GSPartner’s G999 and LYS Ponzi shit tokens are collapsing.

GSPartner’s G999 and LYS Ponzi shit tokens are collapsing.

In an try and create the phantasm that associates haven’t principally misplaced their cash, GSPartners has provide you with GEUR.

G999 is GSPartners’ authentic Ponzi coin. Gullible buyers had been result in consider in the event that they purchased G999 funding packages by way of GSPartners, they’d be bajillionaires as a result of causes.

Right here’s how that’s going:

Because it turned evident G999 was a Ponzi shitcoin that wasn’t going wherever, GSPartners sought to launch extra shitcoins. After some turbulence with foiled Dubai property scams, GSPartners settled on an NFT grift they referred to as Lydian World.

Lydian World is hooked up to LYS and XLT tokens, though today no one talks in regards to the latter.

Anyway, right here’s how Lydian World goes:

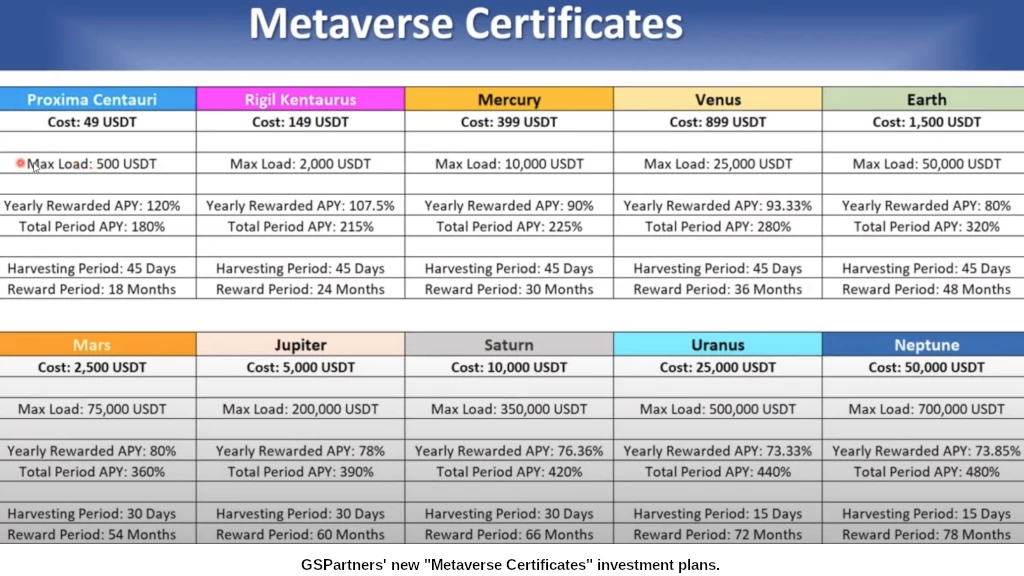

As soon as it turned clear no one was all in favour of a Ponzi money seize NFT “sport”, GSPartners launched a “metaverse certificates” scheme.

Not surprisingly, GSPartners’ metaverse certificates scheme has nothing to do with the metaverse.

The metaverse certificates scheme is a straightforward Ponzi; GSPartners associates pay a price after which make investments as much as 700,000 USDT on the promise of a 480% annual ROI (click on to enlarge):

On a GSPartners webinar directed at US buyers held a couple of days in the past, right here’s how US-based CEO Michael Dalcoe described GSPartners’ metaverse certificates;

We put our cash on the blockchain, and our buying and selling accomplice trades the funds for us and it grows it at a charge of round 72% a 12 months and better.

Sure, I didn’t stutter. Round 72% per 12 months and even increased. I can’t even offer you actual numbers. Which means your cash doubles yearly.

And actually, your cash actually doubles about each six or seven months.

Metaverse certificates returns are paid in USDT however they aren’t withdrawable.

As a substitute GSPartners associates need to put the USDT in the direction of LYS token mining, permitting them to finally money out in GSPartners’ LYS shit token.

Right here’s the issue:

To treatment the Ponzi scheme coming undone, GSPartners has launched GEUR.

GEUR doesn’t exist exterior of GSPartners and is represented to have parity with the euro.

If a GSPartners affiliate cashes out their metaverse certificates ROI to GEUR, they then need to convert GEUR to USDT by way of the GSPartners backoffice.

As much as 5000 GEUR might be cashed out in a single transaction and GSPartners takes a 2.5% reduce of all transactions.

GSPartners’ GEUR webinar was hosted by Steven London Morris, considered one of Dalcoe’s downline based mostly in California.

If you happen to’re questioning how GSPartners is funding withdrawals and why now, that’s answered by way of GSPartners’ current web site stats:

GSPartners has been busy recruiting US buyers over the previous 12 months. These buyers need to money out and, up till lately, all GSPartners has been capable of do is watch LYS decline and their makes an attempt to wash commerce pump G999 fail.

As you possibly can see within the SimilarWeb knowledge above, GSPartners has unfold to Cuba, South Africa (it is a resurrection after GSPartners already collapsed in SA), and Switzerland.

This new injection of funds straight correlates to the launch of GSPartners’ metaverse certificates funding scheme.

What you may as well see within the chart above nonetheless is that total visits to GSPartners’ web site haven’t modified a lot. It’s stagnant.

Pending a dramatic enhance in recruitment of latest soon-to-be victims, GSPartners is simply kicking exponentially growing ROI liabilities down the highway.

It’s one factor to lure individuals’s cash in an infinite chain of shit tokens. When you symbolize one thing is pegged to actual cash, and permit buyers to money out that actual cash – you’ve simply created a monetary black gap that’ll drain invested funds.

It ought to be famous that, regardless of advertising representations on the contrary, GEUR isn’t pegged to the euro – it’s pegged to how a lot invested USDT GSPartners is keen to play out.

Michael Dalcoe after all is aware of this and so, on behalf of GSPartners company, discourages withdrawals by claiming it’s one thing solely “poor and middle-class individuals do”.

How GSPartners’ inevitable USDT crunch manifests itself is but to be seen, however look ahead to GEUR withdrawal issues over the following 6 to 9 months.

In violation of securities regulation within the US, neither GSPartners, proprietor Josip Heit, Michael Dalcoe or Steven London Morris are registered with the SEC.

Exterior income to pay metaverse certificates is purportedly generated through foreign currency trading by BDSwiss.

In violation of the Commodities Change Act, neither GSPartners or BDSwiss are registered with the CFTC.

GSPartners and its promoters usually are not registered to supply securities in any nation.