![]() Hyperverse has acquired a pyramid scheme fraud warning from the Hungarian Nationwide Financial institution.

Hyperverse has acquired a pyramid scheme fraud warning from the Hungarian Nationwide Financial institution.

As per the HNB’s August nineteenth warning;

HyperFund, which has been marketed increasingly more ceaselessly in Hungarian social media recently, operates as a multi-level advertising and marketing (MLM) sort enterprise.

The important thing component of the system is membership, which may be achieved by paying varied entrance charges. Those that be part of purchase the membership with the doorway charges, in return they obtain varied commissions and credit.

This technique is most widespread in pyramid schemes, behind which there is no such thing as a actual financial exercise, the one earnings of the system is the funds of recent entrants.

The only real goal of the exercise is to promote their merchandise to as many individuals as attainable, and for these folks to resell the chance.

As famous by the Financial institution of Hungary, Hyperverse is a continuation of the HyperFund Ponzi scheme. BehindMLM reviewed HyperFund in April 2021, and may verify the MLM aspect of the enterprise operates as a pyramid scheme.

The HNB’s warning continues;

Primarily based on the MNB’s market surveillance expertise, it occurs that the organizers of comparable techniques promote themselves as finishing up actions associated to cryptocurrencies, however in actuality they function an MLM system – in some circumstances a pyramid scheme – through which cryptocurrencies haven’t any or negligible function.

Resulting from these dangers, there’s a vital probability that traders could completely lose half or all of their invested capital.

Earlier than investing, it’s subsequently strongly beneficial that, along with evaluating the dangers, traders additionally receive dependable and actual details about the exercise beneficial to us, the cryptocurrency involved (e.g. trade charge, volatility) and its operator (its precise existence, fatherland, inside laws, relevant publicly accessible knowledge, and so on.).

It’s particularly advisable to ask the individual recommending the funding determination or the organizer concerning the dangers related to the funding, attainable losses and the probabilities of promoting and exiting the deal.

That is additionally vital as a result of the data contained within the – sometimes sponsored – content material showing on social media is commonly inadequate to make knowledgeable funding choices.

HyperFund and Hyperverse are run beneath the HyperTech Group umbrella, owned and operated by serial Ponzi scammers Ryan Xu (aka Zijing Xu) and Samuel Lee (aka Xue Lee).

Xu and Lee (proper) fled to Dubai final 12 months. They haven’t been seen in public since.

Xu and Lee (proper) fled to Dubai final 12 months. They haven’t been seen in public since.

Following Hyperverse’s collapse earlier this 12 months, preceded by HyperFund’s collapse in late 2021, two spinoff Ponzis have emerged; HyperOne and HyperNation.

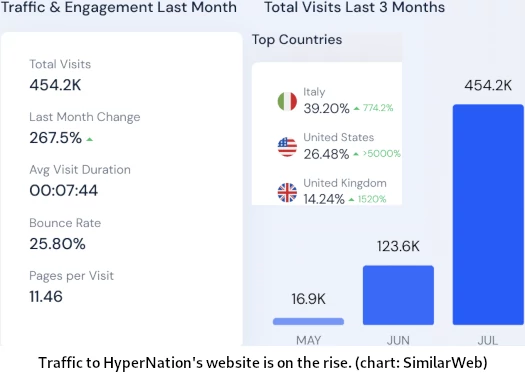

Whereas neither Ponzi scheme has reached the heights of HyperFund (Hyperverse by no means actually went anyplace), web site visitors to HyperNation is on the rise:

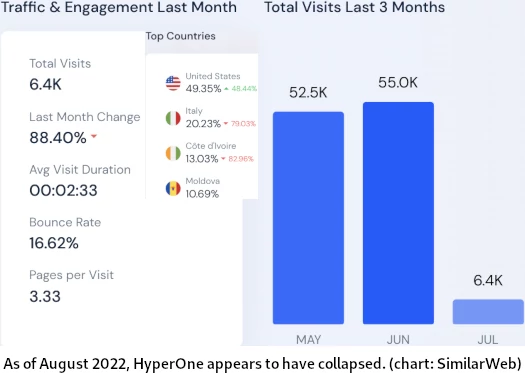

Over at HyperOne, issues aren’t going properly:

Hyperverse’s web site remains to be energetic. Whereas SimilarWeb tracks visitors down 28.59% month on month, Hyperverse’s web site nonetheless recorded over 5 million visits in July 2022.

A big share of Hyper* traders are believed to be US residents. As of but US authorities haven’t taken motion in opposition to the Hyper* Ponzi schemes, Ryan Xu or Samuel Lee.