20 years in the past, it was arduous to think about a world the place money did not exist. However with the rise in recognition of cashless fee strategies, a society with out money may quickly change into a actuality.

The COVID-19 pandemic is one main catalyst for the shift. To attenuate direct contact, folks gravitated in the direction of fee strategies that did not require using bodily cash, like financial institution playing cards and fee apps.

On this article, you will be taught what specialists take into consideration the way forward for cashless funds, fee strategies on the horizon, and corporations which can be already making the change.

Firms Testing Cashless Experiences

Easy methods to Set Up Cashless Funds

Undertake Cashless Cost Strategies

Cashless Cost Predictions

The worldwide transition to cashless fee strategies is going on in a short time. Specialists imagine that earlier than lengthy, we’ll be dwelling in a cashless society. Actually, some international locations are already working to utterly eradicate money from their economies.

Sweden has lowered the quantity of money in circulation by 50% over the past decade.

In line with the European Funds Council, conventional money transactions made up simply 1% of Sweden’s gross home product (GDP), and ATM money withdrawals are steadily declining by 10% annually. The Swedish Central Financial institution just lately said that solely 9% of the nation’s inhabitants makes use of money for transactions proper now.

Now, analysts predict that Sweden will change into the primary cashless nation on the earth by 2023.

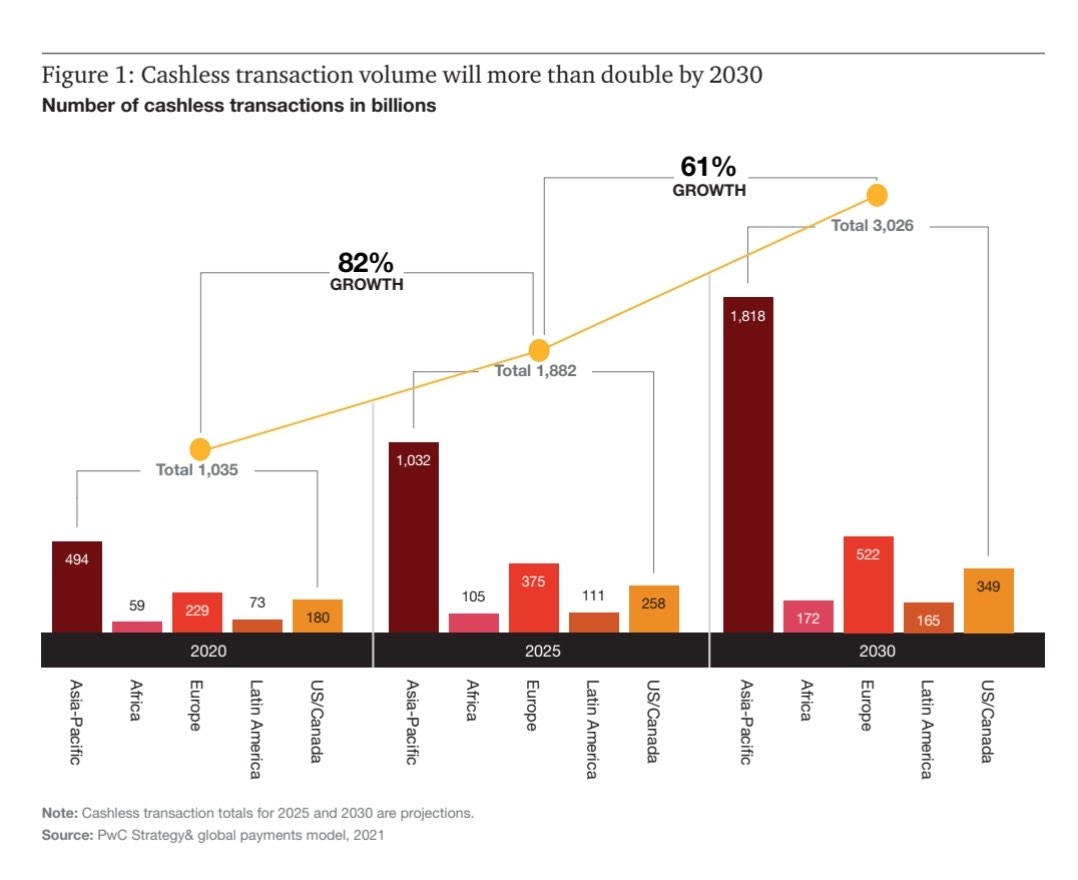

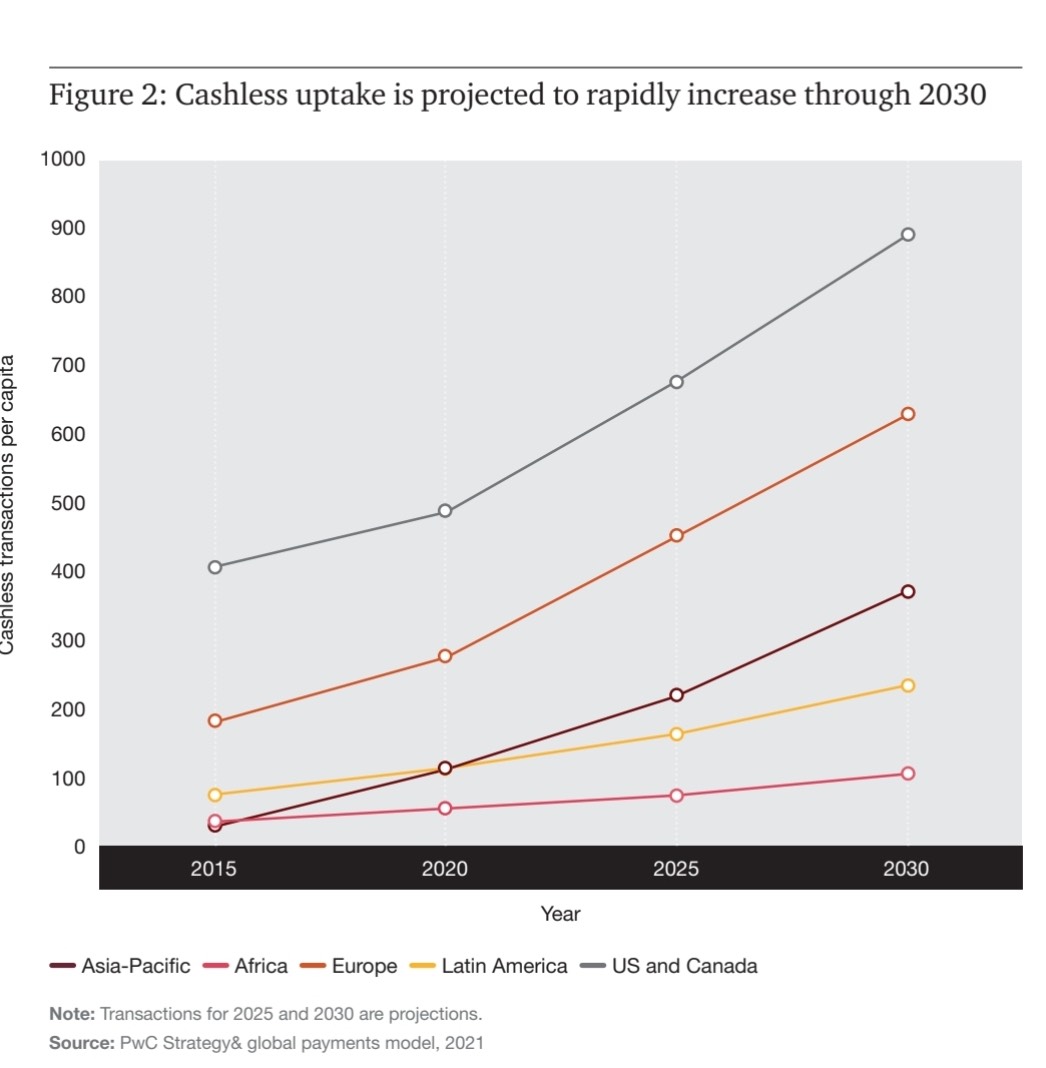

In PwC’s 2025 & Past: Navigating the Funds Matrix, PwC explored the continued transition from cash-based to cashless fee strategies, the event of digital economies, and the affect of recent fee traits.

Listed below are a number of the cashless fee predictions within the report:

- Cashless transactions will develop quickest in Asia-Pacific, growing by 109% from 2020 to 2025, after which by 76% from 2025 to 2030, adopted by Africa and Europe.

- International cashless fee volumes are set to extend by greater than 80% from 2020 to 2025, and to nearly triple by 2030.

- 89% of respondents agreed that the patron shift from bodily shops to on-line shops will proceed to extend, requiring vital funding in on-line fee options.

- Digital wallets will account for greater than half of all e-commerce funds worldwide by 2024.

Cashless Funds Immediately

Listed below are a number of the cashless and contactless fee strategies which can be rising in recognition. You may already use a few of these funds whenever you go to the shop. Specialists predict companies will provide many of those fee strategies transferring ahead.

Credit score and Debit Playing cards

Credit score and debit playing cards are probably the most steadily used cashless fee strategies on the earth proper now. They’re a fast, safe, and handy methodology of fee.

However using banking playing cards has begun to say no in favor of cellular wallets and fee apps. In 2021, bank cards and debit playing cards accounted for 21% and 13% of world e-commerce fee strategies, respectively. By 2025, using bank cards is predicted to fall to 19%, whereas debit playing cards will stay secure at 13%.

When you personal a enterprise, this doesn’t imply it is best to utterly forgo banking playing cards and begin utilizing cellular wallets as an alternative. By 2025 (and past), many individuals will nonetheless depend on banking playing cards to make funds, particularly now that banks are issuing playing cards enabled with Faucet to Pay expertise.

Savvy companies settle for each banking playing cards and cellular wallets as viable fee strategies.

Cellular Wallets and Cost Apps

Cellular wallets, or digital wallets, are monetary functions that run on cellular gadgets. These apps securely retailer your fee card info with the intention to pay for gadgets on-line or in-store with out having to hold your playing cards round. All that you must provoke transactions is your smartphone/smartwatch and a very good web connection.

Examples of cellular wallets and fee apps embrace:

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Venmo

- CashApp

- AliPay

Digital wallets are extraordinarily standard at the moment, and also you seemingly use them usually. Ian Wright, the founding father of Service provider Machine, believes that the recognition of cellular wallets will solely develop sooner or later.

“Merchandise like Apple Pay and Google Pay will definitely change into extra ubiquitous, which can give Apple and Google the chance to disrupt Visa and Mastercard,” Wright says.

That is true. Knowledge from FIS International Funds Report 2022 exhibits that by 2025, cellular wallets can be used for 53% of e-commerce transactions worldwide — rising from 49% in 2021. For world point-of-sale (POS) transactions, using digital wallets is predicted to rise from 29% in 2021 to 39% in 2025.

FIS discovered that individuals have began utilizing digital wallets for funds greater than they use their playing cards. E-wallets are anticipated to outgrow different POS fee strategies and attain a 36.8% share — over $22.7 trillion.

Cryptocurrency

At this yr’s Tremendous Bowl sport, audiences have been proven a intelligent 60-second advert from Coinbase, a platform for purchasing and promoting cryptocurrency. This advert got here within the type of a QR code that, when scanned, took folks to Coinbase’s web site the place they supplied free Bitcoin price $15 to new signups (for a restricted time).

Not lengthy after the advert aired, Coinbase’s app crashed from the inflow of visitors from the Tremendous Bowl.

That goes to point out simply how mainstream cryptocurrency is — particularly Bitcoin, which is the usual digital foreign money for cellular funds.

Bitcoin would not require additional charges or intermediaries to maneuver from a client to a service provider. Apps like Coinbox implement a POS performance to make the fee course of simpler for each companies and clients.

Cost apps like PayPal have additionally began supporting crypto buying and selling and funds on their apps. Main companies like Microsoft and Expedia are additionally accepting crypto funds.

The crypto market is unstable, fluctuating steadily. This fee methodology might not be the best choice for small-to-medium-sized companies proper now. But when the market stabilizes, it may very nicely be.

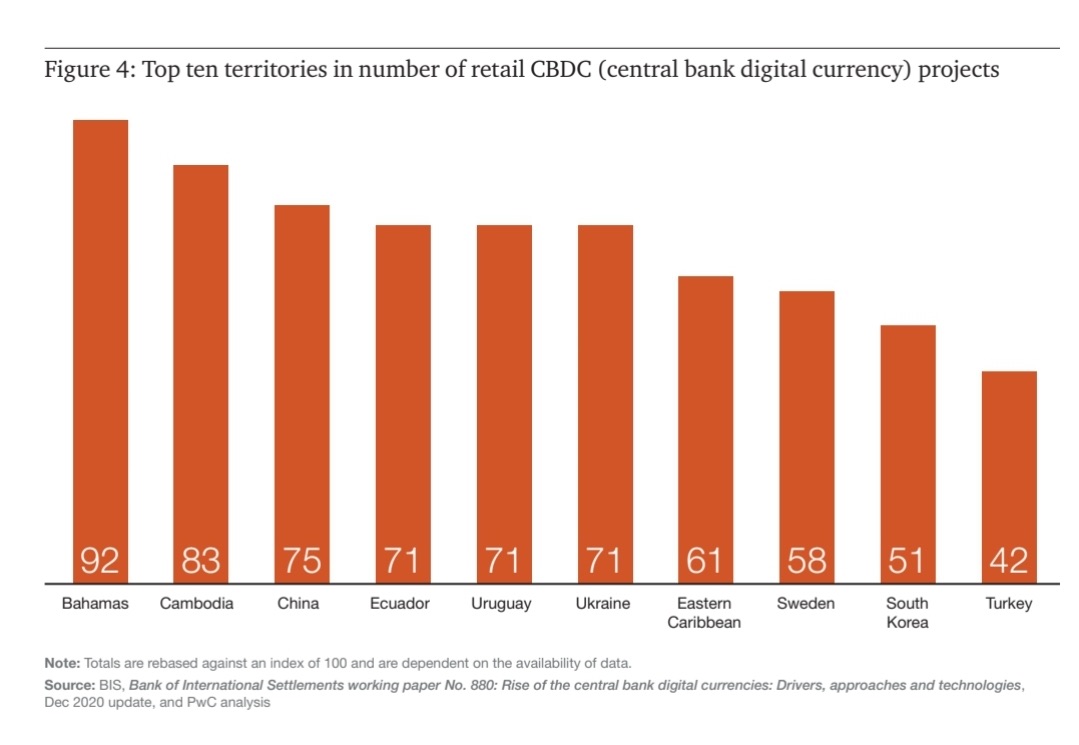

Central Financial institution Digital Forex

Central Financial institution Digital Currencies (CBDCs) are digital tokens issued by a rustic’s central financial institution to signify the digital type of that nation’s foreign money. This digital foreign money has the identical worth as fiat (bodily) cash.

The principle objective of CBDCs is to supply privateness, monetary safety, accessibility, transferability, and comfort to companies and shoppers — particularly those who have restricted entry to banks. CBDCs additionally purpose to scale back the dangers of utilizing digital currencies (aka cryptocurrency) of their current, unstable kind.

“If CBDCs are designed prudently, they’ll probably provide extra resilience, extra security, higher availability, and decrease prices than non-public types of digital cash,” IMF Managing Director, Kristalina Georgieva, stated in her 2022 speech on the Atlantic Council in Washington D.C.

“That’s clearly the case when in comparison with unbacked crypto property which can be inherently unstable,” she says. “And even the higher managed and controlled stablecoins might not be fairly a match in opposition to a secure and well-designed central financial institution digital foreign money.”

Proper now, ten international locations and territories have launched CBDCs:

- Nigeria

- Jamaica

- Grenada

- The Bahamas

- Dominica

- Antigua and Barbuda

- Montserrat

- Saint Lucia

- St. Vincent and the Grenadines

- St. Kitts and Nevis

About 105 different international locations, together with the U.S. and the U.Ok., are nonetheless investigating CBDCs and the way they have an effect on current monetary networks.

QR Codes

Fast Response codes, or QR codes, are machine-readable barcodes that retailer info. This code consists of distinctive black and white pixels in a square-shaped grid.

To make funds through QR codes, an individual has to scan the code displayed by the service provider with their cellular machine. Then, customers put within the quantity they should pay and submit.

Apple launched QR code scanners in smartphones in 2017. Since then, most — if not all — different smartphone manufacturers have included them into their fashions. And now, QR code funds are probably the most environment friendly and standard cashless fee strategies on the earth.

The numbers mirror this. In 2020 in the course of the pandemic, 1.5 billion folks used QR codes to make a fee, in accordance with Juniper Analysis. The agency additionally predicts that 30% of all cellular customers will use QR codes by 2025.

This fee methodology is a safe various to money transfers. Plus, companies can course of transactions with out having to purchase conventional fee {hardware}. All they should do is ready up QR codes that can take clients to their internet fee kind.

ACH Financial institution Transfers

An ACH switch is an digital fee made between financial institution accounts by way of the Automated Clearing Home (ACH) community.

This fee methodology is without doubt one of the hottest forms of financial institution transfers and is used for B2B direct deposit and computerized invoice funds. Actually, 93% of People use ACH transfers to obtain their salaries and pensions.

In 2021, the sum of money transferred by way of the ACH was over $8.89 trillion. That’s greater than the quantity transferred through checks and wire transfers.

All banks in the US help ACH funds. Now, fee processors like PayPal, Stripe, and Sq. additionally help this fee methodology.

All that that you must make or obtain an ACH fee is a working checking account and routing quantity. Transfers made by way of this route sometimes take 3-4 enterprise days to finish.

ACH funds have decrease processing charges than bank cards. So when you have shoppers that pay you recurring charges or workers that you just pay each month, ACH transfers are a good way to try this with out incurring a loss. That is particularly good for companies in industries like authorized, healthcare, training, property administration, and subscription-based providers.

Brick-and-mortar retail companies shouldn’t use ACH funds for POS buyer transactions. ACH transfers require a checking account and routing quantity and many consumers don’t know their banking information off-hand.

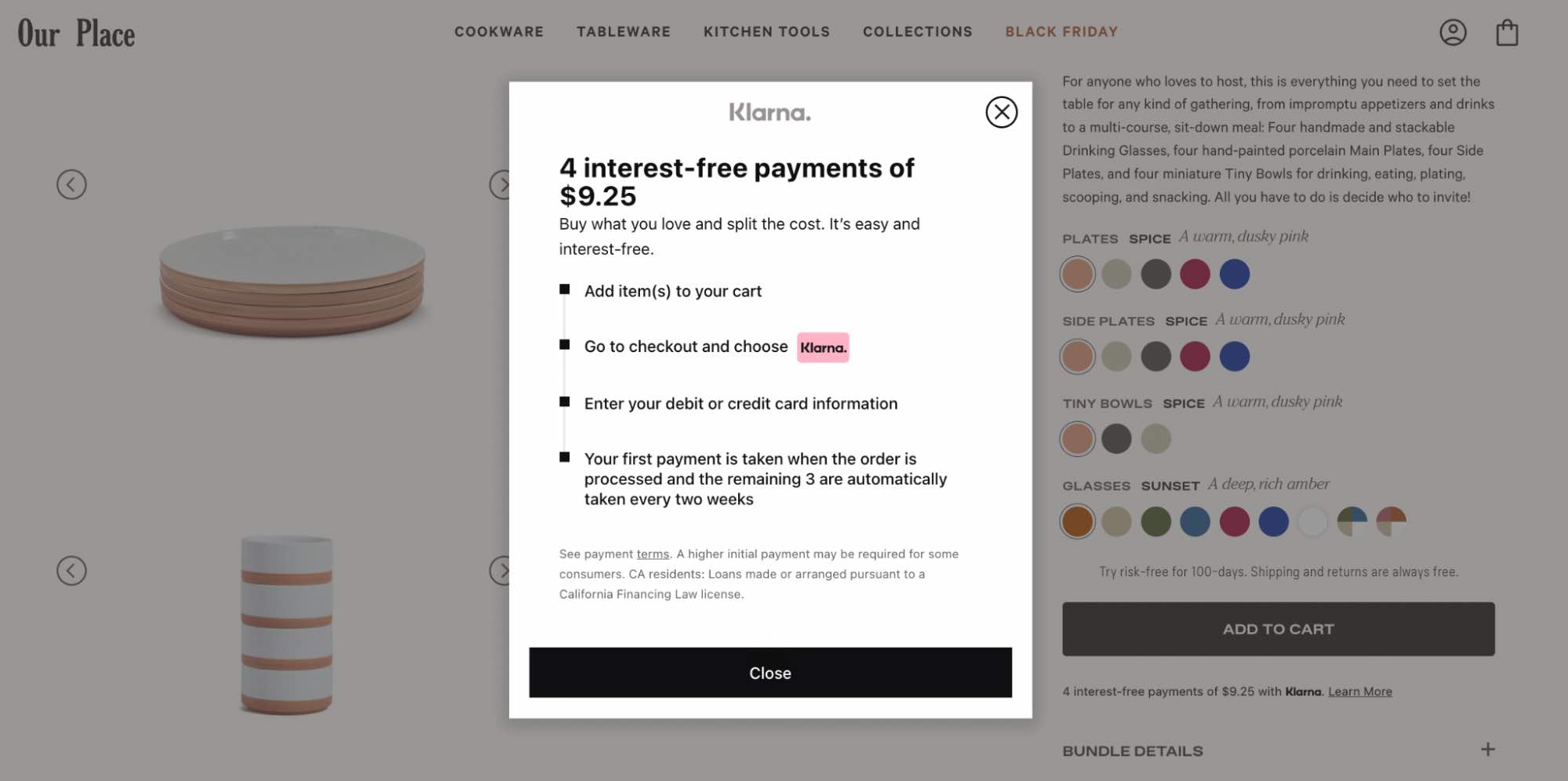

Purchase Now, Pay Later

Purchase Now, Pay Later (BNPL) is a fee methodology that permits clients to buy costly gadgets on credit score and pay in installments over time. It’s a sort of mortgage, besides you don’t should pay curiosity should you make your funds on time and in full.

The prospect of having the ability to make a number of interest-free funds over time can encourage buyers to purchase extra, which leads to extra income for distributors. A examine by McKinsey confirmed that 29% of BNPL customers would have made a smaller purchase or wouldn’t have purchased in any respect if this fee choice wasn’t out there.

Banks like Chase and a few bank card corporations provide cardholders the chance to purchase gadgets and pay for them later. Apps like Afterpay (acquired by Sq.) and PayPal have additionally jumped on the bandwagon.

In 2021, BNPL accounted for 2.9% of world e-commerce transactions (a $157 billion worth). Juniper’s analysis predicts that this worth will develop 5.3% (or to $438 billion worth) by 2025.

Firms which can be already testing new cashless experiences

Amazon

In early 2020, e-commerce large Amazon introduced its new contactless fee expertise, Amazon One. This is the way it works: Customers go to a point-of-sale station in sure places to hyperlink their palms and fee playing cards to Amazon One. As soon as they’ve completed that, all they should do at future checkouts is hover their hand over a scanner to pay for his or her gadgets.

The reasoning behind that is easy. Your palm is made up of tiny, principally undetectable options which can be distinctive to you. The Amazon One machine, nonetheless, can learn and acknowledge these options.

The machine makes use of laptop imaginative and prescient algorithms and proprietary imaging to seize and encipher a picture of your palms. This fashion, it creates a novel palm signature that it might acknowledge each time you utilize the machine.

As of September 2021, Amazon rolled out this new fee methodology to over 65 Complete Meals shops in California. This huge rollout definitely helps Amazon in its effort to modernize retail purchasing and make it simpler for purchasers to make funds.

Walmart

In December 2021, Walmart quietly filed a number of new emblems that point out that it plans to make and promote digital gadgets, together with toys, electronics, self-care merchandise, and residential décor within the metaverse. Principally, Walmart desires to create its personal cryptocurrency and non-fungible token (NFT) collections.

Quick ahead to September 2022 and Walmart introduced that they’re launching two digital experiences — Walmart Land and Walmart Universe of Play — in Roblox, a gaming platform.

These experiences will function completely different video games, a blimp that drops toys, a music pageant with standard artists, and a retailer of digital merchandise (generally known as “verch”) that matches Walmart’s bodily and on-line stock.

Walmart’s Chief Advertising and marketing Officer, William White advised CNBC that Roblox is presently a testing floor for Walmart because it considers working within the metaverse and past. He additionally stated that the best way COVID-19 all of the sudden reworked folks’s purchasing habits and on-line engagement prompted Walmart to begin experimenting with new methods to achieve buyers — particularly Gen Zs.

On income, White famous that Walmart will not make any cash from these newly launched digital experiences for now. But when issues work out nicely, they may generate profits by partnering with different manufacturers or by turning folks’s immersive experiences into real-life retailer visits or on-line purchases.

Albertsons

Yet one more retail large is experimenting with cashless funds. For Albertsons, it is I-powered self-checkout carts.

These carts are made by Veeve, an organization based by two ex-Amazon engineers, they usually purpose to make in-person purchasing smoother, particularly in short-staffed shops. These carts use cameras and sensors to scan gadgets that buyers decide, evaluate merchandise, and make customized suggestions through a small on-cart display. These carts additionally construct 3D fashions of all of the merchandise within the retailer, in order that it might acknowledge these things over time with out the client scanning them.

What’s extra, you do not want to take a look at whenever you use this cart. After purchasing with Veeve carts, folks pays for his or her gadgets by inserting or tapping their card with out ever going to the checkout line.

In November 2021, Albertsons began testing these carts at two of its shops in California and Idaho. Now, they’re increasing and including the carts to extra shops.

Apple

In June this yr, Apple launched the Faucet to Pay expertise on iPhones. In line with Apple, this new tech will allow thousands and thousands of US retailers — from solopreneurs to mega-retailers — to simply settle for contactless credit score and debit playing cards, Apple Pay, and different cellular wallets through a faucet of an iPhone. No fee terminal or additional {hardware} wanted.

After an individual is completed purchasing, the service provider will inform the client to carry their iPhone to pay with their contactless card, Apple Pay, or different digital pockets close to the product owner’s iPhone. With the faucet of a button, the cash strikes from the client to the service provider by way of near-field communication (NFC) expertise.

Apple is partnering with fee apps like Sq. and Stripe to make the Faucet to Pay on iPhone function out there on their platforms. This function will solely work with contactless credit score and debit playing cards from standard fee networks, together with Visa, MasterCard, American Specific, and Uncover.

Be aware: Faucet to Pay function solely works on the Cellphone XS or newer. Older iPhone fashions do not help this function.

In October this yr, Google introduced that it has partnered with Coinbase to simply accept cryptocurrency funds for its cloud providers.

Each Google and Coinbase want to diversify their enterprise fashions and broaden their choices. For Google, accepting crypto funds will give them entry to fast-growth corporations within the Web3 house. These corporations would pay for Google’s cloud providers by way of Coinbase — a platform that trades ten completely different digital currencies, together with Bitcoin, Ethereum, Litecoin, and Dogecoin.

As digital funds are available, Coinbase will take a reduce of the charges, which can function a separate income stream that is not instantly associated to retail buying and selling charges.

Easy methods to Set Up Cashless Funds

With the growing recognition of cashless fee strategies, companies that wish to keep related sooner or later should arrange versatile fee strategies. Listed below are some methods you may put together.

1. Take into account the fee strategies your clients desire.

Not all companies are the identical. When you’re a small enterprise, there is a good probability you will not have the ability to use the identical fee strategies as massive enterprises just because it is not crucial.

One of the best ways to know for positive which fee strategies it is best to settle for is by figuring out your clients’ fee preferences and implementing these choices.

For instance, in case your clients like utilizing their playing cards to pay, arrange a POS terminal. If lots of your clients have contactless fee playing cards or use iPhones lots, you may settle for funds through the Faucet to Pay expertise. But when they do not carry playing cards in any respect, there are different choices you may provide, like digital wallets or QR codes.

An necessary factor to think about is that your clients’ fee preferences might range by age, location, and different demographic elements. So it is best to supply completely different fee choices so that you just cater to all of your clients’ wants.

2. Use a fee processor.

To simply accept debit card and bank card funds, digital pockets funds, and ACH transfers, companies should associate with a fee processor that complies with Cost Card Business (PCI) requirements. Cost processors are third-party distributors (or apps) that handle monetary transactions by mediating between the service provider and clients concerned.

These apps be sure that a buyer has sufficient funds to pay for an merchandise and securely transfer the cash from the client’s account to the product owner’s within the blink of a watch.

Standard fee processors embrace:

- Sq.

- Clover

- Stripe

- Stax

- Cost Depot

- PayPal

- Payoneer

Along with fee processing, a few of these apps provide service provider accounts and fee gateways.

When selecting the best fee processor for your small business, look out for the next:

- The form of funds the processor accepts.

- The charges the processor prices per transaction.

- What platform transactions can happen.

3. Provide Purchase Now, Pay Later.

It has been confirmed that retailers that supply a Purchase Now, Pay Later (BNPL) choice to their clients are more likely to get extra gross sales.

Between 2020 and 2021, the speed of American shoppers utilizing the BNPL fee choice elevated by 80%. Of these customers, 40% have been millennials, and Gen Z shoppers are rapidly catching up. So should you’re attempting to broaden your buyer base to incorporate youthful folks, BNPL might help you get there.

This fee methodology works exceptionally nicely for e-commerce shops to achieve new clients, get extra conversions, and improve common order worth (AOV).

Some dependable BNPL suppliers embrace:

- Affirm

- AfterPay

- Klarna

- Stripe

4. Set up a commerce-powered CRM.

Image this: You have got a buyer who’s ready so that you can ship an bill to their mailbox earlier than they’ll mail you again a test for an merchandise they purchased. As they waited on your bill, they determined to do a trial purchase of the identical merchandise out of your competitor. As a result of your competitor provides the Faucet to Pay choice, the client was in a position to pay for the merchandise in a number of seconds.

Which firm do you suppose the client would wish to work with subsequent time: you or the competitor?

To forestall a state of affairs like this, use a CRM platform with fee gateway integration. HubSpot is a superb instance of this.

Contained in the HubSpot CRM is a local funds instrument that streamlines your total gross sales course of with the intention to receives a commission early, tackle extra clients/shoppers, and develop your small business. HubSpot’s funds instrument means that you can ship your clients quotes or fee hyperlinks, after which they pay you. No want for paper checks.

If the funds are recurring — like on-line subscriptions — you may merely automate the method as an alternative of sending quotes to clients each month. HubSpot funds instrument additionally offers your clients the pliability to make transactions every time and nonetheless they need on the CRM.

This drastically boosts your buyer expertise and helps you keep your relationship along with your clients long-term.

Undertake Cashless Cost Strategies

The elevated use of cashless funds has revolutionized the best way folks do enterprise around the globe. From grocery shops to eating places and on-line shops, many companies now provide cashless transactions.

If you need your small business to remain afloat throughout this transformation, that you must begin accepting a wide range of cashless fee strategies. This fashion, your clients usually are not restricted of their choices, and you’ll acquire funds speedily and securely.

.jpg#keepProtocol)