Envi FX fails to supply firm possession and government data on its web site.

Envi FX fails to supply firm possession and government data on its web site.

Envi FX’s web site area (“envifx.com”), was first registered in 2020. The non-public registration was final up to date on July twenty third, 2022.

As all the time, if an MLM firm shouldn’t be overtly upfront about who’s operating or owns it, suppose lengthy and arduous about becoming a member of and/or handing over any cash.

Envi FX’s Merchandise

Envi FX has no retailable services or products.

Associates are solely capable of market Envi FX affiliate membership itself.

Envi FX’s Compensation Plan

Envi FX associates make investments cryptocurrency on the promise of passive returns.

Envi FX’s returns are dressed up as foreign currency trading, with commissions paid on simulated buying and selling quantity by recruited associates.

Envi FX pays commissions through a unilevel compensation construction.

A unilevel compensation construction locations an affiliate on the prime of a unilevel group, with each personally recruited affiliate positioned instantly underneath them (stage 1):

If any stage 1 associates recruit new associates, they’re positioned on stage 2 of the unique affiliate’s unilevel group.

If any stage 2 associates recruit new associates, they’re positioned on stage 3 and so forth and so forth down a theoretical infinite variety of ranges.

Envi FX caps payable unilevel group ranges at 5.

Commissions are paid per lot commerce quantity throughout these 5 ranges as follows:

- stage 1 (personally recruited associates) – $1.50 per lot

- ranges 2 to five – 75 cents per lot

Lots is usually 100,000 models of the bottom foreign money being traded. How this components into Envi FX’s simulated buying and selling is unclear.

Excessive Rise and Prime Heavy ranked Envi FX associates obtain increased fee charges:

- Excessive Rise ranked associates earn $2 on stage 1, $1 on stage 2, 95 cents on stage 3, 30 cents on stage 4 and 25 cents on stage 5

- Prime Heavy ranked associates earn $2.50 on stage 1, $1.50 on stage 2 and 50 cents on stage 3

Be aware that Excessive Rise and Prime Heavy rank qualification standards shouldn’t be supplied.

Becoming a member of Envi FX

Envi FX affiliate membership seems to be free. No minimal funding quantities are specified.

Envi FX solicits funding in numerous cryptocurrencies.

Envi FX Conclusion

Envi FX’s web site overloads guests with buying and selling data and choices. That is an try to make the location appear like a reliable buying and selling dealer.

All anybody cares about is the passive funding alternative, which Envi FX clothes up as Proportion Allocation Administration Module (PAMM) accounts.

Your first pink flag with Envi FX is you don’t know who’s operating it. This isn’t how reliable firms asking you for cash function.

Your second pink flag with Envi FX is solicitation of funding in cryptocurrency to foreign exchange commerce with.

Your third pink flag is Envi FX committing securities fraud.

Envi FX associates make investments crypto with nameless randoms, do nothing and gather a day by day ROI. Sound acquainted?

Envi FX operates a passive funding alternative. This requires it to be registered with monetary regulators.

Envi FX offers no proof it has registered with monetary regulators and filed legally required audited monetary stories.

Envi FX associates are supplied simulated buying and selling stories of their backoffice. This isn’t substitute for registration with monetary regulators.

Fairly than function legally, Envi FX affords up the next pseudo-compliance:

This web site shouldn’t be directed at or meant to elicit residents and/or residents of the USA.

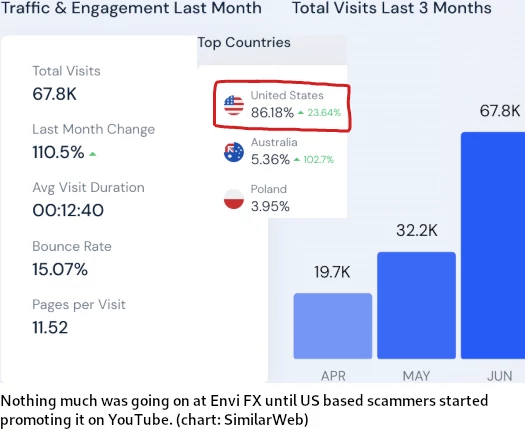

As we are able to see over at SimilarWeb, that is baloney:

86% of Envi FX’s web site site visitors originates from the US.

A search of the SEC’s Edgar database reveals Envi FX shouldn’t be registered to supply securities within the US. They aren’t registered to supply securities anyplace on the planet.

Be aware that as well as Envi FX committing securities fraud, anybody selling can be committing securities fraud. Promotion of unregistered securities can be unlawful the world over.

Lastly, by providing a foreign currency trading funding alternative to US residents, simulated or in any other case, Envi FX must be registered with the CFTC.

A search of the NFA register confirms Envi FX isn’t registered with the CFTC. It is a violation of the Commodities and Trade Act.

Whereas we don’t know who’s operating Envi FX, they’re operating the scheme and speaking to buyers through the “Automated Buying and selling” Telegram group (an MLM firm being run by Telegram is one other pink flag).

Whereas we don’t know who’s operating Envi FX, they’re operating the scheme and speaking to buyers through the “Automated Buying and selling” Telegram group (an MLM firm being run by Telegram is one other pink flag).

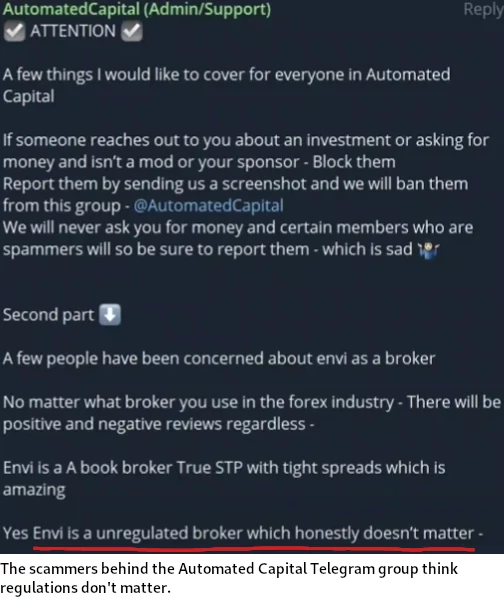

In a message posted to the Automated Buying and selling Telegram group mid July, buyers have been advised Envi FX committing monetary fraud “doesn’t matter”.

The admin of Automated Buying and selling refers to founders of the scheme as “Kyle and I”.

MLM firms commit monetary fraud and function illegally as a result of they aren’t doing what they declare to be. With Envi FX, this could be foreign currency trading to generate exterior ROI income.

If Envi FX isn’t buying and selling, what are they doing?

They’re operating a Ponzi scheme.

New crypto is available in and Envi FX makes use of it to pay early investor withdrawals. That is dressed up as buying and selling, full with simulated backoffice buying and selling stories and lot commissions.

It’s all theater and is totally disconnected from Envi FX shuffling round invested crypto to pay returns.

As with all MLM Ponzi schemes, as soon as Envi FX recruitment dries up so too will new funding.

It will starve Envi FX of ROI income, ultimately prompting a collapse.

The mathematics behind Ponzi schemes ensures that after they collapse, nearly all of individuals lose cash.