The SEC has charged eleven Forsage Ponzi promoters with securities fraud.

The SEC has charged eleven Forsage Ponzi promoters with securities fraud.

The SEC claims Forsage is a $300 million greenback Ponzi scheme.

Forsage proprietor Vladimir “Lado” Okhotnikov is among the many eleven defendants.

The SEC’s grievance was filed on August 1st and names the next defendants:

Vladimir “Lado” Okhotnikov (proper, public face of Forsage, Russian nationwide dwelling in Georgia)

Vladimir “Lado” Okhotnikov (proper, public face of Forsage, Russian nationwide dwelling in Georgia)- Lola Ferrari (pseudonym, claims to be the “goddess” of Forsage, Russian nationwide dwelling in Indonesia)

- Mikail Sergeev (aka Mike Mooney, Gleb and Gleb Million”, Forsage Improvement Director, Russian nationwide dwelling in Moscow)

- Sergey Maslakov (primary Russian promoter, Russian nationwide dwelling in Gelendzhik or Moscow)

- Samuel D. Ellis (Forsage YouTube shill, US nationwide dwelling in Kentucky)

- Mark F. Hamlin (Forsage YouTube shill, US nationwide dwelling in Virginia)

- Sarah L. Theissen (Crypto Crusaders admin, US nationwide dwelling in Wisconsin)

- Carlos L. Martinez (Crypto Crusaders co-founder, US nationwide dwelling in Illinois)

- Ronald R. Deering (Crypto Crusaders co-founder, US nationwide dwelling in Idaho)

Cheri Beth Bowen (proper, Crypto Crusaders co-founder, US nationwide dwelling in Mississippi) and

Cheri Beth Bowen (proper, Crypto Crusaders co-founder, US nationwide dwelling in Mississippi) and- Alisha R. Shepperd (Crypto Crusaders co-founder, US nationwide dwelling in Florida)

The SEC alleges the eleven Forsage defendants

created, operated and maintained a web based pyramid and Ponzi scheme by way of Forsage.io.

Vladimir Okhotnikov, Lola Ferrari (beneath), Mikhail Sergeev and Sergey Maslakov are recognized as Forsage founders.

The Founders perpetuated Forsage and its sensible contracts by way of aggressive on-line promotions and steady improvement of recent funding platforms.

Throughout the related time interval, the Founders raised funds from retail buyers in america and the world over by way of the unregistered supply and sale of securities in Forsage.

In reference to the supply and sale of these securities, the Founders engaged in a scheme to defraud buyers and additional engaged in practices that operated as a fraud or deceit upon these buyers.

Samuel Ellis (beneath), Mark Hamlin and Sarah Theissen are recognized as Forsage promoters;

Throughout the identical time interval, the Founders engaged people in america – Defendants Samuel D. Ellis (“Ellis”), Mark F. Hamlin (“Hamlin”), and Sarah L. Theissen (“Theissen”) (collectively, the “Promoters”) – to advertise Forsage on Forsage-hosted platforms, together with the Forsage Official YouTube channel and Forsage’s training software, the Forsage Academy.

In doing so, the Promoters engaged within the unregistered supply and sale of securities in Forsage.

Theissen, Carlos Martinez, Ronald Deering, Cheri Bowen and Alisa Shepperd are alleged to have

led the biggest Forsage promotional group in america.

In doing so, the Crypto Crusaders engaged within the unregistered supply and sale of securities in Forsage.

As well as, by selling Forsage in america, the Crypto Crusaders engaged in a scheme to defraud buyers and additional engaged in practices that operated as a fraud or deceit upon these buyers.

The Crypto Crusaders had been probably the most profitable Forsage promotional group in america, largely as a result of they emulated the Forsage advertising technique created by the Founders. Certainly, the Crypto Crusaders YouTube channel and Fb group have had over 75,000 subscribers

As to Forsage itself, the SEC alleges it’s

a textbook pyramid and Ponzi scheme. It didn’t promote or purport to promote any precise, consumable product to bona fide retail clients through the related time interval and had no obvious income apart from funds acquired from buyers.

This tracks with BehindMLM’s protection of Forsage starting April 2020.

Thus far BehindMLM has tracked six iterations of the Forsage Ponzi scheme:

- Forsage (April 2020)

- Fortron (September 2020)

- ForsageTron (March 2021)

- Forsage XGold (March 2021)

- Forsage BUSD (Might 2021) and

- MetaForce (July 2022)

Curiously, the SEC notes a break up between Okhotnikov and his fellow co-founders earlier this 12 months.

On or about March 7, 2022, there was a break up among the many Founders of Forsage.

Okhotnikov on the one hand, and Ferrari and Sergeev on the opposite, differed on the route of Forsage, and Okhotnikov apparently was lower off from entry to Forsage.io and the Telegram channels, amongst different issues.

Okhotnikov retained management of the Forsage Official YouTube Channel, nevertheless, which he used to create movies criticizing his former companions.

Quickly thereafter, the 2 units of Founders created their very own matrix advertising platforms: Ferrari and Sergeev launched “Specific Sensible Sport” and Okhotnikov created “Meta Drive”.

Each platforms are variations of the compensation and recruitment construction utilized in Forsage and each symbolize efforts by the Founders to perpetuate the circulate of funds into Forsage and to recruit Forsage buyers into these new platforms.

Along with mimicking many points of the Forsage matrices, Specific Sensible Sport is immediately linked to Forsage.

Meta Drive – additionally known as New Forsage and Drive – is an evolution of Forsage on a brand new sensible contract.

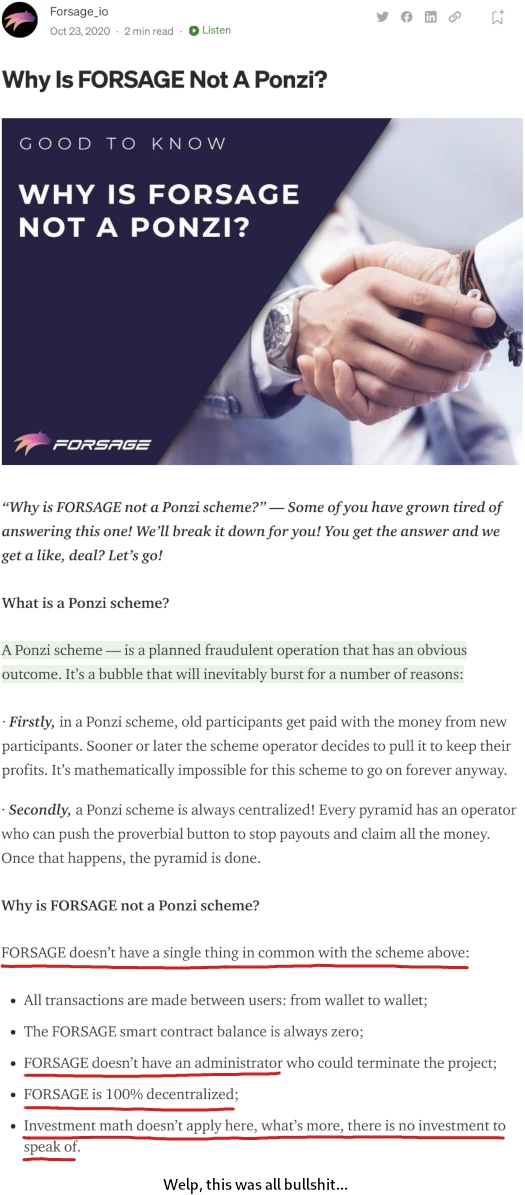

One other attention-grabbing a part of the SEC’s lawsuit is the Forsage Ponzi denials.

When confronted with allegations that Forsage was working as a pyramid scheme, the Founders, Promoters, and Crypto Crusaders expressly denied the allegations and falsely assured buyers that Forsage was a reputable operation.

BehindMLM reported on Lado Okhotnikov claiming securities regulators “don’t perceive the legislation” in April 2021.

And the Crypto Crusaders had been blunt about their recruitment technique with buyers – that’s, damaging statements about Forsage weren’t tolerated they usually warned buyers that in the event that they complained or didn’t recruit extra individuals into Forsage, they’d be faraway from the Crypto Crusaders’ Fb teams.

Anybody selling or observing promotion of MLM crypto Ponzi schemes needs to be accustomed to this conduct.

Regardless of this aggressive promotion of Forsage as an income-generating alternative, the numerous degree of earnings Defendants highlighted was not consultant of the income most buyers generated.

Certainly, the “monetary freedom” Defendants touted merely was not attainable for many buyers on condition that Forsage operated as a pyramid scheme.

In reality, as with most such schemes, the wealth was concentrated primarily on the high of the pyramid, with Defendants, who held earlier Forsage IDs, benefitting on the expense of later buyers.

One other frequent tactic of MLM crypto scammers is to faux their scams are dEcEnTrAlIzEd. This ignores the truth that they aren’t by advantage of getting been arrange by a person or group of people.

The Founders remained deeply concerned in Forsage’s operations and continued sustainability through the related time interval, regardless of claiming to buyers that Forsage was “the world’s first 100% decentralized matrix challenge” by way of the Forsage Advertising Supplies and

web site.Certainly, the Founders created and launched the sensible contracts underpinning your complete operation, maintained the infrastructure to maintain the scheme, and performed a central managerial function in guaranteeing the operation and success of the Forsage Funding Platforms, together with the introduction of Forsage BUSD as the latest funding alternative to maintain the scheme afloat.

The notion that MLM crypto scams create and run themselves is a lie.

Listed below are simply a number of the lies the Forsage defendants informed their victims:

On August 17, 2020, Maslakov posted a video on YouTube denouncing the Philippines Fee’s investigation as “nonsense” and that “all individuals who have a standard sense laughed at this.”

He claimed that “Forsage isn’t partaking in investment-taking actions.” Maslakov then proceeded to dismiss the scheme allegations as being purely motivated by what he termed as “one thing [the critics] can’t management” which makes them accuse Forsage of “mortal sins.”

On September 7, 2020 and October 8, 2020, in movies posted on YouTube for the Forsage Academy and on his Fb web page, Hamlin particularly described investments in Forsage as “completely actual” and “completely authorized” and that Forsage was “not an funding scheme.”

He went on to state to his viewers: “Goodness gracious man, we start to share this sensible contract and what it may possibly do after which you’ve got different individuals with their negativity as a result of they’ve a lack of understanding they usually wish to put that negativity on you.”

On October 25, 2020, Deering launched a 10-minute video on YouTube throughout which he defined why Forsage was not a scheme.

Based on Deering, Forsage “doesn’t have a single factor in frequent with [a] scheme” as a result of “no one can take your cash;” Forsage is “100% decentralized;” and the “requirement of a fabric product is an out of date stereotype.”

Deering went on to advise his viewers that they need to “lookup what [a Ponzi/pyramid scheme] is after which go study it earlier than you open your mouth and begin badmouthing one thing.”

On February 10, 2021, Martinez interviewed a visitor who denied Forsage was a scheme, and he confirmed his visitor’s view.

On February 18, 2021, Ellis informed his followers in a YouTube video that “[w]e can overcome [objections] that [Forsage] is a pyramid. . . . I don’t know why individuals would get that objection [that this is a pyramid scheme], except they’re speaking about bringing it up themselves. However in case you deal with it and discuss this as a enterprise – which it’s – that it might make you thousands and thousands of {dollars}, then individuals aren’t even going to deal with that negativity.”

Okhotnikov participated in an interview on February 27, 2021 with Forsage Indonesia which was later printed on YouTube. In response to the query as as to whether Forsage was a rip-off, Okhotnikov said: “Forsage is an antipyramid.”

Just a few weeks later, Okhotnikov participated on one other panel for Forsage Philippines that was printed to YouTube on March 6, 2011, throughout which he particularly addressed the accusations made by the Philippines Fee:

“Lots of you’ve got heard of the claims of the Philippines Securities Fee. A minimum of I’ve heard of unusual claims. Forsage has

nothing to do with both securities or funding.As you understand, Forsage is totally outdoors the purview of the SEC.”

Two days after that, Bowen hosted a webinar on the Crypto Crusaders’ YouTube channel the place she suggested her viewers to not checklist Forsage’s title in any Fb posts as a result of, in keeping with Bowen, individuals would Google Forsage and see movies and articles that it was a Ponzi scheme.

Ellis additional said in one other YouTube video on March 11, 2021 that the content material of the supplies within the Forsage Academy was to “guarantee that governments and officers perceive that we’re not some rip-off, a pyramid scheme.”

On April 5, 2021, Martinez particularly addressed the Montana CSI’s stop and desist order in considered one of his weekly webinars on the Crypto Crusaders’ YouTube channel, stating that it had “no foundation” and that the Montana CSI “doesn’t perceive crypto in any respect.”

He went on to guarantee his viewers that “Forsage management” was trying into the matter to get the stop and desist order “eliminated.” One in every of his company additionally denied that Forsage even concerned an funding contract, and that each the Montana CSI and the Philippines Fee simply made allegations that Forsage was a scheme – however neither authority had “confirmed [Forsage] responsible.”

Deering participated within the April 5, 2021 webinar hosted by Martinez, and Deering addressed the Montana CSI’s findings by noting “all the pieces that they are saying in there may be not appropriate.”

One of many Crypto Crusaders’ group buyers raised considerations with Shepperd that Forsage was a scheme.

After the investor complained publicly about it, Shepperd blocked the investor from the group’s Fb web page.

BehindMLM routinely comes up towards all these rhetoric and denials when reporting on MLM crypto Ponzi schemes.

Right here’s one other instance from Forsage’s official Medium account, printed again in late 2020;

The SEC alleges that, as of Might 2022,

- 1.05 million participated within the ethereum variations of Forsage;

- 455,246 participation within the tron iterations; and

- 434,992 participated within the BUSD iterations.

With respect to the circulate of cash from victims to Forsage’s creators and high promoters;

- Vladimir Okhotnikov and the opposite Forsage founders acquired a minimum of $4.8 million;

- Okhotnikov and Mikail Sergeev acquired one other $433,909 by way of siphoning of funds outdoors of Forsage;

- Lola Ferrari acquired a further $256,731 or extra;

- Sergey Maslakov acquired a further $110,741 or extra;

- Sam Ellis acquired a minimum of $72,405;

- Mark Hamlin acquired a minimum of $565,828;

- Sarah Theissen acquired a minimum of $130,118

- Carlos Martinez acquired a minimum of $462,925

- Ronald Deering acquired a minimum of $267,075

- Cheri Beth Bowen acquired a minimum of $303,00 and

- Alisha Shepperd acquired a minimum of $549,075

Defendants knew, or had been reckless in not understanding, that Forsage was an unlawful pyramid scheme.

Defendants had beforehand participated in different MLM initiatives and knew, or had been reckless in not understanding, that Forsage didn’t promote or supply to promote any product to bona fide retail buyers – that’s, people who’re customers of an precise, consumable product and never individuals in an earnings alternative.

In that regard, Defendants knew, or had been reckless in not understanding, that Forsage was not engaged in any bona fide retail gross sales. As an alternative, it was centered solely on the sale of the proper to take part in an earnings alternative.

As well as, as a result of the proceeds raised by way of gross sales of slots derived from buyers who recruited extra buyers, the payouts beneath Forsage’s compensation construction had been made based mostly solely on investments from the later buyers.

In utilizing these later investments to pay earlier buyers, Defendants knew, or had been reckless in not understanding, they had been working a basic Ponzi scheme.

The SEC has charged the Forsage Defendants with

- unregistered presents and gross sales of securities in violation of the Securities Act;

- fraud in violation of the Securities Act;

- fraud in violation of the Trade Act; and

- fraud in violation of the Trade Act;

The SEC is looking for an injunction towards the Forsage Defendants, in addition to disgorgement of ill-gotten positive factors and a civil penalty.

Defendants Sam Ellis and Sarah Theissen have already settled the fraud costs towards them.

With out admitting or denying the allegations, two of the defendants, Ellis and Theissen, agreed to settle the costs and to be completely enjoined from future violations of the charged provisions and sure different exercise.

Moreover, Ellis agreed to pay disgorgement and civil penalties, and Theissen will likely be required to pay disgorgement and civil penalties as decided by the court docket.

Each settlements are topic to court docket approval.

At time of publication the SEC’s case isn’t on Pacer but. I’ll verify again later at present for a docket replace.