With Amazon’s October Prime Early Entry Sale within the books, Amazon advertisers must fine-tune their technique for the core stretch of This fall.

A part of that planning revolves round:

- Mapping out how budgets might be spent over the ultimate month and a half of the yr.

- Which days to push the pedal most on.

We dug deep into the greater than $400 million in Amazon advert spend underneath administration yearly at Tinuiti (my employer) to:

- Quantify what we’ve seen previously and higher estimate what would possibly occur this go round.

- Assist manufacturers higher perceive how efficiency for Amazon advertisements shifts over the course of the vacation procuring season.

Let’s dive in.

Trying again on the 2020 vs. 2021 vacation seasons

It could be powerful to recollect at this level, however means again in 2020 the vacation procuring season seemed very completely different than any earlier yr for Amazon distributors and sellers.

First, there was the Oct. 13-14, 2020 Prime Day occasion, which was delayed from its typical mid-year timing. Because of the surge in ecommerce demand pushing Amazon’s success capabilities to the bounds within the early months of the pandemic, the change created a brand new This fall “vacation.”

The gross sales per click on of sponsored merchandise advertisements soared relative to what would sometimes be anticipated in the course of October. We noticed a sequel of this with the Prime Early Entry Sale this yr.

A lot of Amazon’s and different retailers’ efforts to kickstart the This fall 2020 procuring season sooner than typical had been supposed to drag demand earlier within the quarter as:

- Transport delays had been inflicting large complications on the time.

- Final-minute buyers wouldn’t be capable of reliably get packages as rapidly late within the season.

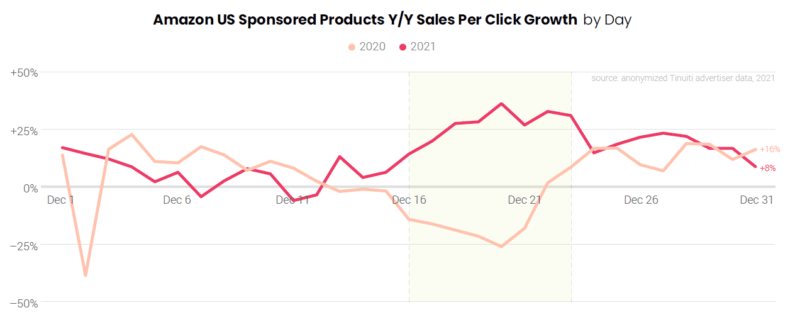

This additionally led to a lot earlier transport cutoff dates as a way to get packages in time for Christmas, and our second key divergence for This fall 2020 advert efficiency in comparison with different years – a significant drop in gross sales per click on within the third week of December in comparison with 2019.

By 2021, transport delays had been a lot much less obstructive than in 2020, and cutoff dates to obtain packages in time for Christmas returned to a extra typical schedule.

In flip, advertisers noticed gross sales per click on within the third week of December soar relative to 2020, the precise reverse of the development a yr prior.

Waiting for this yr’s vacation season, we count on transport cutoffs to be extra consistent with 2021 than 2020, such that advertisers ought to see the gross sales per click on of advertisements maintain up later within the procuring season.

Now, let’s check out how complete gross sales quantity trended on key days through the vacation season final yr.

Black Friday and Cyber Monday are tops in quantity for many manufacturers

With regards to the sheer quantity of gross sales attributed to advertisements through the vacation procuring season, Black Friday and Cyber Monday (BFCM) proceed to be pivotal components of general success.

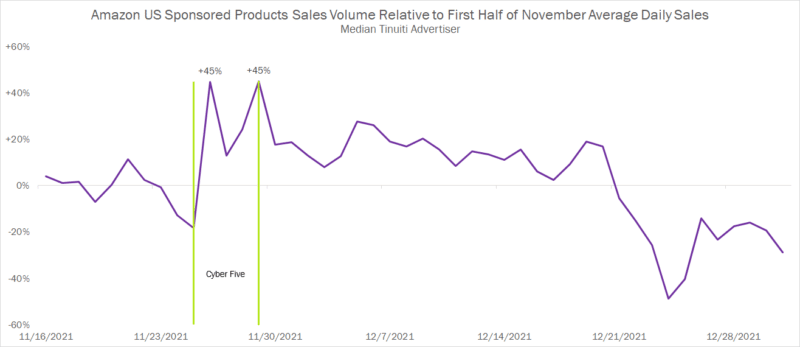

In 2021, the median advertiser noticed gross sales attributed to Sponsored Merchandise advertisements rise 45% on each Black Friday and Cyber Monday in comparison with common day by day gross sales for the primary half of November.

Whereas we’re utilizing median right here to convey how large these two days are for middle-of-the-pack advertisers, the surge in gross sales was actually a lot bigger for some manufacturers than others.

35% of sponsored merchandise advertisers noticed Black Friday gross sales greater than double in comparison with the primary half of November, and 37% noticed the identical for Cyber Monday.

By way of pure quantity, no different day between mid-November and late December comes near the gross sales attributed to advertisements on BFCM for many manufacturers.

It’s potential that the Prime Early Entry Sale in October pulled ahead a number of the quantity that will in any other case occur in November and December.

That stated, it’s unclear how that may play out by way of impacting particular days. It’s very doubtless we’ll nonetheless see Black Friday and Cyber Monday come out on high in comparison with different days over the past month and a half of the yr.

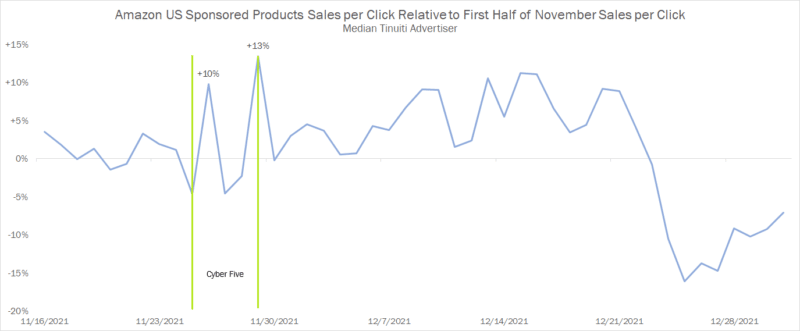

Nevertheless, complete gross sales quantity is just one measure of the chance obtainable to manufacturers. Gross sales-per-click traits present how extremely beneficial different days may be as nicely.

Get the day by day e-newsletter search entrepreneurs depend on.

The worth of advert clicks in late December final yr neared Cyber Monday highs

Customers are actually able to convert in the case of gross sales holidays like Cyber Monday and Black Friday.

However urgency additionally builds towards the tip of the season, when customers are right down to the wire and wish presents in time for Christmas and different holidays.

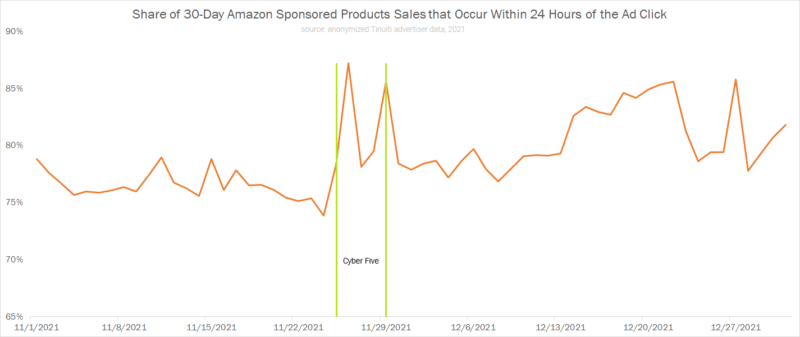

That is clear when trying on the share of complete gross sales attributed to sponsored merchandise utilizing a 30-day window that occurred inside the first 24 hours of the advert click on. This can be utilized as an indicator of how compelled buyers felt to transform at any given time.

As you’ll be able to see, the share of purchases that occurred rapidly after an advert click on went up considerably on Black Friday and Cyber Monday, falling thereafter earlier than rising all through the remainder of the procuring season till transport cutoffs for Christmas supply got here into impact.

An analogous development unfolds when taking a look at how gross sales per click on modified over the course of the vacation season final yr.

The worth of advert clicks peaked on Cyber Monday for the median advertiser, however a number of days in late December neared this excessive as the worth of advert clicks rose with buyers’ sense of urgency.

However right here’s the catch! A number of the conversions which can be attributed to advertisements on BFCM or to days simply earlier than the transport cutoff may be partially attributed to advertising and marketing efforts that occurred earlier than these key stretches.

For instance, search codecs like sponsored merchandise typically get a lift in efficiency from show campaigns that construct consciousness on and off Amazon previous to the ultimate advert interplay and conversion.

When evaluating alternative, advertisers must look past easy quantity metrics to information technique, particularly in setting bid changes to account for adjustments within the anticipated worth of advert clicks.

However they additionally want to grasp that enhances in gross sales per click on on any given day is perhaps the results of advert interactions on different days that weren’t credited with the sale.

Given completely different sorts of buyers carry completely different lifetime values, manufacturers also needs to look past simply the direct gross sales per click on in assessing how a lot buyers are value throughout completely different durations of the vacation procuring season. New-to-brand metrics may help advertisers do exactly that.

New-to-brand clients provide one other incentive for manufacturers to be aggressive on large days

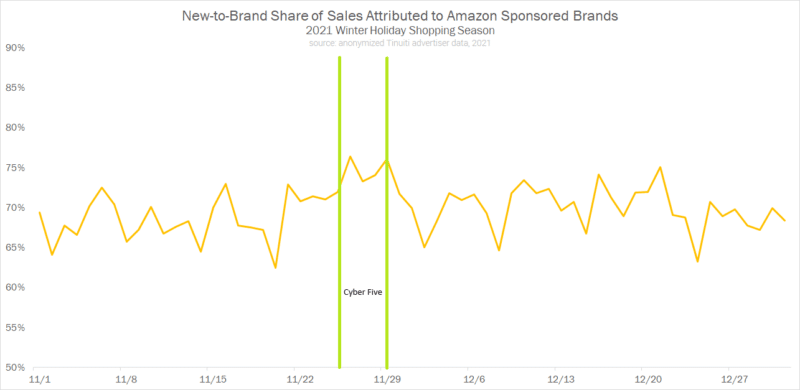

New-to-brand gross sales, outlined by Amazon as these gross sales that come from clients who haven’t bought from a model in at the very least a yr, permit advertisers to get a greater sense of what sorts of consumers their sponsored manufacturers and Amazon demand-side platform (DSP) campaigns are attracting.

Trying on the share of complete gross sales attributed to sponsored manufacturers that got here from new-to-brand clients through the vacation procuring season final yr, advertisers discovered the very best share days between the start of November and the tip of the yr got here on Black Friday and Cyber Monday, which each noticed 76% of gross sales attributed as new to model.

An in depth third place went to Dec. 21 at 75% new-to-brand share, as buyers appeared extra prepared to buy from new manufacturers as they secured last-minute presents.

New-to-brand share was the bottom (62%) over the last two months of the yr on Nov. 20, the Saturday earlier than Thanksgiving.

These traits range by the advertiser, and swings may be rather more important for some manufacturers than others.

how new-to-brand share has trended throughout previous vacation seasons ought to assist inform when manufacturers ought to alter technique this go round.

Vacation gross sales takeaways for Amazon advertisers

There are plenty of unknowns heading into the vacation procuring season in 2022, particularly concerning how nicely the economic system as an entire will maintain up.

Even so, manufacturers ought to nonetheless perceive how latest efficiency has trended through the core weeks of This fall previously. 2021 is probably going a good indicator of how completely different days will examine to 1 one other in 2022.

Key days like Cyber Monday and Black Friday nonetheless play a significant function, with gross sales quantity for these two days far eclipsing that of different days through the vacation procuring season.

As such, manufacturers ought to have a technique in place for profiting from the surge in procuring intent that comes with these gross sales holidays.

That stated, advertisers can discover gold within the type of larger gross sales per click on and elevated new-to-brand buyer share at different factors in This fall.

Amazon entrepreneurs ought to look into 2021 information as quickly as potential to get a way of when to hit the fuel on promoting.

Opinions expressed on this article are these of the visitor writer and never essentially Search Engine Land. Workers authors are listed right here.

New on Search Engine Land