I’m beginning a brand new weekly gross sales collection specializing in enterprise ideas. Enterprise is on the core of gross sales. B2B gross sales don’t occur except there’s a enterprise cause. Subsequently, I figured, fuck it, let’s begin a collection that strengthens all of our enterprise acumen and challenges us all to attach what we promote to our clients enterprise.

We’re going to make use of the phrase WITCE <wit-cee> (What’s the buyer expertise?) all through this collection. I realized this phrase from the previous CIO of T-Cellular. Rob believed one of the simplest ways to achieve success was to have a look at issues from the shopper perspective. He’s proper and it’s much more essential in gross sales. To achieve success, we now have to repeatedly be considering like our clients and all the time be seeking to enhance their world.

To kick the collection off, I made a decision to go together with the P&L assertion or revenue and loss assertion. It’s some of the essential issues in enterprise. A P&L highlights the modifications in bills and earnings over a specified time interval. That could possibly be months, quarters or years.

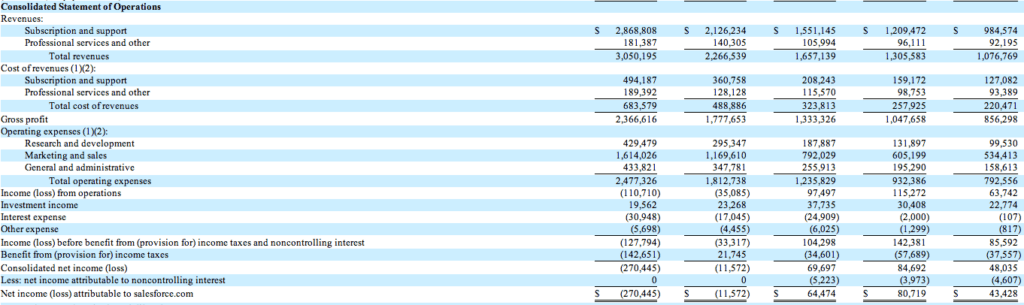

That is what a P&L assertion appears like:

That is Salesforce.com’s Revenue and Loss Assertion.

The Prime Line

The very first thing to notice a few P&L assertion are the highest few traces. These are the income traces. Thus the time period “prime line.” The highest line is the place income is discovered. This isn’t to be confused with money. Money can come from a lot of areas apart from income, resembling financing, sale of property pay as you go providers and so on. Income shouldn’t be confused with money. Income recognition and money stream are subjects we’ll sort out later within the collection.

Understanding the place your clients get their income might be VERY essential to you. Salesforce.com drives over 95% of their income from subscriptions and assist. Though providers generates over 180 million in income, it’s a drop within the hat in comparison with their subscription income. Relying on what it’s you might be promoting, realizing this might play a considerable function in your deal technique.

The Income Line

Slightly below the income line is what’s known as value of products or whole value of income. Whole value of products or income is the whole sum of money the corporate spends to create the product(s)/providers or create the income. Whole value of products or income are the bills that instantly relate to the income being created. In Salesforce.com’s case, bills related to creating the platform, internet hosting the software program, growth, assist sources, providers salaries, and so on. are all accounted for in whole value of income.

Separating bills associated to creating or delivering the services or products from different bills resembling advertising is essential as a result of it lets you understand how costly it’s to create the income. To find out how costly a services or products is, is a straightforward equation. Merely subtract whole value of income from the income. This calculation known as gross margin. Gross margin tells you ways a lot cash an organization has left over after they’ve spent what they should ship or create the product.

In 2013 Salesforce.com’s gross margin was 2.36 billion (Income of three.0b minus whole value of income of 683m). It is a very wholesome gross margin. It signifies that it’s not very costly for Salesforce.com to create 3 billion {dollars} in income. Gross margin can also be generally displayed as a proportion. SF.com’s gross margin proportion in 2013 was 78.6% That’s VERY excessive margin enterprise. Excessive margin companies have a lot of cash left over to speculate, function the corporate, retailer money, leverage M&A and extra — all good issues.

For distinction Amazon’s 2012 gross margin proportion was 24%. It’s rather more costly for Amazon to create their income. (be aware Amazon put their value of income, what they name value of gross sales within the working expense line. That is most likely to keep away from displaying gross margin, because of the reality its a decent margin enterprise)

Working Bills

The subsequent line after whole value of income is working bills. Working bills are all the opposite prices related to operating the enterprise. Usually divided into 3 classes, analysis and growth, gross sales and advertising and common administration, these bills embrace issues like gross sales folks’s commissions, advertising bills, janitorial providers, electrical energy, safety and so on. Working bills are precisely that, bills required to function the enterprise.

Sadly it’s uncommon to see a bills damaged down past a number of rolled up classes, nevertheless understanding the place your prospects or shoppers are spending their cash and whether or not or not they are earning profits could possibly be very useful in your gross sales course of.

Revenue From Operations

The subsequent line in a Revenue and Loss assertion is the juicy one. It’s the earnings from operations. The earnings from operations tells you if the corporate is earning profits or not. Revenue from operations is income minus bills. It’s that easy. If the quantity is optimistic, the corporate is worthwhile. If the quantity is unfavorable, the corporate is shedding cash.

The earnings from operations quantity is vital. If it’s optimistic, the corporate is making a revenue and assuming their are not any cashflow issues the alternatives for promoting one thing to them are excessive. If the quantity is unfavorable, your means to promote one thing could possibly be hampered. That being stated, if what you’re promoting can flip that quantity from a unfavorable to a optimistic, you’ll get the eye of lots of people.

Realizing whether or not or not your clients or prospects are worthwhile might be an especially useful piece of data. That being stated, 10k’s not often present detailed Revenue and Loss by particular person enterprise or subsidiaries. Subsequently, a bunch inside a bigger firm that’s shedding cash can have a P&L with optimistic earnings from operations. Simply because the corporate as complete is shedding cash doesn’t imply each side of the enterprise is.

Web Revenue

The road under earnings from operations consists of bills and earnings not related to operating the core enterprise. To make certain, they’re actual bills, and earnings, they only aren’t a part of the core enterprise. They embrace curiosity earnings, (earnings from financial institution balances, cash markets, and so on.) curiosity expense (curiosity paid on firm debt) and taxes. Though not key to the core enterprise realizing in case your services or products impacts these bills and the way is simply as essential.

The ultimate line after earnings from operations is web earnings. Web earnings is precisely that, web earnings. It’s what’s left for the enterprise after everybody and every thing has taken their piece of the pie. Salesforce.com is operating their enterprise at a loss. I’d need to learn extra of the 10k and do extra analysis to know why, particularly as a result of their gross margins are so excessive. That being stated, 1.6 billion of their working bills are in gross sales and advertising, so one clarification is they’re investing closely in progress. If I’m proper and your services or products may also help them develop, you might be in place.

How can a Prospect’s Revenue and Loss make it easier to?

Now you might have a baseline understanding of what a Revenue and Loss Assertion is and find out how to learn one. Though not good they usually don’t let you know every thing, they do provide you with a number of data, particularly when considered with an eye fixed for traits. How is the P&L trending over a number of quarters and a number of years, and so on?

Use the P&L that will help you develop your deal technique, search for alternatives to ask questions and for issues you would possibly be capable to resolve.

WITCE Revenue and Loss Questions:

- Does your services or products have an effect on their Revenue and Loss? How?

- Does your product have an effect on the expense facet or the income facet?

- Does your product instantly have an effect on your prospects Revenue and Loss, like an on the spot discount on a selected expense line? Or does it not directly have an effect on it, resembling creating an effectivity that “might” cut back expense or enhance income? (a product that cuts power consumption in half instantly impacts the Revenue and Loss. A job sourcing service that finds higher candidates quicker, not directly impacts the Revenue and Loss)

- What kind of firm does your services or products finest serve, these shedding cash or these earning profits?

- What does the Revenue and Lack of your prospects and clients appear to be?

- How a lot influence does your services or products have on the Revenue and Loss?

- Does your services or products initially negatively have an effect on a Revenue and Loss after which progressively positively have an effect on it extra time?

- Are you able to articulate the influence of your product or service when it comes to influence to the Revenue and Loss?

- How does your buyer view their Revenue and Loss?

- How does your clients or prospects Revenue and Loss have an effect on your deal technique?

How does your services or products have an effect on the shoppers Revenue and Loss expertise? It’s factor to know.