Commerce and retail media instantly turned an unbelievable tailwind for internet advertising.

Retail media is now an essential a part of the expansion image painted for buyers by The Commerce Desk. And a report printed by McKinsey final month forecasts that retail media networks (RMNs) will develop from about $45 billion in advert spend to surpass $100 billion in 2026.

“It has the potential to generate over $1.3 trillion of enterprise worth in the USA and create a paradigm shift in digital promoting not seen for the reason that rise of programmatic,” in accordance with the consulting agency.

It’s simple to see the enchantment: RMNs join impressions on to purchases, a neat trick that’s helped Amazon turn into an promoting powerhouse. And RMNs are coming into the scene at a time when dependable conversion attribution is evaporating.

However anybody banking on RMNs to energy programmatic progress for years to return wants a actuality verify. The engaging prospect of potential progress alternatives in retail media masks a class with much less progress alternative for advert tech than might seem within the uncooked numbers.

The patron silo

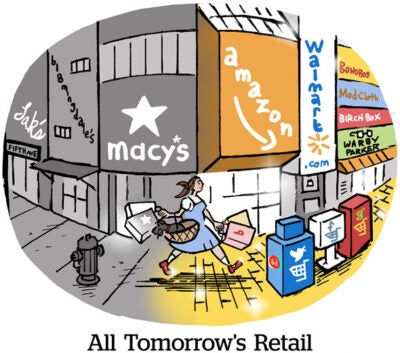

The unbelievable trajectory of retail media from being comprised of Amazon and some marginal enterprise teams at Walmart, Kroger and Goal just a few years in the past to now a broad community of RMNs – Michael’s, Albertsons, Greenback Basic, Macy’s, Finest Purchase and Petco amongst them – that course of tens of billions of on-line advert {dollars} per 12 months and will double once more in just a few years provides a distorted sense of potential progress.

These RMN budgets, excluding Amazon’s, are nonetheless largely trapped inside shopper advertising siloes. Earlier this 12 months, Walmart and Goal disclosed annual advert income for the primary time. Walmart earned a bit of greater than $2 billion in 2021, and Goal Roundel cleared $1 billion. However they’re not going out and profitable open programmatic budgets, at the least not but.

Manufacturers carried by these corporations and different giant retailer chains are contractually obligated to re-spend a % of gross sales, sometimes 5% to 10%, on commerce advertising with the retailer. Traditionally, that cash would go towards coupon offers, in-store model shows or shelf placement. Now it’s packaged into on-line advert platforms.

The relationships between retailers and types, in addition to the budgets themselves, have existed for years and are solely simply transitioning on-line. It’s a really completely different dynamic than with CTV, the opposite huge programmatic tailwind, which introduced 1000’s of solely new sorts of advertisers to TV promoting for the primary time and introduced many tech corporations their first scaled supply of video provide.

The non-endemic non-story?

RMNs have a compelling pitch to flee their commerce advertising siloes.

If advertisers can’t goal primarily based on earnings bracket on Fb anymore (which they will’t), and widespread third-party viewers segments akin to “Excessive Earners” or “Energy Customers” lose their luster (which they’ve), retail media may be the next-best choice. A mortgage firm that may now not merely goal low-income households or an airline on the lookout for spendthrift customers may use the Greenback Basic Media Community as a proxy. Or if Peloton believes there’s an overlap between its prospects and, say, individuals who purchase sure natural groceries, they will goal Kroger and Goal buyers who they know purchase these merchandise. That technique works even when Kroger and Goal don’t promote Peloton bikes.

The issue is that, except for Amazon, non-endemic progress (that means progress amongst advertisers that aren’t carried by the shop) is hypothetical.

Rising a non-endemic base isn’t on the radar for a lot of retailers; even the most important are nonetheless engaged on the fundamentals simply to gather the low-hanging fruit of manufacturers they carry. However even when non-endemic manufacturers had been a precedence, one thing must give for advertisers to leap in.

And we all know what must give: worth.

Retail media CPMs are bonkers. Shopping for impressions on a big-box retailer web site can value as a lot because the shiniest CTV stock, within the $20 to $50 vary.

Retail media CPMs are bonkers. Shopping for impressions on a big-box retailer web site can value as a lot because the shiniest CTV stock, within the $20 to $50 vary.

For non-endemic advertisers, retail media worth factors could also be robust to swallow. Manufacturers might pay that a lot when advertisements generate direct ecommerce gross sales and may be attributed later to retailer gross sales. However, once more, these manufacturers are obligated to re-spend a % of gross sales on retail commerce advertising. There isn’t the identical fixed downward stress on pricing as the remainder of programmatic, the place each greenback should be justified or it’s going some other place subsequent time.

The walled backyard evolution

One other retail media progress block for the programmatic trade is the potential (to not say inevitable) transformation from primarily open programmatic infrastructure to a walled backyard method.

Retailers, even the most important and most superior, have leaned closely on programmatic companions to assist their on-line advert platforms. In June, Kroger launched an API with new advert companions Skai, Pacvue and Flywheel Digital. Every week later, Sam’s Membership rebranded its advert enterprise, now the Member Entry Platform, with companions The Commerce Desk, LiveRamp and Criteo. And prior to now few months, Walmart Join, the corporate’s advert enterprise, created a companion program that now has 14 ad-buying and ad-measurement distributors.

Wait, you may say, didn’t I say this transformation was dangerous for programmatic distributors?

Sure, and that’s as a result of the present state of retail media shouldn’t be the top state. Programmatic distributors are a present necessity that retailers begrudge.

Expanded companion applications, particularly for sponsored product search advert specialists like Skai and Pacvue, are an indication that retailers need assistance sourcing demand for his or her websites. But when in some unspecified time in the future they will do it themselves, they’ll drop the middlemen and take the margin.

Amazon Writer Companies as soon as had a Hearth TV stock program that included dataxu (earlier than it was acquired by Roku) and The Commerce Desk and allowed open internet advert IDs to be linked to Amazon gross sales.

“This settlement is a crucial indicator of the place the trade goes, and can turn into simply one among many, over time,” The Commerce Desk CEO Jeff Inexperienced mentioned in a memo on the time. “APS [Amazon Publisher Services, the company’s sell-side tech for Fire TV and other media] is supporting the open web, in distinction to different huge tech walled gardens.”

Looking back, Inexperienced seemingly hopes the APS Hearth TV companion program shouldn’t be an indicator of the place the trade goes. As a result of dataxu was kicked out after the Roku deal in 2019, and The Commerce Desk was expelled in 2020.

Now solely the Amazon DSP should purchase Hearth TV stock and attribute it to gross sales information.

In some unspecified time in the future, the Walmart DSP delivered to you by The Commerce Desk may be the Walmart DSP.

It’s a greater wager than the possibilities of open programmatic distributors getting a ten-billion-dollar slice of the retail media pie by the point it reaches $100 billion.