.elementor-column .elementor-spacer-inner{top:var(–spacer-size)}.e-con{–container-widget-width:100%}.e-con-inner>.elementor-widget-spacer,.e-con>.elementor-widget-spacer{width:var(–container-widget-width,var(–spacer-size));–align-self:var(–container-widget-align-self,preliminary);–flex-shrink:0}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container,.e-con>.elementor-widget-spacer>.elementor-widget-container{top:100%;width:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer{top:100%}.e-con-inner>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner,.e-con>.elementor-widget-spacer>.elementor-widget-container>.elementor-spacer>.elementor-spacer-inner{top:var(–container-widget-height,var(–spacer-size))}.e-con-inner>.elementor-widget-spacer.elementor-widget-empty,.e-con>.elementor-widget-spacer.elementor-widget-empty{place:relative;min-height:22px;min-width:22px}.e-con-inner>.elementor-widget-spacer.elementor-widget-empty .elementor-widget-empty-icon,.e-con>.elementor-widget-spacer.elementor-widget-empty .elementor-widget-empty-icon{place:absolute;prime:0;backside:0;left:0;proper:0;margin:auto;padding:0;width:22px;top:22px}

.elementor-heading-title{padding:0;margin:0;line-height:1}.elementor-widget-heading .elementor-heading-title[class*=elementor-size-]>a{colour:inherit;font-size:inherit;line-height:inherit}.elementor-widget-heading .elementor-heading-title.elementor-size-small{font-size:15px}.elementor-widget-heading .elementor-heading-title.elementor-size-medium{font-size:19px}.elementor-widget-heading .elementor-heading-title.elementor-size-large{font-size:29px}.elementor-widget-heading .elementor-heading-title.elementor-size-xl{font-size:39px}.elementor-widget-heading .elementor-heading-title.elementor-size-xxl{font-size:59px}

Dissolve an LLC in Washington

.elementor-widget-image{text-align:middle}.elementor-widget-image a{show:inline-block}.elementor-widget-image a img[src$=”.svg”]{width:48px}.elementor-widget-image img{vertical-align:center;show:inline-block}

.elementor-widget-text-editor.elementor-drop-cap-view-stacked .elementor-drop-cap{background-color:#69727d;colour:#fff}.elementor-widget-text-editor.elementor-drop-cap-view-framed .elementor-drop-cap{colour:#69727d;border:3px strong;background-color:clear}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap{margin-top:8px}.elementor-widget-text-editor:not(.elementor-drop-cap-view-default) .elementor-drop-cap-letter{width:1em;top:1em}.elementor-widget-text-editor .elementor-drop-cap{float:left;text-align:middle;line-height:1;font-size:50px}.elementor-widget-text-editor .elementor-drop-cap-letter{show:inline-block}

Deciding to name it quits on an organization you labored arduous to construct is an enormous choice. However when you do decide that dissolving your LLC is one of the best path ahead, it’s important to observe the proper course of and do it accurately.

Dissolving an LLC in Washington requires a couple of particular steps that have to be rigorously accomplished. On this information on easy methods to dissolve an LLC in Washington, we’ll go over the fundamentals of LLC dissolution and the step-by-step course of you possibly can observe to make sure your organization is formally dissolved within the eyes of the regulation.

Fundamentals of LLC Dissolution

Dissolving an LLC means that you’re formally ending the corporate’s existence within the eyes of the state. Which means that you and the corporate will not be required to satisfy obligations corresponding to reporting necessities and submitting company taxes.

Forms of LLC Dissolution

In Washington, there are three several types of LLC dissolution. Here’s a breakdown of those three sorts and the circumstances that apply to every one:

Administrative Dissolution

Administrative dissolution is a sort of LLC dissolution that’s ordered and initiated by the state. This occurs when LLCs in Washington fail to adjust to state necessities. Nevertheless, administrative dissolution can usually be overturned if the corporate rectifies the difficulty(s) that led to the dissolution.

Judicial Dissolution

Any such dissolution happens when an organization is ordered by the court docket to be dissolved, usually as a consequence of causes corresponding to unlawful actions, fraud, or conditions the place it’s not doable for the enterprise to proceed its operations.

Voluntary Dissolution

The most typical kind of LLC dissolution is voluntary dissolution, and this happens when the members of an LLC voluntarily resolve to dissolve the corporate. Any such dissolution requires LLC members to finish a particular course of, and it’s the kind that we are going to concentrate on for the rest of this information.

Dissolving Your LLC in Washington

In the event you and the opposite members of your Washington LLC resolve to voluntarily dissolve the corporate, it’s important to observe the proper steps. Right here is the step-by-step course of you possibly can observe to dissolve your organization and keep away from any problems:

Step 1: Vote to Dissolve the LLC

Earlier than an LLC might be dissolved, its members should vote to approve the dissolution. For single-member LLCs, this choice lies with only one particular person. However for multi-member LLCs, a proper vote will probably be required.

Single vs multi member LLC dissolution

House owners of a single-member LLC can resolve all on their very own whether or not they need to dissolve the corporate. For multi-member LLCs, the process for voting on dissolution is usually outlined within the firm’s working settlement. This contains particulars corresponding to how the vote is to be held and the bulk that’s required to proceed with dissolving the corporate.

Dissolution guidelines in your LLC working settlement

Most LLC working agreements will embrace particular particulars on how the dissolution course of is to be performed. This contains specifics on voting for dissolution, however it additionally contains issues like how the corporate is to distribute its remaining belongings, cancel contracts, and notify collectors. Earlier than you progress ahead with dissolving the corporate, make sure you rigorously overview its working settlement and observe all the necessities it outlines.

Step 2: Wind Up All Enterprise Affairs and Deal with Any Different Enterprise Issues

When you and the remainder of the LLC’s members have made the choice to dissolve the corporate, the following step is to wind up any remaining enterprise affairs. This contains issues like:

-

Notifying your registered agent, suppliers, prospects, and every other stakeholders -

Canceling your whole enterprise licenses or permits -

Dealing with any worker issues, corresponding to last paychecks and unemployment insurance coverage -

Closing enterprise financial institution accounts and ensuring that you have met all monetary obligations

Step 3: Notify collectors and claimants about your LLC’s dissolution, settle current money owed, and distribute remaining belongings

If your organization owes any excellent money owed, these must be paid in full earlier than the LLC might be legally dissolved. Notify all collectors and claimants of your intention to dissolve the corporate, and pay any money owed which are nonetheless owed to them.

As soon as all excellent money owed are paid, you will have to distribute any firm belongings that stay. As we beforehand mentioned, your organization’s working settlement ought to element how belongings are to be distributed amongst members.

Step 4: Notify Tax Companies and settle remaining taxes

The ultimate matter that have to be seen to earlier than you possibly can legally dissolve your Washington LLC is to file last state and federal tax returns. If the LLC owes any taxes, these should even be paid earlier than it may be dissolved.

Whereas Washington doesn’t have a state earnings tax, your LLC should still owe different kinds of state taxes, corresponding to enterprise and occupation (B&O) tax, gross sales tax, or use tax. Affirm that every one state taxes have been paid by checking with the Washington State Division of Income.

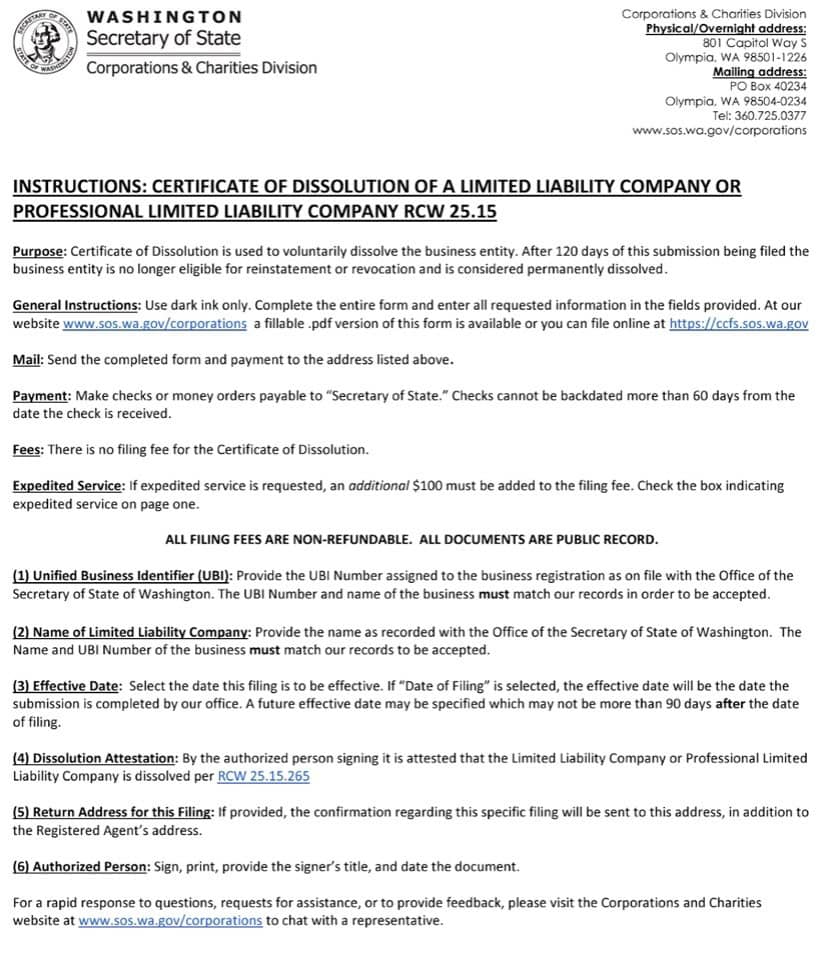

Step 5: File certificates of dissolution (termination kind) with the Secretary of State

After getting accomplished all the required steps to dissolve your LLC, you possibly can formally dissolve it by submitting a Certificates of Dissolution with the Washington Secretary of State. This way is obtainable on the Secretary of State’s web site, and it seems to be like this:

Rigorously overview the Certificates of Dissolution kind and fill in all required data to make sure there aren’t any errors that would delay the method. You’ll be able to file the Certificates of Dissolution both on-line or by mail.

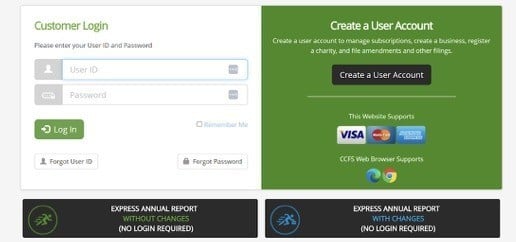

To file on-line:

-

Go to the Washington Secretary of State’s web site and entry the Companies and Charities Submitting System (CCFS).

-

Log in or create an account, then choose “Dissolve or Withdraw” from the menu.

-

Seek for your LLC by its identify or UBI quantity.

-

As soon as you discover your LLC, choose the choice to file the “Certificates of Dissolution” and full the shape.

-

You will want to pay a submitting price of $20 when submitting the shape on-line.

- Full the Certificates of Dissolution kind, which is obtainable as a PDF on the Washington Secretary of State’s web site.

- Embody a examine or cash order for the $20 submitting price.

- Mail the finished kind and cost to:

Washington Secretary of State

Companies and Charities Division

801 Capitol Approach S

PO Field 40234

Olympia, WA 98504-0234

You’ll obtain a affirmation as soon as your submitting has been processed. Understand that mailed filings might take longer to course of in comparison with on-line submissions.

Conclusion

In the event you and the remainder of your LLC’s members have determined that it’s greatest to not proceed working the corporate, legally dissolving it’s a necessary last step. By following the steps coated on this information, you possibly can dissolve your Washington LLC in order that it ceases to exist so far as the state is worried, liberating you as much as put the corporate behind you and transfer on to your subsequent enterprise.

Understand that each enterprise end result is a studying alternative. Dissolving your LLC might mark the top of 1 period, however it might additionally mark the start of one thing new and extra profitable!

FAQs

There’s a variety of explanation why enterprise house owners select to dissolve an organization. Regardless of the purpose could also be, although, it’s important to formally dissolve your LLC by following the suitable course of. This may get rid of any ongoing authorized obligations that the corporate has.

The one price related to dissolving an LLC in Washington (not together with paying off current money owed and tax obligations) is the submitting price of $20 that you can be required to pay if you file a Certificates of Dissolution with the Washington Secretary of State.

Sure, as soon as you have accomplished all prior steps (corresponding to holding a dissolution vote and submitting a last tax return), the remainder of the method might be accomplished fully on-line by visiting the Washington Secretary of State’s web site and accessing the Companies and Charities Submitting System (CCFS).

How lengthy it takes to dissolve an LLC in Washington relies on whether or not you’re submitting by mail or on-line. On-line filings usually take 2-3 enterprise days to be processed, whereas mailed filings usually take 7-10 enterprise days. Washington additionally provides an expedited submitting choice for an extra price, With expedited service, on-line filings are often processed inside 24 hours, whereas mailed filings are processed inside 1-2 enterprise days after they’re obtained.

In the event you fail to formally dissolve your Washington LLC, you’ll nonetheless be required to satisfy obligations corresponding to submitting annual stories, submitting taxes, and different compliance obligations. That is true even when you don’t proceed working the corporate.

In case your Washington LLC can also be registered to conduct enterprise in different states, you’ll have to dissolve the corporate in every a kind of states individually. You should definitely understand that completely different states could have their very own distinctive necessities and charges when dissolving an LLC.

This portion of our web site is for informational functions solely. Tailor Manufacturers isn’t a regulation agency, and not one of the data on this web site constitutes or is meant to convey authorized recommendation. All statements, opinions, suggestions, and conclusions are solely the expression of the writer and offered on an as-is foundation. Accordingly, Tailor Manufacturers isn’t accountable for the data and/or its accuracy or completeness.

The put up Dissolve an LLC in Washington appeared first on Tailor Manufacturers.