Merkle’s retail and client items group has turn out to be a testbed for a number of different verticals.

That isn’t shocking.

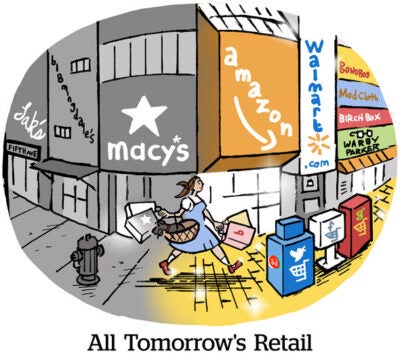

Though individuals have a tendency to consider retail promoting from the angle of grocery retailer chains and main CPG manufacturers (Walmart, Goal, Kroger and the manufacturers they carry), lately the “retail media” class features a host of latest entrant: Greatest Purchase, Marriott, Lyft, Uber, craft items retailer Michael’s. Take your decide.

Anne-Marie Schaffer, an EVP and progress officer for Merkle’s retail and CPG group, is experiencing the same evolution in her position. Merkle not too long ago folded “automobility” into its retail and client items group – Uber, Lyft and T-Cellular have all launched media networks – and has these days been incorporating quick-serve eating places and different kinds of retail chains.

AdExchanger spoke with Schaffer about her position and the way Merkle stays on high of the fast-moving retail media alternative.

AdExchanger: What does the retail and CPG “progress officer” position entail?

ANNE-MARIE SCHAFFER: I work with {our capability} leaders to develop options for Merkle as we begin to see wants within the market.

An instance of that: A few years in the past was the beginning of retail media community acceleration. We had labored with Goal’s Roundel media community for 3 years, with our ambition to have them take it in home. We then took that answer and course of and replicated it throughout different big-box retailers. Now it’s even going throughout different kind of outlets.

We search for these varieties of quick currents and create options round them.

Any options which might be within the early stage now?

Extra not too long ago, we’ve been making an attempt to create options round new digital messaging methods, in addition to social commerce. As we observe shopper wants, we begin to construct this stuff and take a look at the waters from a knowledge perspective with a few of our shoppers after which get it in market to see if it will get traction inside our enterprise.

Retailers, even these with giant in-house advert teams, have added many new advert tech and company companions this 12 months. Will that pattern proceed?

We’re going to see it proceed to increase over the course of the following 18 to 24 months. After that, although, we’d see consolidation.

However we’re nonetheless seeing lots of second-tier retailers what the big-box corporations are doing and on the alternative to monetize their web sites with numerous companions. We’ll see these capabilities increase as marketplaces begin to achieve traction on the tech facet.

The pattern will proceed to morph and evolve however, sooner or later, it’ll hit a degree of scale the place {dollars} can solely go up to now. Proper now, Amazon represents round $40 billion of a $45 billion market for retail media networks – and there’s solely so many advert {dollars} that may go to shopper advertising.

The statistic I’ve seen is that retail media ought to double over the course of the following 18 months to about $90 billion. As soon as we get there the query turns into, what number of {dollars} can nonetheless movement by way of these media networks?

That’s once we’ll begin to see some consolidation.

What has to occur proper now from a progress perspective to ensure that retailer networks to double inside 18 months?

Let’s say you’re an organization like Get together Metropolis, for instance, and you already know there’s a chance to promote different varieties of providers and merchandise. They will promote experiences by way of marketplaces. They will accomplice with social gathering planners, native shops or discover different varieties of experiences that cater to events.

We’re going to begin to see increasingly of these varieties of retailers shifting into the monetization facet of retail media networks. If you happen to’re a shoe retailer that sells soccer cleats, that’s a chance to promote different points of soccer which might be non-endemic to the location. That may be a means into native companies.

Proper now, retail media is primarily for big-box retailers and large CPG manufacturers. However there’s the chance to have native {dollars} movement by way of a few of these retail networks as effectively, which is a giant a part of the chance captured by Google and Fb. We’ll see that increase.

Apart from Amazon, are there examples of outlets with attention-grabbing non-endemic enterprise?

Conversations are beginning to occur, however usually within the reverse means.

Earlier than we see a retailer like Walmart develop a non-endemic monetary providers class, for instance, I’d anticipate to see monetary providers to enter retail media.

Like, what a couple of monetary providers firm that may monetize its web site? They’ve lots of services and products they promote. American Categorical or Chase, say, aren’t simply promoting bank cards and monetary providers. They’re additionally sharing experiences, they could have bodily banks and so they have lots of content material hubs. They will begin to monetize their media and knowledge, too.

I’ve but to see one come to market, however that’s the place we’ll see future iterations of retail media networks in a non-endemic area.

Earlier you talked about social commerce as an thrilling early-stage alternative for Merkle. What’s the state of social commerce proper now?

It’s very nascent. We’re nonetheless in testing mode to see what’s working and what’s not. It’s a really Gen-Z focused atmosphere proper now.

The large query because it pertains to social commerce is: Is it a consideration play or a buying play?

We’ve completed some surveys, together with a Dentsu client report that we put out each couple of months.

The newest wave confirmed that youthful and higher-income shoppers take note of and are extremely influenced by social platforms and cultural traits associated to services and products.

What we’re testing is whether or not they’ll really make purchases.

This interview has been edited and condensed.