That is Half 3 within the sequence on API Monetisation. Make sure you additionally learn Half 1 and Half 2.

In the event you aren’t planning on instantly making income out of your API then you could want to attract on oblique monetisation fashions to construct your small business case. Usually talking, oblique API monetisation is the place you hyperlink the impression of your API via to income drivers elsewhere within the enterprise.

This can be a widespread type of monetisation that’s principally related for companies with present income streams, similar to present enterprises and software-as-a-service corporations.

Measuring the income generated by direct API monetisation is easy. Measuring oblique monetisation is a bit more sophisticated, and also you’ll have to work out which metrics and leavers are going to impression direct measures of income.

That will help you construct your API enterprise case round oblique monetisation, this part of the API Monetisation Information covers:

- Income Linked Monetisation

- Inner Billing

To be taught extra in regards to the cost-saving advantages of APIs, see Half 1 of this complete API Monetisation Information.

You could possibly hyperlink your API’s impression to income earned elsewhere within the enterprise.

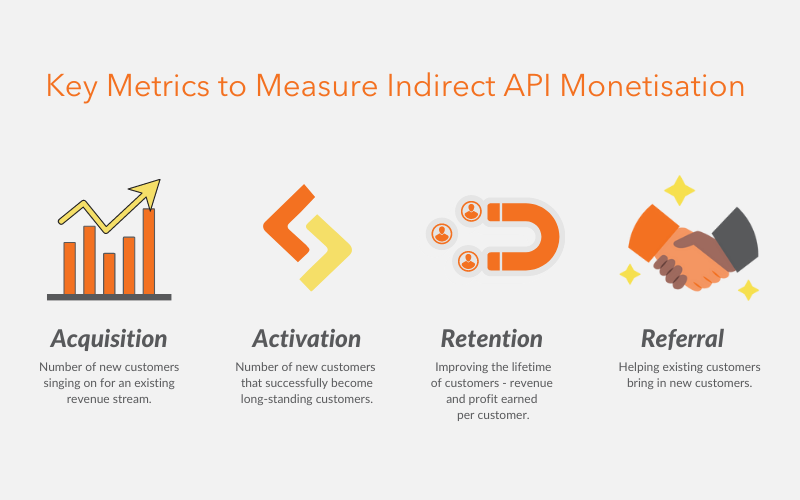

The important thing metrics you should utilize to do that are:

- Acquisition: Can your API enhance the variety of new prospects signing on for an present income stream?

- Activation: Can your API enhance the variety of new prospects that efficiently turn out to be long-standing prospects for an present income stream?

- Retention: Can your API enhance the lifetime of your prospects, the income earned per buyer, or the revenue per buyer?

- Referral: Can your API assist prospects refer new prospects?

You may be conversant in this because the Pirate Metrics (A.A.R.R.R.) that drive the considering behind most tech corporations immediately. The third R from the Pirate Metrics, Income, was coated within the Direct Monetisation part of this information.

Every of the metrics is explored in additional element under.

You should utilize an API to drive signups from new prospects or new customers. You’ll be able to then measure the worth of your API within the income gained from these new signups.

E-commerce and insurance coverage present examples of APIs that drive acquisition. For instance, Amazon supplies an API for third events to construct their very own functions utilizing Amazon merchandise, fulfilment data, feeds, evaluations and extra. In insurance coverage, CoverGenius supplies an API for the likes of Skyscanner and Ryanair to enroll prospects onto their insurance coverage merchandise.

Usually talking, your formulation for figuring out the brand new buyer income pushed by your API will take two kinds: (1) Taking a look at general income, and (2) Attributing a portion of the income to the API.

The general income is comparatively simple. You estimate or monitor the shoppers that come from the API and the income that they carry (or will carry).

The attribution method recognises that the API isn’t solely chargeable for the entire income and that different components could also be contributing. For instance, an API couldn’t drive the acquisition of a product that doesn’t exist. It’s worthwhile to calculate and stability an applicable portion of the income to attribute to your APIs.

You should utilize an API to drive the variety of new prospects that efficiently begin or proceed to make use of your product-this is known as activation. You’ll be able to then measure the worth of your API within the income gained from prospects that often would have churned.

Activation is much less widespread for APIs to deal with, and solely tends to look with software-as-a-service or technology-enabled service choices. For instance, an accounting software program service like Xero makes use of an API to assist individuals join different programs, like financial institution accounts, which makes individuals extra more likely to succeed with Xero.

Similar to acquisition, activation could be measured by attributing a portion of the general income gained from having the API.

That being stated, lots of the API’s activation options may additionally fall within the retention class. Activation is a much less widespread oblique monetisation method for APIs.

You should utilize an API to assist guarantee prospects keep together with your product and improve the quantity they pay for its use. You’ll be able to then measure the worth of your API by the income gained from the shoppers that keep or improve their spend.

It appears easy, however it may be fairly sophisticated. There are easy conditions the place prospects keep due to the API, however most of the time it’s a bit much less clear. The API might have been simply one in every of the concerns that led them to staying or growing their spend.

In SaaS, Atlassian’s intensive use of APIs to permit their prospects to combine with and construct upon their merchandise is a key motive for his or her success. As soon as a buyer has comprehensively built-in Atlassian’s merchandise with their programs, it’s a troublesome resolution to shift elsewhere.

Elsewhere, conventional banks are beginning to lose prospects and companions to the likes of Stripe, Paypal, and neobanks as a result of banking APIs aren’t obtainable or are too difficult to make use of.

To measure the income impression your API has on retention, you’ll be able to measure the income gained from prospects, in addition to by attributing a portion of the general income to the API.

There’s a possibility to get clever together with your attribution. For instance, you’ll be able to run surveys to find out the portion of shoppers for whom the API is a key issue. You can also make estimates of the significance of the API primarily based on the utilization of options. You’ll be able to then use these numbers to tell what share of income gained from a particular buyer to attribute to the API.

You should utilize an API to assist with referral, though it’s much less widespread, so we received’t go into it with as a lot element as the opposite metric areas.

Fb’s APIs for sharing and different social interactions are a superb instance of this.

To measure the income impression of your API on referral, you’d measure the variety of prospects or customers your API brings and mix this with the income they generate or are anticipated to generate for you.

One other solution to not directly monetise your API is to invoice for it internally. That is most suited to bigger corporations with a longtime mannequin of inside cross charging.

On the floor it’s a easy mannequin: simply cost some quantity for different departments to make use of the API. However, because it’s not at all times instantly clear how a lot you’ll be able to cost for the API, discovering an applicable price could be sophisticated.

Listed here are some fashions that may match:

- Price plus — You’re taking the price of offering the API, then add a share for loading, margin, or contingency (20–30% is a quantity that arises typically right here). You will want to keep in mind setup prices, base operating prices, and per transaction/utilization prices.

- Utilizing comparables — If the API you’re offering has externally comparable APIs then you’ll be able to replicate their charging mannequin of these APIs. For instance, when you have been to offer a Stripe like funds API to different enterprise items, then you may use Stripe’s pricing to find out the way you worth your API internally.

- Income share — You negotiate a share of the income different enterprise items achieve by having your API. This does overlap with a number of the different fashions mentioned elsewhere on this information although.

You may additionally look to mix points from every of those inside billing fashions.

On this part of the API Monetisation Information, we coated Oblique API Monetisation. We checked out linking your API to income via metrics like acquisition, activation and referral. We additionally checked out inside billing fashions

Initially revealed at https://terem.tech on March 9, 2022.