The way to Dissolve an LLC in Kentucky

For those who plan to finish your enterprise and dissolve your LLC (Restricted Legal responsibility Firm) you’ve in all probability thought in regards to the course of and the significance of that call for some time. Nevertheless, you possibly can’t simply resolve to close your enterprise down with out following the best course of. The State of Kentucky has particular necessities to shut down your LLC and it’s important that you just implement that course of the best method.

Right here, we’ll check out the explanations you might need for dissolving your Kentucky LLC, what kinds of LLC dissolution choices you’ve, and the steps and necessities so that you can do this in Kentucky. Then, you possibly can really feel assured that you just’re doing issues the best method and received’t have regulatory repercussions sooner or later.

Fundamentals of LLC Dissolution

Dissolution, particularly, is the method by way of which you formally dissolve your LLC with the state the place it’s registered. An LLC dissolution removes the impartial authorized standing of your LLC with the Kentucky Secretary of State. This cancelation of your LLC could be both voluntary or involuntary.

In an effort to make certain that your state chooses to just accept your software for enterprise dissolution you’ll have to comply with the best steps. That features notifying your collectors, in addition to native and federal authorities businesses that relate to your enterprise. You’ll additionally have to pay any excellent money owed you’ve and embody a certification relating to the standing of your account. That certificates will point out that you just don’t personal cash and your LLC is at the moment in good standing.

By following the right dissolution procedures you’ll have the ability to dissolve your LLC successfully and shield your self from liabilities sooner or later.

Varieties of LLC Dissolution

There are three most important classes of LLC dissolution, that are judicial, administrative, and voluntary. The process you’ll want to comply with to dissolve your LLC will rely on which one of many three sorts applies to you. Right here’s what to learn about the differing types and the way they work.

Administrative dissolution

When there’s an administrative dissolution the State of Kentucky will take away your LLC’s powers, authority, and rights since you didn’t comply along with your obligations. Among the causes this might occur to an LLC are:

-

Not paying correct taxes inside their allotted time-frame. -

Not submitting annual stories by their due date or in any respect. -

Not sustaining a registered agent on file with the Kentucky Secretary of State.

Judicial dissolution

A judicial dissolution isn’t the identical factor as an administrative dissolution, nevertheless it’s nonetheless thought of involuntary as a result of the proprietor(s) of the LLC didn’t select it. One of these dissolution is also known as the company demise penalty, and it’s a course of whereby the court docket orders that your LLC be dissolved. Among the most important causes for a judicial dissolution embody:

-

Breaching fiduciary obligation -

Mismanagement or fraud -

Inside member disagreements -

A member who dies or turns into mentally unwell and can’t fulfill their tasks

Voluntary dissolution

For those who and another members of your LLC vote to dissolve the enterprise that counts as a voluntary dissolution. You could want a majority vote to do that, relying on what number of members are a part of the LLC. There are two ways in which this sort of dissolution can happen:

-

Members vote to dissolve the LLC resulting from monetary points or inner disputes. -

Members have set dissolution triggers inside the working settlement, similar to departure or demise of a member.

Dissolving Your LLC in Kentucky

If you wish to know tips on how to dissolve an LLC in Kentucky these are the steps you’ll want to comply with.

Step 1: Vote to dissolve the LLC

For those who resolve to dissolve your LLC, that’s the method of voluntary dissolution. When there are a number of LLC members, although, they should vote in favor of it for it to undergo. With out a majority resolution you typically received’t have the ability to shut down your LLC.

Nevertheless, one exception to this can be a pre-agreed set off for dissolution in your LLC working settlement. For instance, your working settlement might say that the demise of an LLC member is a set off for dissolving the enterprise. LLCs that don’t have working agreements, or those who don’t have data on voluntary dissolution, must comply with the default provisions of the the Kentucky state statutes.

Single vs multi-member LLC dissolution

The one actual distinction between multi-member and single-member LLC dissolution is that multi-member dissolution requires the companions to forged a majority vote. In the event that they don’t, the LLC can’t be voluntarily dissolved.

Dissolution guidelines in your LLC working settlement

It’s a good suggestion to your working settlement to have inner guidelines for working your LLC but in addition details about dissolving it. Referring to the working settlement is the best strategy to set off your LLC dissolution, permitting you to ensure that every thing complies with the phrases you created in the beginning of your enterprise journey.

The foundations in an working settlement would possibly embody:

-

The share (or required quantity) of members that must approve a dissolution. -

How the LLC plans to discharge and tackle its liabilities and money owed. -

Any procedures for closing and settling the actions of the LLC. -

The best way belongings will probably be divided, money owed dealt with, and contracts canceled.

Kentucky-Particular Guidelines for Voting to Dissolve Your LLC

At the least two-thirds of the members of your LLC should vote for dissolution to ensure that it to maneuver ahead. That’s true with most states, and Kentucky is not any exception.

Step 2: Wind up all enterprise affairs and deal with another enterprise issues

“Winding up” your LLC and its affairs is an important a part of shutting issues down and ensuring you’re legally complying with every thing required by the state. For instance, you must count on to:

-

Notify any registered agent you have employed. -

Let clients and suppliers know you are closing. -

Cancel any permits or enterprise licenses. -

Cease gross sales or companies. -

Inform staff and deal with any issues associated to them. -

Shut the LLC’s financial institution accounts.

Step 3: Notify collectors and claimants about your LLC’s dissolution, settle current money owed and distribute remaining belongings

Regardless that having an LLC means legal responsibility safety for the members primarily based on any money owed the enterprise accrues, dissolving the LLC doesn’t take away the duty for the enterprise to pay these money owed.

While you’re dissolving your Kentucky LLC you’ll want to let claimants and collectors know. You additionally have to repay any loans or bank cards your enterprise had earlier than the dissolution could be thought of remaining. Your obligations on this space embody:

-

Notifying collectors and claimants that you’ll dissolve your LLC. -

Assembly monetary obligations like paying excellent invoices, bank cards, and enterprise loans. -

Liquidating your belongings by way of promoting or splitting them primarily based on the working settlement.

Step 4: Notify Tax Companies and settle remaining taxes

Earlier than you could be allowed to dissolve your LLC in Kentucky you’ll want to present proof that each one of its state and federal taxes have been paid. When you’ve proven that you just’ve taken care of excellent enterprise points you will get able to file the paperwork that can formally shut your LLC.

Step 5: File an announcement of dissolution with the Secretary of State

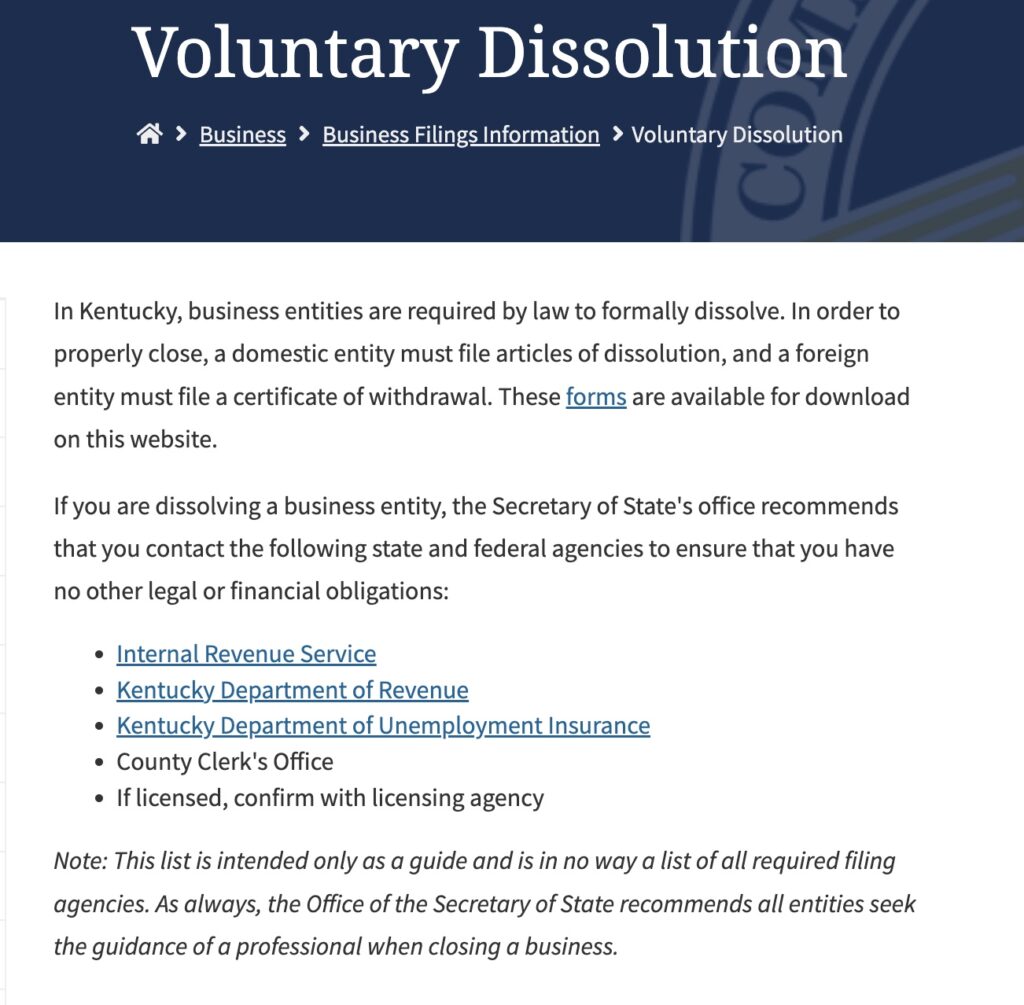

To file articles of dissolution with the Kentucky Secretary of State you’ll need to go to the Voluntary Dissolution web page positioned beneath Enterprise Submitting Info.

On that web page yow will discover a hyperlink to the varieties you’ll want to fill out. Hyperlinks to the IRS, the Kentucky Division of Income, and the Kentucky Division of Unemployment Insurance coverage are additionally offered, so you possibly can attain out on to these entities and make sure that you’re in compliance with them and don’t owe taxes or different charges.

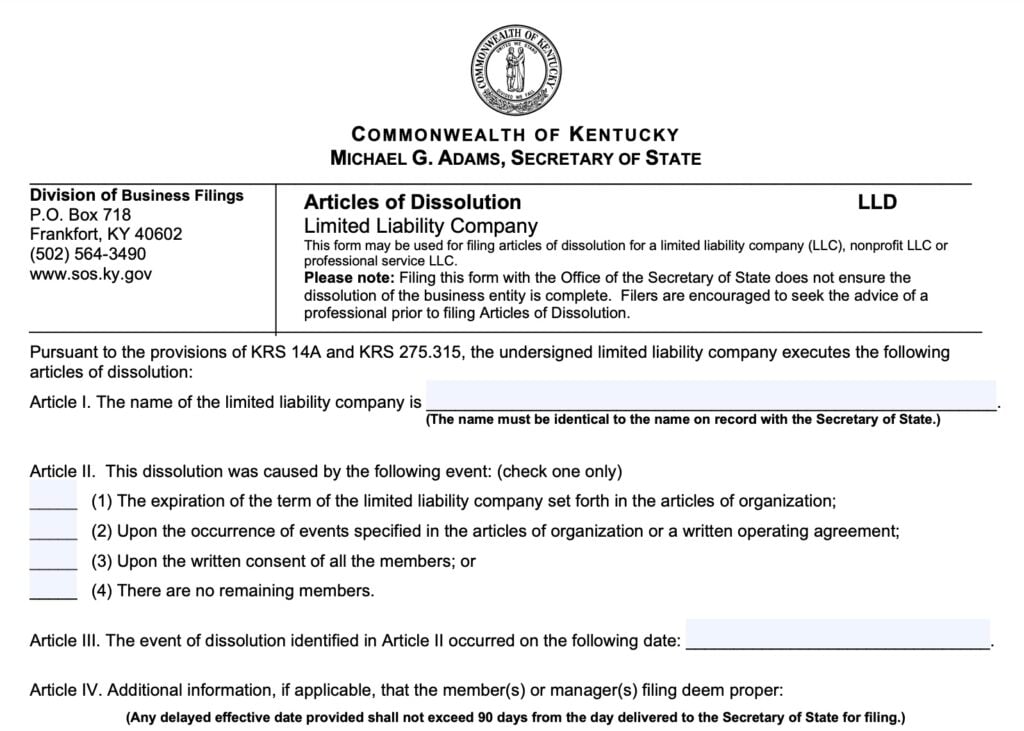

When you click on on the hyperlink for the varieties, select the + signal subsequent to Restricted Legal responsibility Firm Varieties. That can take you to this display:

Select the hyperlink for articles of dissolution, which can open a pdf doc with highlighted areas to fill out. That is the primary a part of that type:

When you’ve stuffed in all of the required areas, it’s time to print the shape and mail it. There’s a set of directions in the identical pdf that gives you with the tackle for mailing and in addition provides you steering on tips on how to fill out the shape appropriately.

Conclusion

When you file articles of dissolution it’s a really easy course of to shut your enterprise with the state. That’s as a result of many of the work that goes into shutting down and dissolving your LLC will probably be performed earlier than the articles are literally filed. It’s not essentially simple to say goodbye to a enterprise you’ve put your coronary heart and soul into, however you can even give attention to the concept that it’s a brand new starting for you.

Taking every thing you realized by way of the creation and operation of your restricted legal responsibility firm is an effective way to make use of that data on one thing new. Experiences aren’t wasted in the event you take them with you and apply the data you’ve gained to new ventures.

FAQs

There are a number of explanation why you would possibly resolve to dissolve your LLC, however some are extra widespread than others. Inside disagreements between the members, rising prices or competitors, merging with one other enterprise, money stream or accounting points, and transferring to a different state are all large causes so that you can select LLC dissolution.

The submitting charge for articles of dissolution is $40.

You’ll be able to’t dissolve your Kentucky LLC on-line, however you possibly can get the best varieties on the Secretary of State’s web site. Then, you will be required to mail these to the tackle listed within the type’s directions.

After the articles of dissolution are filed it typically takes one to 3 days for a Certificates of Dissolution.

For those who do not formally dissolve your Kentucky LLC you might find yourself with liabilities similar to taxes, annual charges, and different bills. You may be in violation for not submitting annual stories or different required documentation.

You may find yourself with double taxation in case your LLC is registered in multiple state. Some states have tax credit score agreements, however not all of them do. For those who’re transferring your LLC to a brand new state it is higher to dissolve it within the state that you just’re leaving, generally.

This portion of our web site is for informational functions solely. Tailor Manufacturers shouldn’t be a legislation agency, and not one of the data on this web site constitutes or is meant to convey authorized recommendation. All statements, opinions, suggestions, and conclusions are solely the expression of the writer and offered on an as-is foundation. Accordingly, Tailor Manufacturers shouldn’t be answerable for the data and/or its accuracy or completeness.

The submit The way to Dissolve an LLC in Kentucky appeared first on Tailor Manufacturers.