In case you’ve watched the information just lately, it appears that evidently the chance of a recession has captured everybody’s consideration.

People have already seen indicators just like the inflation of lease, gasoline costs, groceries, and different requirements that pre-existing wages can’t meet. However, nonetheless, some specialists say that we may nonetheless avert a recession – and if we do not – a recession won’t final so long as 2008’s.

With all these modifications and newsbites in thoughts, enterprise decision-makers may marvel how their potential prospects are reacting. And, if their spending habits could possibly be altering within the close to future consequently?

Whereas we do not know if we’ll head right into a recession, this publish goals to assist manufacturers and entrepreneurs put together to proceed to fulfill shoppers the place they’re – even in unsure occasions.

To offer readers perception on how spending behaviors are or could possibly be shifting, we surveyed greater than 200 U.S. shoppers throughout all age teams.

Earlier than we dive in, we’ll briefly clarify the idea of a recession:

What’s a recession?

A recession is a protracted downturn in financial exercise that happens when the worth of products and providers falls for 2 or extra consecutive quarters. This enterprise cycle contraction displays not solely the lowered worth of products but additionally decreased revenue ranges, industrial manufacturing, and inventory costs.

Recessions are a traditional a part of the enterprise cycle and may be induced by international financial shocks, modifications in client confidence, and different large-scale financial modifications.

However this yr, specifically, there are a choose few components which have spurred concern a few potential recession, though one nonetheless hasn’t been declared or confirmed.

For extra on the reason for recessions and why some are involved about them taking place within the close to future, try this useful publish from our companions at The Hustle.

How Client Spending Habits Might be Altering

We performed a Glimpse survey of U.S. shoppers to grasp how they spend their cash and the way monetary uncertainties like recession may have an effect on them. This is how they responded to our questions:

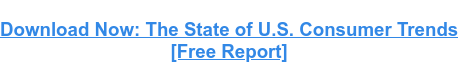

1. How has the information of a possible US recession impacted your spending habits?

Though a recession will not be but sure, most respondents are buying much less and spending cash extra concisely than they have been in earlier months.

Rising prices of products and providers typically trigger shoppers to grow to be extra cautious in frivolous spending, and we’re certain People are feeling the consequences come up shortly.

As a marketer or model chief, now may be a very good time to think about reductions, gross sales, offers, or freemium advertising and marketing. Whereas persons are doubtlessly tightening their wallets, they nonetheless may buy objects, providers or experiences which might be reasonably priced or present bang for his or her buck.

How Spending Might Change In a Recession

When occupied with client spending conduct, it’s typically contingent on exterior components, and information of immense modifications within the financial system is value wanting into. Beneath is the distribution of various client choices and the way they’d reply to monetary uncertainty or a possible recession sooner or later.

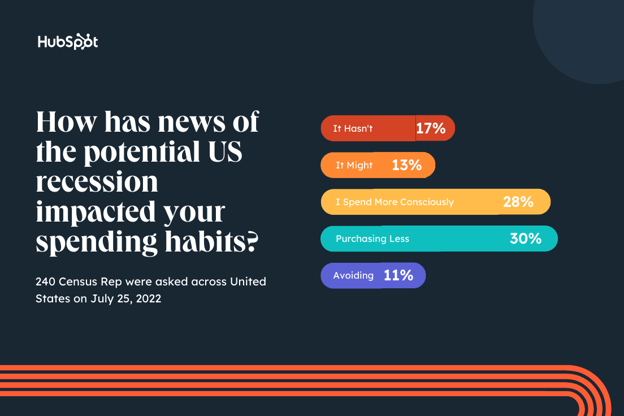

2. If a recession is asserted, how will your own home price range change within the first three months of this new monetary period?

Unsurprisingly, most shoppers polled (64%) say they’d lower or proceed to lower their residence price range if a recession was declared.

As of June, inflation hit 9.1%, a historic new peak by the Federal Reserve. However, wages aren’t shifting to match these more and more quick modifications. Naturally, the general public is already on the lookout for methods to keep away from breaking the financial institution — by decreasing their budgets.

In case you market B2C manufacturers, or merchandise that may be used particularly within the residence, that is essential to remember if monetary uncertainty continues. Whilst you should not panic and alter your complete advertising and marketing technique over only one small survey, you may need to take into account methods like advertising and marketing your most reasonably priced, discounted, or important merchandise over higher-priced or luxurious objects.

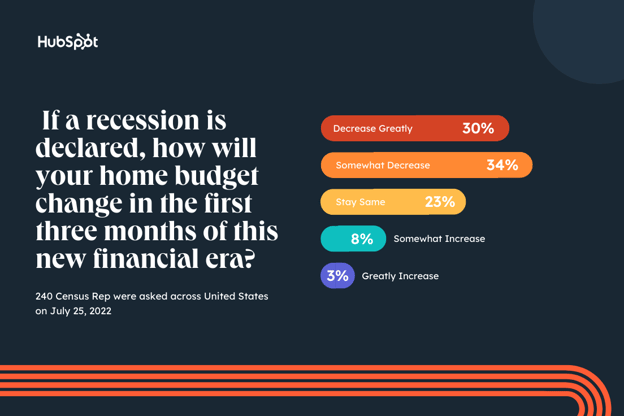

3. Throughout unsure monetary occasions, what did you spend essentially the most cash on?

We additionally requested shoppers to replicate on their buying conduct in earlier financial eras with the query, “Throughout unsure monetary occasions (akin to previous recessions or throughout the COVID-19 pandemic), what did you spend essentially the most cash on?”

When surveyed, essentially the most outstanding items shoppers have purchased in unsure occasions are usually thought of primary requirements.

- Important Groceries and Meals

- Lease, Mortgage, Housing Payments

- Important Private Care Merchandise

- Treatment and Healthcare

The info displays a shift to self-preservation and fewer on purchasing for pleasure or taking up dangers comes as no shock. By eliminating prices for leisure or leisure, individuals can guarantee their households are taken care of earlier than taking their greenback to do issues like begin a enterprise, take a stroll to the films, or put money into an unpredictable market.

The excellent news? This does not essentially imply there will likely be an entire pause in retail, leisure, or different non-essential providers. Greater than 10% nonetheless plan to put money into digital or on-line leisure, round 7% would nonetheless put money into eating places and bar outings – in addition to schooling and teachers, and over 16% would put money into clothes and attire, So, not like the pandemic, we most likely will not see complete economies shut up utterly for months at a time.

How an Upcoming Recession Might Differ from 2008

There are a number of key variations between this recession and that of 2008, primarily within the components that triggered it and its projected period.

In keeping with Morgan Stanley, the potential recession can be largely pandemic-induced and credit-driven.

COVID-related fiscal and financial stimulus contributed to inflation and drove hypothesis in monetary belongings. That is very totally different from the Nice Recession of 2008.

The 2008 recession was resulting from debt-related excesses constructed up in housing infrastructure, which took the financial system practically a decade to soak up. In contrast, extra liquidity, not debt, is the most definitely catalyst for a recession right now.

Because of the distinction in causes, specialists at IMF predict a brand new recession could possibly be quick and shallow.

Key Takeaways for Companies in 2022

As entrepreneurs, we’re not specialists in monetary markets and should not be seen as a supply for funding, HR, and authorized recommendation. And, nobody ever is aware of for sure if or when there will likely be a recession.

It is also to remember that, whereas the outcomes above can actually aid you navigate how one can market your model, they’re only a portion of 1 small survey and a short look into the eyes of shoppers. Earlier than making any main choices about your advertising and marketing division, spend, or enterprise, you completely ought to do your analysis, analyze a number of information factors, and seek the advice of specialists in your business.

Whereas your choices must be primarily based on a deep dive of knowledge, the survey outcomes above do present that entrepreneurs must be cautious about how their efforts may have to pivot with altering client wants or developments.

Listed here are a number of takeaways to remember.

- A recession right now won’t be the identical as 2008. Whereas shoppers possible will tighten budgets and search for merchandise that supply essentially the most worth or necessity for his or her greenback, they may not be in detrimental monetary circumstances. They may nonetheless be persuaded to purchase a fantastic product that is marketed to them within the coming months.

- Market your product’s affordability, worth, and/or necessity: As shoppers and companies tighten their budgets, making gross sales, retaining prospects, and persuading individuals to purchase non-essential merchandise will likely be tougher. Ensure you are advertising and marketing that your product has added worth or significance, apart from being flashy, fashionable, or cool.

- Entrepreneurs may need to discover more cost effective methods. (Suppose decreasing extra advert spend and specializing in natural social, search engine optimisation, or e-mail advertising and marketing as an alternative.)

Keep in mind, monetary uncertainties – and even recessions – are frequent. And whereas it would grow to be tougher to win prospects within the coming months, enterprise and shoppers will nonetheless hold shifting (and making purchases) at the same time as we watch for the cycle to run its course.