Are you curious to be taught the highest finance product supervisor abilities recruiters are in search of?

Finance PMs occupy a singular place throughout the world of product administration. As specialised product professionals, they’re essential roles that assist startups and established firms develop, launch, and handle merchandise that present monetary companies to a target market.

Since finance PMs are answerable for a selected area of interest of merchandise, recruiters who scout for them search for a specific set of abilities in candidates. These abilities assist to information them in the course of the choice course of in order that they select the most effective applicant for the job.

This text discusses eleven abilities that employers search for when hiring finance product managers. You additionally be taught methods to start out refining these abilities from as early as at this time.

Let’s dive proper into the dialogue.

Important Finance Product Supervisor Abilities

Listed here are the highest abilities of finance product managers:

1. Finance Abilities

As a finance product supervisor, your main accountability is to create merchandise that drive and maintain income development.

Recruiters, due to this fact, require that finance PMs have robust capabilities in abilities associated to finance and fintech.

Finance and fintech are broad fields that cowl a few of the most typical companies that buyers use at this time:

- Conventional shopper banking

- Digital banking

- Private Finance

- Lending, financing, mortgages

- Fee applied sciences

- Insurance coverage

- Worldwide cash transfers and exchanges

In mild of this, finance product managers should show familiarity with the intricacies of the forms of services and products that characterize the finance and fintech industries.

On one hand, this entails having a transparent understanding of the finance and fintech market. Finance PMs should know the challenges that companies face on this area of interest in addition to the merchandise that they develop to focus on attainable customers. They need to additionally know the developments and tendencies that affect the sorts of merchandise that business leaders are investing in.

Then again, it additionally includes realizing the sorts of difficulties that product groups expertise when creating finance merchandise. Relying on the kind of product, these difficulties are both technical or conceptual.

Conceptual setbacks refer to those who take care of the imaginative and prescient, product technique, or objective of a specific product. Technical setbacks are those who converse to the challenges that groups face once they use complicated applied sciences for finance product improvement.

With that stated, top-of-the-line methods to develop finance abilities is to dedicate time to finding out the sphere.

In accordance with knowledge shared by PayScale, recruiters search for candidates who’ve a bachelor’s diploma or greater in finance, enterprise administration, and advertising and marketing to take up the function of a finance PM.

Relying on the state you’re in, there could also be necessities for certification or licensing in particular areas equivalent to a securities license.

Other than levels, recruiters additionally worth candidates who’ve taken specialised programs in product administration or finance. Contemplate taking our Product HQ Product Supervisor Certification Course to face out amongst competing candidates and enhance your possibilities of touchdown a job within the area.

2. Communication Abilities

Monetary product managers must be wonderful communicators. Not solely are you the spokesperson to your product, however you might be additionally the voice of your gross sales group and your clients.

The product improvement course of requires robust groups, and robust groups are constructed on stable communication abilities. Efficient communication lets you construct belief along with your cross-functional group and inspire them at each stage of product improvement.

PMs must juggle a number of relationships. Failure to speak your concepts and ideas clearly to your target market severs the bond you’ve got with them and lays the groundwork for tense relationships.

You should be a talented presenter and a superb listener who takes into consideration the suggestions of your group members to strategize product and enterprise improvement additional. In doing so, you show diplomacy, empathy, and respect for everybody you work together with at your organization.

Finance product managers use three streams of communication inside their groups.

Horizontal communication streams

These contain speaking along with your group members as you all work to succeed in a shared aim.

Vertical communication streams

Vertical communication streams are those who have a wider attain and all have a distinct objective. Finance PMs apply vertical communication streams with executives, buyers, board members, and stakeholders.

Exterior communication streams

Exterior communication streams check with all types of contact you make with enterprise companions, customers, and clients.

3. Information Analytics Abilities

Sturdy analytical abilities are crucial for any finance product supervisor.

Merchandise that enchantment to monetary customers incorporate some type of monetary knowledge and evaluation of their improvement. It is because the know-how that builders use to liven up finance product options depends on knowledge acquisition and evaluation to supply a given end result. In any case, product groups use data-driven options to construct options as an alternative of probability or guesswork.

Due to this fact, finance product managers should perceive methods to use knowledge to construct a aggressive benefit towards their rivals. This implies amassing knowledge from a number of departments and sources and placing it collectively to create actionable insights into monetary statements.

Information is crucial in terms of decision-making inside a corporation when contemplating new merchandise or modifications to current merchandise. Making sense of complicated knowledge helps spotlight alternatives that exist.

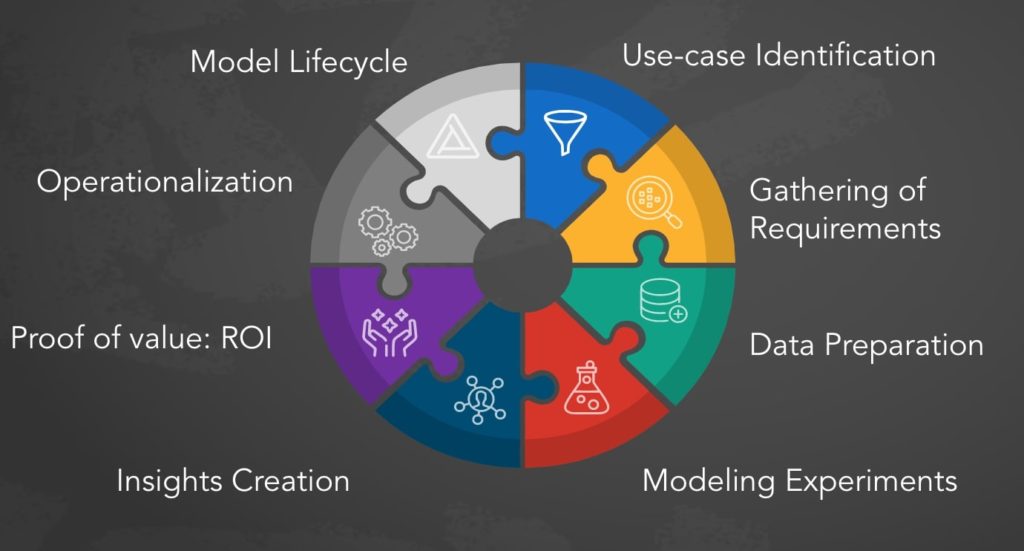

You should definitely take note of the technical features concerned in your product’s improvement. This entails understanding what the consumer move seems like, how many individuals are onboarding, and its hottest options. Monitoring this sort of knowledge reveals new insights and alternatives that assist finance PMs enhance the product throughout its lifecycle.

4. Spreadsheet Abilities

As a follow-up to knowledge analytic abilities, each finance skilled should be competent in utilizing spreadsheets.

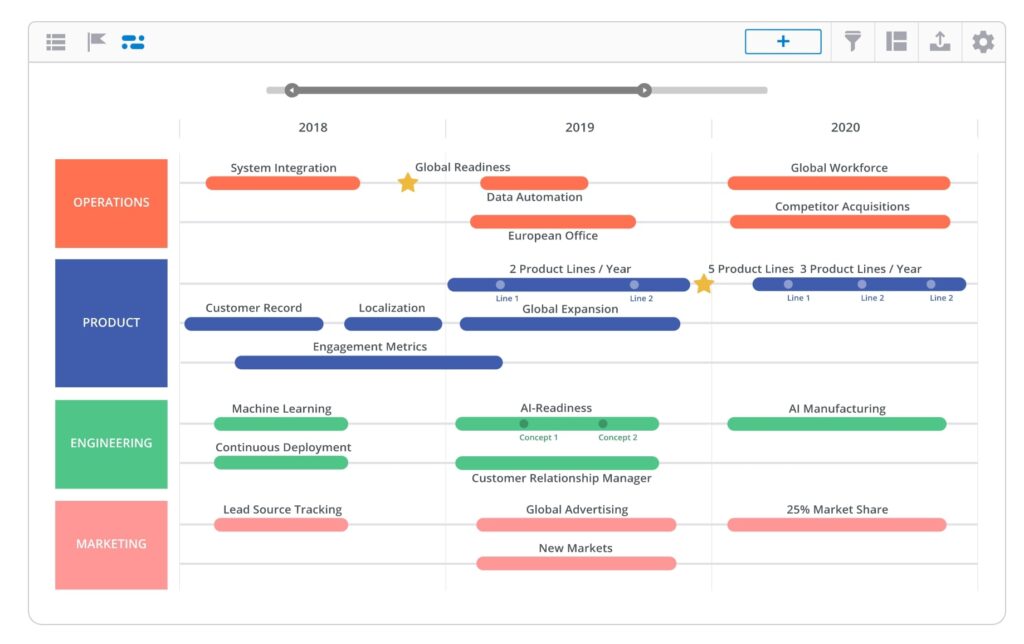

Credit: Roadmunk

Spreadsheets are an integral side of a finance product supervisor’s day-to-day actions. Finance PMs use spreadsheets to:

- Calculate prices

- Anticipate income

- Predict revenue features

- Acquire, retailer, and analyze knowledge

Spreadsheets act as roadmaps that assist finance product managers handle and keep the cost-related features of product improvement. For that purpose, finance PMs should find out about spreadsheet administration to execute metrics and hold a report of their enterprise goals and monetary objectives.

These embody understanding:

Pivot Tables

Finance PMs use this operate to group matching knowledge and give you fast summaries.

Regression Evaluation

This can be a statistical evaluation that helps PMs perceive how a call impacts their income stream. For instance, it helps managers perceive how completely different variables affect their consumer engagement.

Filters

Utilizing filters permits you to conceal knowledge that isn’t related.

SUMIF

This operate permits managers to extract abstract info from giant databases.

COUNTIF

This statistical operate permits you to depend the variety of cells that match a selected criterion.

VLOOKUP

This operate searches via giant datasets and returns corresponding values, making evaluation fast and straightforward.

5. Strategic Pondering Abilities

When deciding on methods to launch a brand new product or attempting to know the market, PMs must faucet into their strategic abilities. In addition they want the mindset of an issue solver.

As a finance PM, you need to prioritize issues in monetary methods that each inside and exterior clients expertise. Then, you’re employed to unravel them with efficient options.

Strategic considering abilities are crucial to find out which issues to deal with first. In addition they assist you to to know the present scenario an organization is going through in addition to the last word aim. That manner, you’ve got a greater understanding of the strategies wanted to deliver you to the end line.

6. Time Administration Abilities

Each monetary product supervisor must handle and prioritize time all through the product lifecycle. All PMs have days once they have extra on their to-do lists than time permits.

If you wish to be a product supervisor, you must shift priorities every day. You could shift focus to reply to modifications whereas managing to maintain a number of balls within the air.

Prioritizing helps make sure that no matter process you and your group are engaged on contributes to the underside line. Delegate duties which might be time-consuming and ignore these that aren’t related.

Safeguarding your time means being conscious of something that robs you of time to give attention to vital issues. Conferences are a typical perpetrator. Whereas conferences are crucial, they stall productiveness, so hold them quick and on course.

7. Teamwork Abilities

To deliver a product to market, monetary product managers typically work with a number of cross-functional groups. This consists of designers, builders, gross sales and advertising and marketing groups, and even buyer assist.

A finance product supervisor performs an efficient function in constructing teamwork abilities, given their reliance on these groups. As groups develop with cross-collaboration between departments it takes work to make sure a cohesive, high-performing group.

These groups are various in personalities, types, and talent units. What’s extra, every group member has their expectations. Put all that collectively and a product supervisor faces inconsistencies that have an effect on total productiveness.

For that purpose, finance PMs should do their half to make sure that there may be chemistry inside their advertising and marketing group and that everybody feels enthusiastic about making product objectives a actuality.

8. Agile Abilities

Utilizing the ideas of agile helps monetary product managers plan and construct their merchandise.

As we’ve seen in the previous few years, product demand modifications. When buyer wants and market calls for are pivoted, old-school improvement groups have problem holding up.

Not like extra conventional approaches to product improvement, agile follows a distinct product technique. The place the normal approaches typically meant an extended, sequential improvement cycle, agile gives a extra versatile method.

This flexibility minimizes the time spent on the product roadmap.

The agile technique breaks the product improvement course of into smaller parts in a frequent launch cycle known as sprints. Smaller parts and shorter cycles make it simpler for a product supervisor to validate concepts and methods.

The ideas of agile weigh closely on the 80/20 rule. This implies profitable product managers should give attention to doing issues which have the best affect whereas aligning product technique with organizational objectives.

Agile retains a product supervisor centered on the correct factor and permits them to adapt to the altering wants and circumstances of their clients and stakeholders.

9. Danger Administration Abilities

As a product supervisor, you want threat administration abilities. There may be all the time a level of threat when introducing any new product. Each funding determination you make comes with potential threat and also you want to have the ability to handle what that threat could entail.

Danger administration typically means containment and mitigation. When it comes to product administration, you should be able to act when a threat arises. In any other case, you threat jeopardizing the product and its possibilities for achievement.

A product supervisor additionally must establish threats upfront to make sure the success of a product. Threats embody:

- Ache factors for purchasers

- Failed product-market match

- Rivals and their respective merchandise

- Regulatory compliance

10. Negotiation Abilities

A product supervisor is a go-to particular person in terms of setting priorities or managing battle. Because you’re working with completely different groups and stakeholders who’ve completely different objectives and pursuits, battle and crises are certain to come up.

Because the product chief, you must negotiate and compromise. However that doesn’t imply assembly within the center simply to maintain all people completely happy.

Stable negotiation abilities imply you need to:

- Justify your last determination with knowledge

- Set up and keep rapport with stakeholders and group members

- Set objectives to your negotiation course of and don’t get sidetracked by them

- Do not forget that the aim of negotiation is to deliver all events collectively and discover an agreed-upon consequence that maintains relationships

- Keep goal and work for a conclusion that’s based mostly upon knowledge, not emotion

11. Analysis Abilities

Anybody in monetary product administration should carry out intensive market analysis first.

A part of product imaginative and prescient requires understanding who your product is for and what issues they should resolve. Finance PMs should conduct thorough market analysis to find out the kind of product clients are in search of and current competitors

Analysis abilities and knowledge evaluation assist to tell product managers about present market developments and future alternatives and threats throughout the market. With the correct info, they create profitable merchandise.

Last Remarks

A finance product supervisor should possess a deep understanding of economic merchandise and markets, coupled with the flexibility to leverage knowledge analytics to drive decision-making. Moreover, the combination of technological options is paramount, making familiarity with fintech improvements and agile methodologies indispensable.

An inherent ability for customer-centric considering ensures that the merchandise developed are usually not solely revolutionary but additionally align with the wants and expectations of the top customers.

By mastering these various talent units, finance product managers can drive their organizations towards sustainable development and aggressive benefit in a posh and fast-paced monetary business..

FAQs

Listed here are solutions to probably the most continuously requested questions relating to finance product administration:

What abilities do you must be a monetary product supervisor?

A monetary product supervisor wants:

- Sturdy analytical abilities

- Proficiency in knowledge analytics

- Familiarity with fintech improvements and agile challenge administration

- Glorious communication and management skills coordinate cross-functional groups and stakeholder relationships

- Deep understanding of economic markets and product technique

What does a product supervisor do in finance?

A product supervisor in finance:

- Develops and manages monetary merchandise equivalent to loans, funding autos, and insurance coverage merchandise. Conduct market analysis

- Monitor product efficiency

- Collaborate with numerous groups to deliver the product to market

- Make data-driven choices to reinforce product choices

- Outline product necessities

What abilities are wanted for a product supervisor?

A product supervisor wants strategic considering, market analysis skills, product administration abilities, and wonderful communication abilities. Analytical abilities and customer-centric considering are essential for making data-driven choices and creating precious merchandise.

Tips on how to develop into a monetary product supervisor?

To develop into a monetary product supervisor:

- Begin by acquiring a level in finance, enterprise, or a associated area

- Achieve expertise in finance or product administration roles

- Develop a powerful understanding of economic markets and merchandise

- Pursue extra certifications like CFA or PMP to construct abilities in knowledge analytics and challenge administration

In case you are new to product administration and want to break into your very first product supervisor function, we advocate taking our Product Administration Certification Programs, the place you’ll be taught the basics of product administration, launch your product, and get on the quick monitor towards touchdown your first product job.