Estimated learn time: quarter-hour, 27 seconds

Many corporations that increase globally attain a degree the place they will’t correctly assist their worldwide clients with their present cost platform. They’ll begin noticing points like low conversion charges, low authorization charges, extra chargebacks, and an general plateau in world development.

A global cost gateway may also help with a few of these points, but it surely’s just one piece of the puzzle. To just accept funds internationally, you additionally want to supply native cost strategies, gather and pay consumption tax, adhere to native transaction legal guidelines and rules, and far more.

On this publish, we make clear what a global cost gateway is, the way it suits into the cost processing panorama, and the way to decide on the most effective one for your corporation. Then, we examine 10 of the highest cost options beginning with a deep-dive into our resolution, FastSpring.

Desk of Contents

FastSpring handles every little thing from sustaining excessive authorization charges to paying end-of-year consumption taxes for SaaS corporations. Join a free account or request a demo right now to see how FastSpring may also help you increase globally.

What’s a global cost gateway?

Historically, cost gateways and cost processors have been supplied as two separate providers and you’ll have completely different suppliers for every service:

- Fee gateways rapidly and securely switch the cost particulars from the checkout software program to the cost processor.

- Fee processors confirm that every one needed data is current and within the appropriate format after which carry it to the issuing financial institution or bank card community for remaining authorization. Some cost gateways combine with a number of cost processors behind the scenes to optimize efficiency.

Quick ahead to right now, and these two providers are sometimes supplied collectively, which is why many corporations use these phrases interchangeably.

For the rest of this publish, if we point out one, we assume the opposite is included.

Worldwide cost processors allow you to instantly begin accepting most popular funds from across the globe. With out a global cost processor, you would need to keep a relationship with every card community (e.g., MasterCard or Visa), issuing financial institution, or digital pockets (a.ok.a., e-wallet) that you simply need to settle for. Every cost supplier has completely different rules to comply with and completely different acceptance ranges for fraud and chargebacks, so it may be very tough to take care of a very good relationship with every of them by yourself.

Worldwide cost processors tackle the accountability of staying in good standing with numerous cost suppliers so that you simply don’t must.

Associated: Worldwide Recurring Funds (How We Deal with It for You)

Elements to Take into account When Selecting an Worldwide Fee Gateway

When selecting a global cost gateway, an important factor to think about is whether or not or not additionally they act as your Service provider of Report.

A Service provider of Report (MoR) takes on the legal responsibility of SaaS transactions for you which implies they deal with cost processing, gathering and remitting taxes, staying compliant with native legal guidelines and rules, chargebacks, and far more. If one thing goes flawed in any of those areas, your MoR takes the result in resolve it for you.

In case your cost gateway does not act as your MoR, then you definately’ll be by yourself to:

- Calculate tax, add tax to the ultimate quantity, and pay these taxes to the native authorities

- Perceive and cling to native transaction legal guidelines and rules

- Enhance conversions with an optimized checkout stream

- Deal with chargebacks and fraud

- And extra

Many cost processors will present an API or built-in integrations with different options that may assist you to with these issues. Nonetheless, you’ll must handle that whole software program stack and you’ll nonetheless be held liable for every little thing from paying taxes to fraud prevention. If taxes don’t receives a commission accurately, for instance, chances are you’ll face big fines or be prevented from transacting in that area.

When you’ve decided if the cost gateway additionally acts as a MoR, there are two different elements to think about:

- What international locations they allow you to transact in (it’s going to differ with every cost gateway supplier).

- How they keep excessive authorization charges (there are lots of causes a cost can fail even in case you have a very good relationship with the cardboard community).

Subsequent, we’ll take a deep-dive into how FastSpring acts as your MoR after which examine 9 different worldwide cost gateway suppliers.

FastSpring: Service provider of Report for International SaaS Firms

Increasing your corporation globally is a really advanced course of that features every little thing from translating your web site to studying about every area’s legal guidelines and rules. So as to add to the complexity, many of those methods and rules always change.

For instance, SaaS corporations didn’t all the time must pay consumption tax however now most international locations are requiring it. Plus, most states, provinces, territories, and international locations change the quantities of taxes that have to be collected and the way it’s important to pay these taxes yearly. This can be a lot to maintain observe of and most areas cost you hefty fines if you happen to don’t pay the correct quantity of taxes on time. And, that is simply one piece of what you want to handle worldwide transactions.

With FastSpring, you’ll be able to scale nearly immediately to over 200+ areas as a result of we:

- Keep in good standing with dozens of cost suppliers world wide so you’ll be able to settle for in style native cost strategies (together with however not restricted to Apple Pay, ACH, SEPA, Amazon Pay, and extra).

- Gather and remit consumption tax (together with GST, VAT, SST, and so on.) for each transaction and file all needed tax returns for you.

- Tackle the accountability of adhering to native transaction legal guidelines and rules. Our group of authorized specialists keep updated on all related legalities and ensure all the required procedures are in place for gathering funds.

- Deal with foreign money conversions and language translations at checkout.

FastSpring is absolutely compliant with the EU Normal Information Safety Regulation (GDPR) and the California Client Privateness Act (CCPA). Moreover, we renew our degree one certification (which is the best degree doable) with the Fee Card Trade Information Safety Customary (PCI DSS) yearly.

Within the following sections, we cowl intimately how FastSpring helps you:

Obtain Excessive Authorization Charges in 200+ Areas with Superior Fee Failure Dealing with and Native Fee Processing

Many corporations are in a position to keep excessive authorization charges of their house nation however rapidly see a decline in authorization charges after they increase internationally. It is because transacting globally is far more sophisticated so extra issues can go flawed. For instance, the cardboard community or issuing financial institution may mark the transaction as suspicious (and due to this fact deny authorization) as a result of the vendor isn’t in the identical nation as the customer.

It may be very tough — and a drain on assets — to establish what’s making the funds fail and discover a method to remedy these points by yourself.

As your cost processing resolution and MoR, FastSpring takes care of sustaining excessive authorization charges for you. Listed below are two ways in which we keep excessive authorization charges.

1. Fee Processor Rerouting

Whereas funds can fail for easy causes like low funds or inaccurate cost particulars, funds may fail due to community or system failures. If a cost fails on the primary try, FastSpring tries once more utilizing a secondary processor. Whereas this received’t remedy points like low funds, it usually solves the problem of community or system failures.

2. Native Fee Processors

Card networks and issuing banks usually tend to authorize transactions when the cost processor has a authorized entity in the identical nation as the customer. FastSpring works with cost processors who concentrate on world transactions in order that your whole transactions are processed in the identical location as your buyer.

Enhance Conversions with an Optimized Checkout Expertise

Earlier than the cost particulars are even despatched to the cost gateway, there are lots of causes a buyer might abandon the checkout course of. For instance:

- They must create an account with the intention to buy and don’t need to.

- Further charges and taxes are added however not clearly labeled so the shopper doesn’t know why the worth is completely different.

- The checkout display isn’t clearly labeled as safe so the shopper doesn’t really feel secure coming into private data.

FastSpring helps you cut back checkout abandonment and enhance conversion charges with:

- Dynamic foreign money and tax updates based mostly on the person’s location. You may set the worth in several currencies or let FastSpring routinely convert costs to the native foreign money. (FastSpring makes use of OANDA for trade charges and we replace costs 4 occasions per day.) In case you have us convert the worth for you, we’ll match the overall format of the unique value. (For instance, in case your base value is $17.99 and the conversion to Euros is €18.29, FastSpring would replace it to €18.99.)

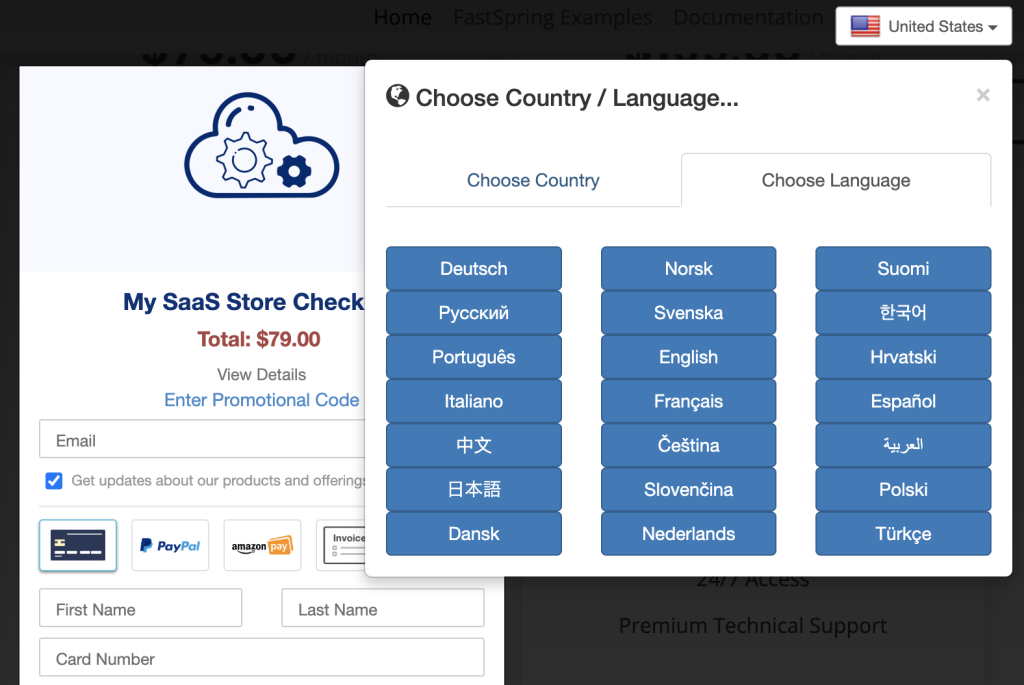

- Translations at checkout. You may let every purchaser choose their most popular language from a dropdown menu or lock the language and FastSpring will routinely choose the suitable language based mostly on the customer’s location.

- Full visible customization. Most cost gateways solely present checkout templates with just a few fundamental choices for personalization (like including your brand or selecting from a preset checklist of colours). FastSpring offers you the instruments and customized assist wanted to create a customized, absolutely branded checkout expertise. (We additionally present a pre-built template that’s optimized for top conversion charges.)

- An embedded, pop-up, or net storefront checkout. With FastSpring, you’ll be able to embed checkout instantly in your web site, insert a popup modal on prime of your webpage, or ship clients to a safe FastSpring storefront. This offers you the flexibleness to decide on the answer that’s greatest to your group and clients.

Scale back Involuntary Churn with Proactive Dunning Administration

Efficiently changing potential patrons to paying clients is simply step one. For SaaS companies, further cost points usually come up between that preliminary buy and subsequent billings. The commonest method to cope with cost failures is to easily notify the shopper, nonetheless, you’ll have to do extra — like ship out a number of reminders — if you wish to considerably cut back involuntary churn.

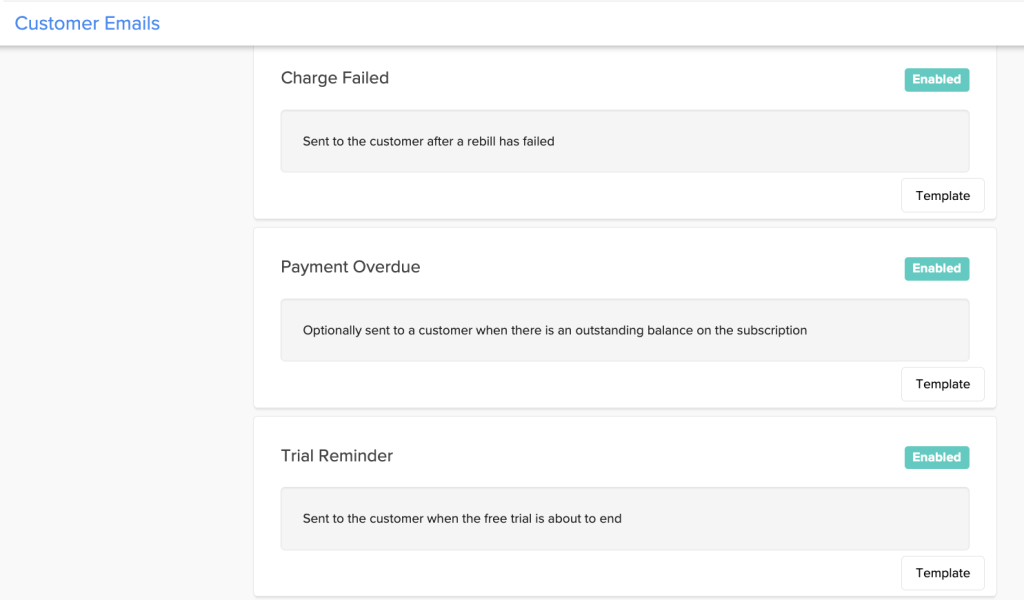

FastSpring offers versatile dunning administration which incorporates:

- Proactive reminders to replace cost data. FastSpring will ship out e-mail reminders when a buyer’s card is about to run out. You need to use our pre-made e-mail template or customise your individual message.

- A number of, scheduled retries and follow-up notifications. After the preliminary cost retry and notification, you’ll be able to schedule notifications to be despatched two, 5, seven, 14, and 21 days after the preliminary failure. Earlier than sending out every reminder, FastSpring will retry the cost.

- Straightforward to entry self-serve portal. FastSpring offers a self-serve portal the place your clients can view their order historical past, change their subscription, and replace cost or checking account data. This self-serve web site is totally managed by FastSpring however the look of the portal will match the branding of your checkout to offer clients with a cohesive shopping for expertise.

You may select what number of reminders it takes earlier than the shopper’s service is paused. We’ve discovered that permitting the service to proceed by way of the primary a number of reminders reduces involuntary churn and offers a greater buyer expertise.

After the ultimate reminder, you’ve got the flexibleness to decide on whether or not to pause or cancel their service in the event that they fail to replace their cost data. Pausing their service makes it simpler for them to start out up the service once more with out going by way of the whole onboarding course of once more.

Deal with Complicated Billing Logic and Free Trials With out Code

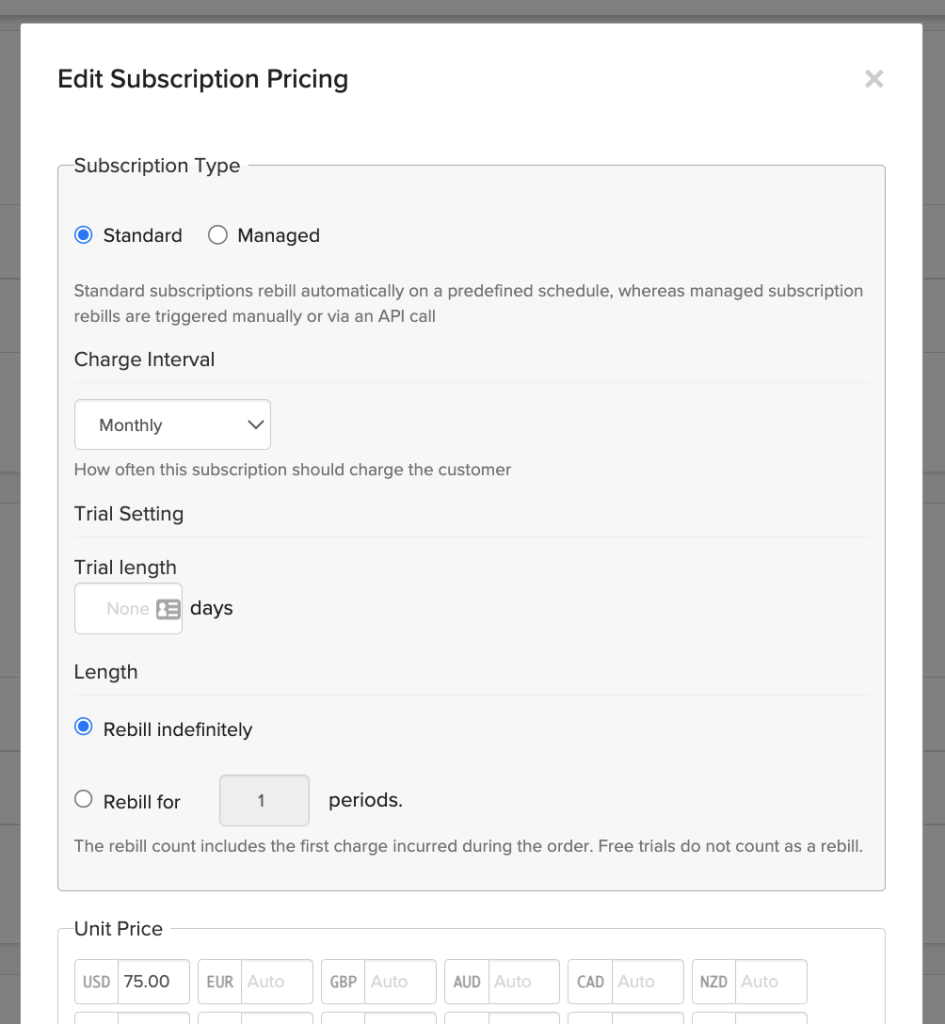

Constructing out recurring billing logic internally is usually a drain on developer time and it’s tough to take care of. Whereas some worldwide cost gateways will assist subscription billing, most suppliers solely provide fundamental choices (e.g., a free trial that routinely turns into month-to-month billing).

FastSpring, then again, provides versatile choices free of charge trials, billing intervals, and cost. Right here’s an outline of the choices you’ve got with FastSpring’s recurring billing function:

- Free trial intervals of any size

- Free trials with or with out gathering cost data upfront

- Prorated subscription funds

- Variable billing intervals

- Utilization-based billing

- Improve at renewal or in the course of a cycle

- Prospects can change the billing date at any time (or you’ll be able to lock the billing date)

- Pay as you go recurring billing

- Subscription bundled with a one-time buy at enroll

- Refunds utilized to the subsequent cost

- And plenty of extra

Most of those choices could be arrange with only a few clicks and 0 code.

For those who want customized subscription logic, you need to use our API and webhooks library. Plus, our skilled builders are available that can assist you create the most effective resolution for your corporation mannequin.

Observe: If you have already got subscriptions arrange on one other platform, our group may also help you migrate over to FastSpring. Study extra right here.

Associated: Create, Handle, and Localize Your Digital Invoices

Scale Shortly with Clear Flat-Charge Pricing

With most worldwide cost processors, you’ll have so as to add further software program to your stack to handle recurring billing, taxes, dunning, and so on. Moreover, many worldwide cost processors cost additional for every function past processing funds. This makes it tough to know what you’ll be paying and the prices can rack up rapidly as you develop.

FastSpring doesn’t cost additional for every function. This makes it simpler to plan your funds and scale. As a substitute of charging per function, our group works with you to discover a easy, flat-rate value based mostly on the amount of transactions you progress by way of FastSpring. You’ll have entry to each side of FastSpring and also you’ll solely be charged when transactions happen.

FastSpring is extra than simply a global cost gateway — we’re your Service provider of Report. Join a free account or request a demo right now to see how we may also help you go additional, sooner.

9 Different Worldwide Fee Gateways for SaaS and Non-SaaS Companies

Verifone

Verifone (previously 2Checkout) is a cost platform for digital items and retail. Their options embody:

- Subscription administration

- Reporting and analytics

- International tax and monetary providers

- Threat administration and compliance

- B2B quote builder

- Channel accomplice administration

A few of these options are supplied for a further value as an add-on. Verifone is the one different choice on this checklist that gives MoR providers. They allow you to select between a MoR mannequin and cost service supplier mannequin.

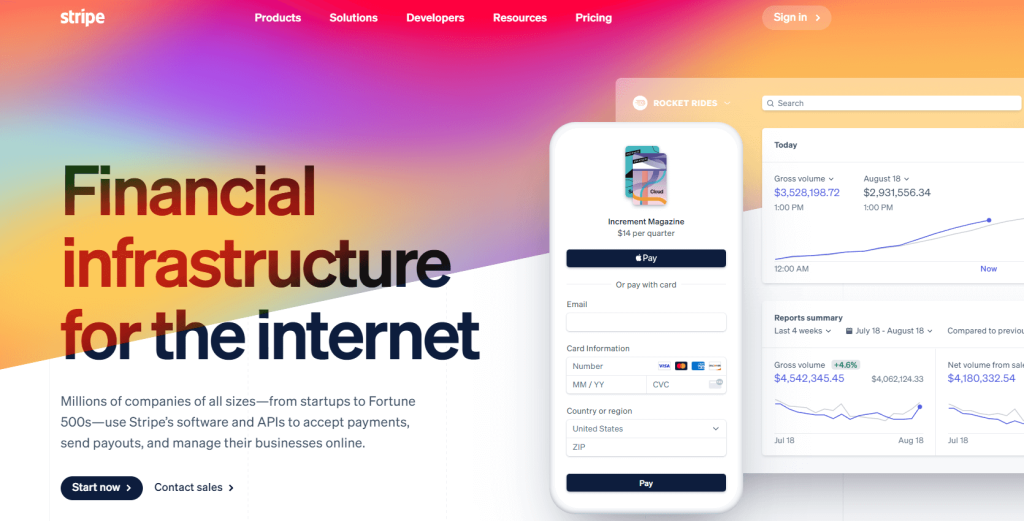

Stripe

Stripe is a well-liked cross-border cost processing platform that gives many various options together with:

- Customizable UI and pre-built checkout flows

- Easy subscription administration

- Fraud prevention and danger administration

- Versatile billing logic

- On-line invoicing

- In-person funds

Stripe may help you in issuing digital and bodily playing cards and assist you to handle enterprise spend. Stripe is pretty straightforward to arrange and combine with different methods, nonetheless, they don’t act as a MoR.

PayPal

PayPal is each a cost processor and a well-liked digital pockets (not a MoR). PayPal helps on-line companies and brick-and-mortar companies. PayPal’s providers embody:

- QR code and POS methods

- Invoicing

- Installment cost administration

- Assist for most popular cost strategies (aside from PayPal’s digital pockets)

- Crypto funds

- Chargeback safety

As a cost processor, PayPal makes use of one service provider account for all of its clients after which pays you out of that account.

Braintree

Braintree by PayPal is one other on-line cost gateway resolution that doesn’t provide MoR providers. The principle distinction between Braintree and PayPal is that Braintree offers you with your individual service provider account. Braintree additionally provides just a few extra providers (like subscription administration). Braintree’s options embody:

- Subscription administration

- Optimized checkout stream

- Versatile danger mitigation choices

- Reporting and analytics

- Third-party integrations for recurring billing, accounting, and extra

Braintree helps cost from PayPal, Venmo (within the US), Apple Pay and Google Pay.

Authorize.internet

Authorize.internet provides cost options for ecommerce retailers and in-person gross sales. Authorize.internet’s merchandise embody:

- Month-to-month billing administration

- Digital level of sale

- Fee processing

- Superior fraud detection suite (AFDS)

They provide a bundle for cost gateways or you’ll be able to select a bundle that features a service provider account. Authorize.internet serves corporations within the U.S., Canada, Europe, and Australia.

Adyen

Adyen is an end-to-end cost processing and monetary administration resolution. Right here’s an outline of Adyen’s options:

- On-line and in-person debit card and bank card funds

- Fraud detection

- Clever cost routing

- Automated dunning

- Subscription administration

Adyen serves corporations providing digital items, transportation providers, retail, meals and beverage, and hospitality.

WorldPay by FIS

Constancy Nationwide Data Companies, Inc. provides many monetary providers and merchandise together with WorldPay, their world cost processing resolution. WorldPay’s options embody:

- Pay by e-mail hyperlink

- Multi-currency assist

- Assist for 200+ different cost strategies together with cellular funds, e-wallets, pre-pay, and extra

- 24/7/365 assist in most world areas

Whereas WorldPay can provide you immediate world attain, cost processing is only one of their many choices. So, chances are you’ll not obtain customized consideration.

Amazon Pay

Amazon Pay lets your clients use the account they’ve already arrange on Amazon to pay you. When clients go to checkout in your ecommerce website, they’ll see Amazon Pay as an choice and can have the ability to use the cost choices and call data already saved of their account. Amazon Pay consists of:

- Fee processing

- Optimized checkout stream (modeled after Amazon’s personal checkout expertise)

- Recurring billing administration

- Fraud detection

You do not want to grow to be a vendor on Amazon Market to make use of Amazon Pay. Amazon Pay could also be a very good choice for small companies which are simply getting began.

Observe: You may settle for Amazon Pay with FastSpring.

Checkout.com

Checkout.com provides:

- Fee processing

- Payouts

- Fraud detection

- 3D safe authentication

Additionally they provide versatile incoming cost choices that allow you to select how one can allocate cash from cut up funds to fee charges. Checkout.com companions with over 50+ different distributors so you’ll be able to construct your world cost system.

FastSpring allows you to handle each side of world SaaS cost from one platform — with out managing tons of various software program options. We tackle taxes, regulation compliance, and far more for you. Join a free account or request a demo right now.