There have been only a few industries that weren’t affected by the COVID-19 pandemic, and the UK finance business was no exception. Pushed by restrictions on bodily places, the business as an entire solid a larger reliance on digital channels. The transfer to a predominantly digital mannequin was a long-time coming, improvements in monetary expertise have created a extra seamless digital banking expertise for customers, and contactless expertise has streamlined and improved customers’ cost expertise. Because of these advances in expertise, the usage of money has been persistently falling within the UK for years now. The way forward for spending is undoubtedly digital.

For nearly two years now, Brits have been dwelling by means of a value of dwelling disaster. Naturally, this has had a damaging impression on the funds of many households. The financial disaster has eroded client monetary wellbeing and confidence. Mintel’s client analysis has discovered that simply one in 4 Brits describe their private funds as wholesome. It’s no shock then that this decline monetary wellbeing has had an impression on customers’ spending habits, significantly in relation to cost preferences. We have now outlined how the continued financial difficulties have affected client behaviour, and examined whether or not money is able to stage a comeback in an more and more digital world.

Fee Preferences in a Value of Dwelling Disaster

1 / 4 of UK bank card homeowners have been utilizing their card extra steadily within the final 12 months, highlighting the function of playing cards in on a regular basis spending because of elevated financial pressures. General, debit playing cards proceed to be the favoured cost technique, however the usage of money is on the rise once more throughout all age teams. Half of Britons aged 16-34 years-old use money on a weekly foundation. There’s a need for selection in the case of cost strategies, and companies must be conscious of this sooner or later.

Through the COVID-19 pandemic, hygiene was all of the sudden a precedence focus for most individuals. The thought of a pound coin or a ten pound word lined within the micro organism from all those that’ve dealt with it earlier than put many individuals off utilizing money. Use fell dramatically as individuals opted for the extra hygienic choice of contactless funds. However because the pandemic fades into reminiscence, the price of dwelling disaster has changed it on the forefront of customers’ minds. Mintel has discovered that the decline in money use has slowed as customers navigate the continued financial disaster, with many discovering it simpler to price range and maintain monitor of spending when utilizing money. That is mirrored in two-thirds of individuals saying money significance has elevated throughout the price of dwelling disaster, whereas nearly 9 in ten say you will need to maintain money as a precautionary measure. Whereas money could not be king, it’s not able to resign its declare to the throne simply but.

Budgeting – The Solely Means is App

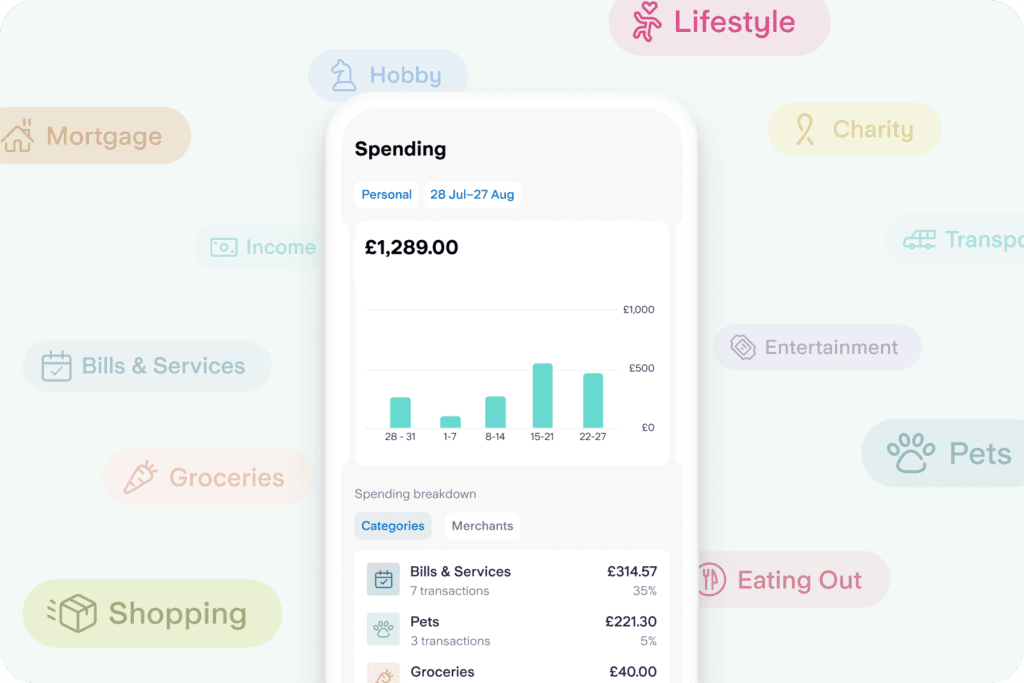

An growing variety of customers are feeling the necessity to monitor their spending extra carefully, and one in style approach to do that is thru the usage of cash administration apps. The rise in recognition of digital-only banks, comparable to Starling Financial institution and Revolut, has pushed innovation within the FinTech business. The evolution of smartphone expertise and a seamless shift away from department banking is driving development in the usage of monetary apps. Expertise has turn out to be an instrumental a part of monetary administration, and the usage of monetary apps is now the norm, with two-thirds of Brits accessing them a minimum of as soon as a day.

Go to Mintel Retailer for extra Finance Business Market Analysis

Nevertheless, whereas funds and transfers dominate this use, and solely a small share of economic app customers use them to price range,that is prone to rise as the price of dwelling disaster progresses. There shall be a extra urgent have to price range, and there shall be a possibility for monetary service suppliers to broaden the usage of budgeting instruments inside their apps. Starling financial institution launched a free price range planner in September 2022 to assist clients lower prices. Budgeting instruments is an space inside digital banking that presently scores comparatively low when it comes to satisfaction, so there’s a clear want to enhance. Banks and monetary providers suppliers ought to observe Starling’s lead and look to boost their budgeting instruments.

Open Banking: An Open Purpose for the Banking Business?

The 12 months 2023 marks the fifth anniversary of open banking within the UK. This progressive expertise presents a easy, safe approach for customers and companies to maneuver and handle their cash. The usage of open banking will proceed to broaden, Mintel’s analysis uncovered that nearly 1 / 4 of UK customers who haven’t but used open banking earlier than are possible to make use of it sooner or later. The expertise tremendously helps these trying to enhance their budgeting and monetary planning capabilities. It depends on customers being keen to share their information, which extra customers are keen to do because of the price of dwelling disaster. It’s important that manufacturers proceed to innovate across the budgeting and planning instruments that may enhance customers’ monetary confidence and wellbeing. A rising variety of customers are comfy sharing their monetary information, however there should be a transparent incentive and profit.

Is the Future Cashless, or Simply Much less Money?

There’s a clear generational divide in willingness to make use of expertise. Lower than a tenth of customers aged 55+ use a cell pockets, comparable to Apple Pay, in comparison with over half of 16-24 12 months olds. The identical applies to most monetary apps; utilization is way larger throughout youthful age teams. Because of this, the monetary providers business is at a crossroads. Does it push innovation and transfer in direction of a cashless society, on the threat of alienating older customers? Instantly post-pandemic (and pre-cost of dwelling disaster), the reply could have been extra easy. However now that financial difficulties have pushed customers again to money, the reply, for now a minimum of, is for monetary service suppliers to discover a steadiness between the 2.

There’s a robust alternative for finance manufacturers to have interaction with youthful customers by means of the usage of apps and progressive expertise, however older customers, preferring a extra conventional approach of banking should even be catered for. If the UK is to maneuver nearer in direction of a cashless society, it is important that there’s robust communication between the federal government, banks and customers to make sure that nobody is left behind.

What We Assume

The usage of digital banking in monetary providers goes to develop, with or with no value of dwelling disaster. Nevertheless, it’s clear that many customers, significantly older, usually are not keen, or shouldn’t have the means, to go fully digital, so monetary manufacturers should proceed to cater for them.

Client sentiment a few cashless society stays extra damaging than constructive and appreciable effort from the federal government, banks and companies shall be required earlier than persons are prepared to surrender on money. In the end, customers need flexibility round their cost choices; as beforehand talked about, it’s not simply older customers who nonetheless need the choice of money funds.

Discover our Monetary Providers Market Analysis, or fill out the shape under to enroll to Highlight, Mintel’s free e-newsletter for unique insights.