money for every of your merchandise; which foreign money is displayed based mostly on location could be chosen by FastSpring, by you, or by the patron.

To stay a pacesetter in fraud and danger assist, FastSpring is partnered with world danger evaluation and fraud prevention chief Sift to maintain transactions safe with elevated accuracy in fraud selections and higher approval charges (and fewer false positives).

And since FastSpring is a service provider of report, we’re answerable for retaining fraud charges and chargebacks underneath sure thresholds. For those who want assist help with chargebacks, our Danger workforce will help, and the FastSpring platform additionally features a Chargeback Overview Dashboard that can assist you preserve observe of chargeback charges, which merchandise are most often concerned, and a complete log of the newest chargebacks with filters that can assist you drill down for evaluation.

2Checkout vs. Stripe vs. FastSpring: Platform Options

Moreover the web cost processing options and providers which are core to PSPs and MoRs for on-line companies, the platforms and the way they combine with your online business (and web site) could make or break how properly they assist your online business transfer product and assist a profitable sale.

Listed here are rundowns on checkout, payouts, integrations, APIs, reporting, and analytics for 2Checkout, Stripe, and FastSpring.

Stripe

Stripe gives a hosted, brandable checkout for each one-time funds and recurring funds, which could be embedded by yourself web site, or you may pay a month-to-month payment to make use of their hosted checkout with a customized URL of your personal. They’ve a software to stroll prospects by way of the customizations they provide so you may see what the checkout web page may appear like.

Many elements go into how and when you may obtain payouts from Stripe, particularly dependent in your nation, so you should definitely take a look at their documentation web page for extra data. However in the event you’re in an eligible nation, you might be able to obtain day by day payouts (though weekly, month-to-month, or handbook schedule choices may be obtainable). Stripe’s multi-currency assist for payouts seems to incorporate the identical currencies as their presentment currencies, which means that in the event you can course of funds in a foreign money with Stripe, you may obtain a payout in that foreign money.

Stripe has a listing of companions that will supply integrations or connections to Stripe for ease of use, however they provide restricted assist on this space and refer customers to the third events for help when wanted. Additionally they have a REST API, with Cost objects used to facilitate funds, in addition to SDKs.

A few of Stripe’s monetary reviews are free, however for extra superior instruments, you’ll have to improve your account and/or request beta entry. For instance, Superior Income Reporting and Reconciliation Automation are nonetheless in beta, and their customized reporting providing utilizing SQL, referred to as Sigma, begins at 2¢ per cost with a potential infrastructure payment.

Stripe gives some sturdy analytics instruments, resembling through their cost authentication report, however that requires their Sigma product.

2Checkout

2Checkout gives a number of checkout varieties. Customers can select between one-step or multi-step popup experiences with their InLine checkout, or customers can select the hosted checkout choice that redirects customers to a 2Checkout web page. A 3rd choice for customers of standard ecommerce web sites like Shopify, Magento, and Woocommerce is to combine 2Checkout with that web site’s native on-line purchasing cart; a listing of these websites could be discovered on their web site.

2Checkout additionally gives a number of integration connectors with standard CRMs like Salesforce and Adobe Analytics, although some are “off the shelf” and a few are “on demand.” Additionally obtainable are an API and webhooks.

By default, 2Checkout’s payouts happen on a weekly or month-to-month foundation relying on the kind of 2Checkout bundle you employ, and minimums of fifty or 100 USD/EUR/GBP additionally apply. These are the one three currencies by which 2Checkout will facilitate payouts.

2Checkout’s Enterprise Intelligence, an engine for customized reporting and scheduled reviews, is included in all three of their pricing packages, however superior options like person log audits, subscription evaluation, and monetary reporting will not be obtainable of their base bundle of 2Sell.

Evaluation could be carried out utilizing the reporting dashboard, and third-party analytics instruments resembling Google Analytics could be related to your account for cart net analytics (on request for 2Sell and 2Subscribe customers; included in 2Monetize).

FastSpring

FastSpring gives three kinds of checkouts. A Net Storefront hosted by FastSpring serves because the default choice, permitting customers to make use of product catalogs from their very own web sites or to make the most of FastSpring’s platform to show merchandise. A Popup Checkout makes use of your personal web site’s catalog after which gives a same-page expertise by displaying the checkout window in entrance of your webpage. And the Embedded Checkout retains the checkout expertise in your web site with out the necessity for redirects or popups.

For payouts, most FastSpring sellers have a two per 30 days frequency, however this may also be set to month-to-month. FastSpring also can change the minimal cost quantity at your request. There are 5 currencies obtainable for payouts — USD, EUR, GBP, AUD, and CAD — however there’s a small foreign money conversion payment for payouts in currencies aside from USD.

FastSpring’s dashboards allow customers to dig into reporting round income, subscriptions, and even chargebacks. See transaction charges, internet gross sales, refund charges, and extra to evaluate most income impacts by every product. Perceive vital subscription traits throughout areas, over time, and by particular person merchandise with built-in widgets for MRR, buyer lifetime worth, charge of churn, and extra. That information could be exported to CSV or JSON, or you need to use FastSpring’s information API and webhooks to generate income and subscription reviews to take your information wherever you want it.

FastSpring gives many instruments that work together to empower your integrations: extensions, webhooks, APIs, a WordPress plugin, and the FastSpring Retailer Builder Library (our JavaScript library). These are the instruments and techniques that assist companies rise up and operating rapidly on FastSpring, to allow them to go world quicker.

The developer-friendly, ready-to-deploy FastSpring Retailer Builder Library (SBL) allows you to move delicate data in an encrypted format — which is nice for integrations — however it’s additionally nice for organising your retailer initially. This extremely customizable JavaScript library helps rapidly embed FastSp-ring ecommerce experiences into your web site or software.

Webhooks work along with your backend or third-party techniques for superior integration and monitoring occasions, and the FastSpring API enables you to simply question your gross sales and subscription information through GraphQL or REST format on a programmatic foundation. Extensions resembling MailChimp for emails, AdRoll for retargeting, and Google’s Analytics, AdWords, and Tag Supervisor make it simple to combine FastSpring’s platform with different useful enterprise instruments. The FastSpring WordPress plugin is obtainable from the WordPress plugin retailer.

2Checkout vs. Stripe vs. FastSpring: Calculating, Accumulating, and Remitting Taxes

Tax calculation, assortment, and remittance are crucial actions a enterprise must take to remain compliant wherever its product is being offered.

Every cost providers supplier could deal with completely different mixtures of these capabilities, whereas a service provider of report ought to deal with all of them. Figuring out which items your supplier takes care of for you (and in the event you’ll have to deal with any your self) is essential to retaining your online business compliant — and avoiding hefty tax fines.

Stripe

Stripe will calculate and accumulate taxes for you, however it gained’t file or remit any of these taxes.

They will inform you the place all you’ll have to register, however you’ll need to register your online business in all relevant jurisdictions your self, and then you definately’ll need to file and submit the taxes your self in all of these jurisdictions as properly.

For those who’re on the lookout for a turnkey tax resolution from begin to end, Stripe isn’t that.

2Checkout

Since 2Checkout gives both a PSP or a MoR mannequin, there are completely different ranges of tax dealing with with every kind.

For companies utilizing their PSP packages (2Sell or 2Subscribe), there’s a tax calculator that may be activated, however it’s based mostly in your tax information provided to 2Checkout and comes with a disclaimer to that finish. There seems to be a fairly prolonged course of to get the tax calculation function arrange and activated.

For companies utilizing their 2Monetize bundle, world VAT and gross sales tax assortment and dealing with are included, and 2Checkout assumes the monetary legal responsibility.

FastSpring

FastSpring is intrinsically a service provider of report, so tax calculation, assortment, and remittance in over 200 areas around the globe is at all times included for companies utilizing our providers.

You additionally gained’t have to register for tax functions in all of these areas, since FastSpring is the entity really promoting your product. Our tax specialists keep updated on world VAT, GST, and gross sales taxes so that you don’t need to, and we file and pay $50M+ in taxes for our prospects yearly.

Conclusion: 2Checkout vs. Stripe vs. FastSpring

Stripe is an entry step into utilizing a cost providers supplier, however it isn’t a service provider of report and gained’t deal with your taxes for you. You possibly can settle for funds, however you’ll nonetheless have loads of different enterprise administration to deal with by yourself or with further companions apart from Stripe.

If in case you have a small enterprise or startup, Stripe could also be a serviceable choice at first, however you possibly can rapidly outgrow it in the event you take your online business world. For starters, you’ll have dozens of jurisdictions to handle danger and taxes in, you’ll have to resolve tips on how to handle chargebacks, and also you’ll have to arrange subscription administration instruments and settings like dunning for rebilling, and so on. — or you may watch the Stripe or third-party charges stack up as you add on extra merchandise to cowl as a lot of that as they’ll.

2Checkout gives both simply PSP providers or with an improve to MoR providers, however some platform options like pricing localization and sure reviews are solely obtainable on a restricted or upcharge foundation. Their PSP-only providers will calculate taxes for you, however that’s based mostly totally on tax information you provide to them, so that you’ll nonetheless want to fret about these in the event you don’t improve to 2Monetize.

FastSpring handles each funds and taxes by providing one complete MoR service. Select between a number of checkout varieties with localized pricing, combine with different necessary enterprise instruments, and cease worrying about world taxes as your online business grows. This makes FastSpring very person pleasant for B2B and B2C SMBs promoting digital merchandise, downloads, software program, SaaS, video video games, and extra.

Accomplice With FastSpring

For those who’re on the lookout for a cost providers supplier and service provider of report that can assist you develop your online business internationally, we will help. FastSpring gives an all-in-one cost platform for SaaS, software program, video video games, and digital merchandise companies, together with VAT and gross sales tax administration, cost localization, and client assist.

For those who assume FastSpring could possibly be the suitable funds and MoR resolution for your online business, attain out to our workforce or arrange a free account.

Associated Studying

- SaaS Billing Software program: 7 Instruments in 3 Classes & Tips on how to Select: Find out about different billing and subscription instruments, together with Braintree, Chargebee, Chargify, and extra.

- A Full Information to SaaS Tax Software program: Choices, FAQs, and Extra: Be taught extra about what companies want to fret about relating to taxes, what software program and consultants will help with, what they can’t assist with, and the way FastSpring can exchange them each.

- SaaS Corporations: 4 Indicators You’ve Outgrown Stripe: Development knowledgeable Fred Linfjärd (a former FastSpring person himself) explains the disadvantages of DIY-ing a funds resolution with Stripe, and the way FastSpring frees up dev sources to focus in your core product as a substitute of funds and monetization.