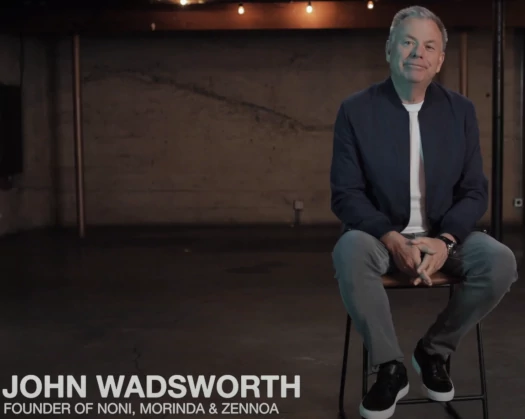

Approval has been granted to promote NewAge off to authentic Morinda co-founder John Wadsworth.

Approval has been granted to promote NewAge off to authentic Morinda co-founder John Wadsworth.

NewAge, who owns the MLM corporations Noni by NewAge and Ariix, filed for Chapter 11 chapter on August thirtieth.

That very same day NewAge signed an Asset Buy Settlement with DIP Financing LLC.

DIP Financing LLC is a Wyoming shell firm with a PO Field tackle in Puerto Rico.

The only real named consultant of DIP Financing LLC within the NewAge Asset Buy Settlement is “John Wadsworth”.

I initially pegged this as John J. Wadsworth, certainly one of Morinda’s authentic co-founders.

Morinda launched as Tahitian Noni Worldwide, relationship all the best way again to 1996. Non-MLM enterprise operations date again even farther to 1993.

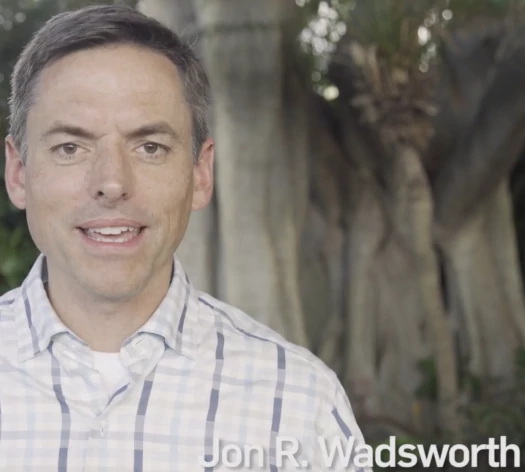

Seems the “John Wadsworth” that signed the DIP Financing submitting was John J. Wadsworth’s nephew, John R. Wadsworth.

This was disclosed in a September twentieth submitting, pursuant to an objection as as to if John R. Wadsworth had any hand in NewAge’s decline.

John R. Wadsworth identifies himself as a distributor for each Morinda and now NewAge.

Apart from an element time summer season job in 1997, whereas I used to be faculty scholar doing analysis work for Morinda, I’ve by no means been an insider, worker, officer, director or vital shareholder of NewAge, Inc.

I’m a useful proprietor of lower than 0.4% of the excellent shares of NewAge, Inc.

John R. Wadsworth isn’t the one different Wadsworth tied to the enterprise. John J. Wadsworth we’ve already lined above.

B. Joseph Wadsworth (“Brother”) is my brother and is an space president of NewAge for the North Asia Space.

BehindMLM reader “D”, who appears to be aware of the Wadsworths, claims within the feedback under that “Joseph is his brother and already runs NewAge Japan.”

Whereas he’s clearly closely concerned in NewAge as a distributor, John R. Wadsworth maintains;

By comparability with my Uncle and Brother, I’m not now, nor have I ever been an worker, officer or director of NewAge or its associates.

By comparability, I’ve all the time been an entirely impartial gross sales agent/distributor of Morinda, each earlier than and because it was acquired by (New Age).

John R. Wadsworth additionally asserts he “had nothing to do with the decline of the corporate”.

Quite the opposite, my gross sales of firm merchandise, as an impartial gross sales agent/distributor, have been rising.

John R. Wadsworth claims he turned conscious of NewAge’s monetary points by his brother, B. Joseph Wadsworth, on August seventeenth.

B. Joseph Wadsworth recommended his brother name Joe Ebb at Houlihan Lokey Capital, Inc., to debate NewAge’s state of affairs.

After talking by telephone with Houlihan on August 17, 2022, Houlihan requested I execute a non-disclosure settlement so they might share with me the identical info they shared with some other potential acquirers, pursuant to the exact same phrases of confidentiality to which I agreed.

Apart from suggesting I name Houlihan, no member of the family shared any info with me about NewAge’s challenges.

On August twentieth, John R. Wadsworth set about forming DIP Financing LLP.

Along with me, the opposite buyers in DIP Financing LLC are neither present nor former insiders, staff, officers, administrators or vital shareholders of NewAge, Inc.

John R. Wadsworth’s declaration goes on to say some mortgage points in China however I don’t suppose that’s related to NewAge being bought off.

Personally I feel whereas John R. Wadsworth might need not included his household in DIP Financing LLC for the sake of legality, that is clearly a return of Morinda to the Wadsworth household as a complete.

Sadly, a minimum of for now, who John R. Wadsworth’s DIP Financing LLP companions are hasn’t been disclosed. Nor do we all know how a lot DIP Financing paid for NewAge.

In associated filings, a September twenty eighth Statements of Monetary Affairs reveal that, all through 2021, NewAge seems to have been saved afloat by a $3.2 million PPP Mortgage.

Of the mortgage quantity, $2.8 million was forgiven.

Ariix’s monetary affairs in the meantime look kinda suss. The corporate recorded $23.9 million in gross income in 2021, which plummeted to only $15,506 from January 2022 to August 2022.

Whereas NewAge did add a press-release to their web site acknowledging its chapter on August thirtieth, the corporate hasn’t in any other case made any public acknowledgement.

All through chapter NewAge has remained energetic on social media, evidently discussing… extra “vital” points.

I’m not anticipating any additional substantial updates however I’ll proceed to watch NewAge’s chapter docket.