The consistently altering panorama of know-how implies that quite a few industries are occasion to steady and unavoidable innovation, and finance is on no account exempt. The cultural dialog round fintech has grown lately, with cryptocurrency, digital funds, and cellular banking applied sciences that includes as main focuses. With so many new fee strategies obtainable, Mintel’s specialists have researched shoppers’ attitudes in direction of and utilization of monetary applied sciences to discover the place know-how sits in the way forward for finance.

The Rise of Cryptocurrency Change Funds

Cryptocurrency refers to monetary tokens which might be owned and transacted in a decentralised system, externally from centralised authorities like banks. It’s a fashionable, non-traditional foreign money and fee methodology which has risen in prominence and fluctuated in recognition within the final 5 years.

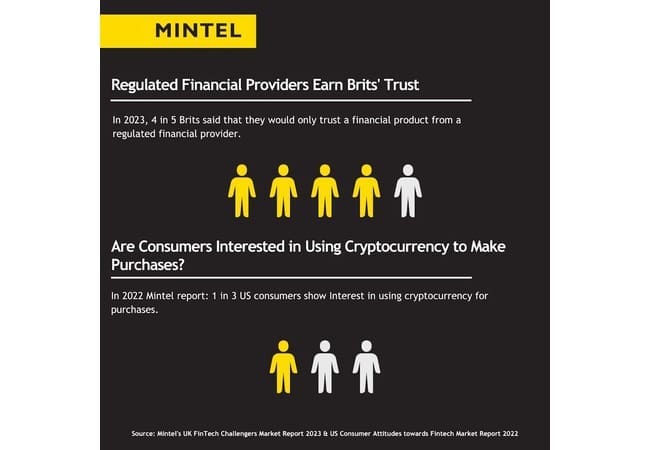

Novel and revolutionary applied sciences normally entice numerous consideration, however could not have a sustainable, lasting affect on the trade. With regards to cryptocurrency, we’re nonetheless ready to seek out out which approach it can go. Though when cryptocurrencies first appeared available on the market, they gave the impression to be the rising star of fintech. In 2023, 4 in 5 Brits stated that they might solely belief a monetary product from a regulated monetary supplier.

Nevertheless, Individuals are way more open to the potential of cryptocurrency, much more so than in earlier years. In keeping with the Mintel Client Attitudes In the direction of Fintech within the US report from 2022, we revealed that round a 3rd of shoppers are serious about utilizing cryptocurrency to make purchases. Moreover, 4 in 10 describe themselves as extra serious about cryptocurrency than they have been a 12 months in the past, so American curiosity in crypto is on the rise.

British prospects of monetary companies seem like extra cautious of the place they put their cash as a result of latest price of residing disaster and are subsequently steering away from untested trade challengers. That is highlighted by the truth that greater than half of individuals within the UK say that the price of residing disaster has made them extra possible to make use of established suppliers reasonably than new firms.

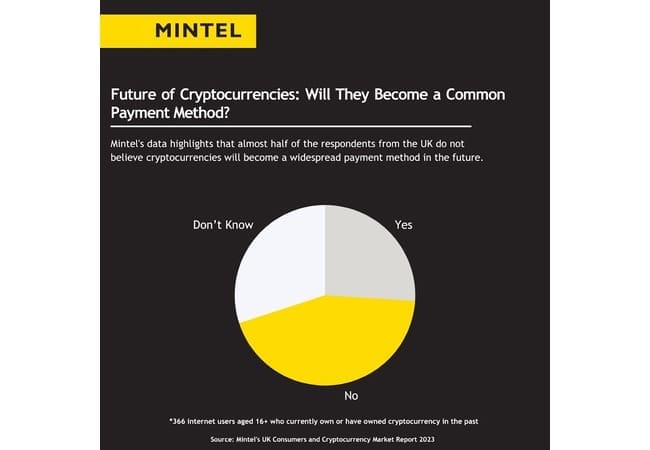

If one of many predominant causes behind the reluctance to make use of cryptocurrency is the current financial circumstances, might that imply that there’s nonetheless a future for cryptocurrency within the UK? It appears not. When surveyed by Mintel, virtually half stated that they don’t suppose cryptocurrencies will turn out to be a typical fee methodology sooner or later. What’s extra, two-thirds say that they don’t perceive crypto sufficient to make use of it. This means that the obstacles to cryptocurrency’s elevated recognition will not be momentary; in truth, the principle obstacle to the success of crypto is that folks don’t perceive or belief it.

Go to Mintel Retailer to discover our Finance Market Analysis

The Altering Panorama of Digital Funds

Apart from cryptocurrency, the panorama of extra conventional digital and digital funds is altering too. Nevertheless, the conservative attitudes in direction of crypto funds are largely mirrored in attitudes in direction of digital funds – although to a barely lesser extent. The extra conventional fee choices of bank cards, debit playing cards, and money nonetheless reign supreme, with 30-50% of individuals within the UK utilizing these fee strategies weekly.

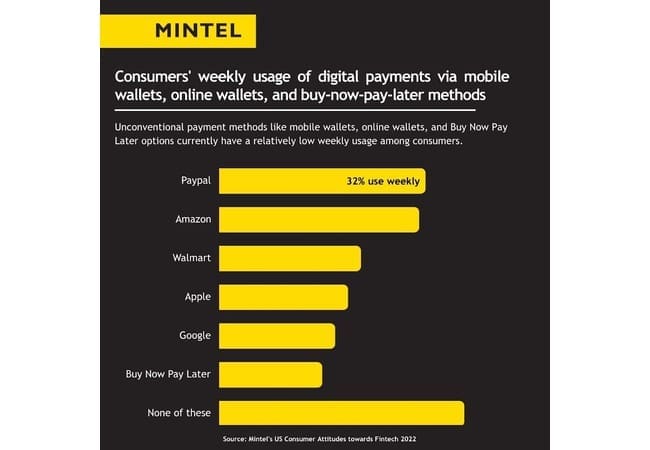

Different fee strategies embrace cellular wallets like ApplePay, on-line wallets like PayPal, and Purchase Now Pay Later choices like Klarna. These much less conventional strategies are used weekly by a transparent minority of shoppers, although maybe they are going to improve in regularity as digital funds turn out to be extra customary and extra extensively trusted.

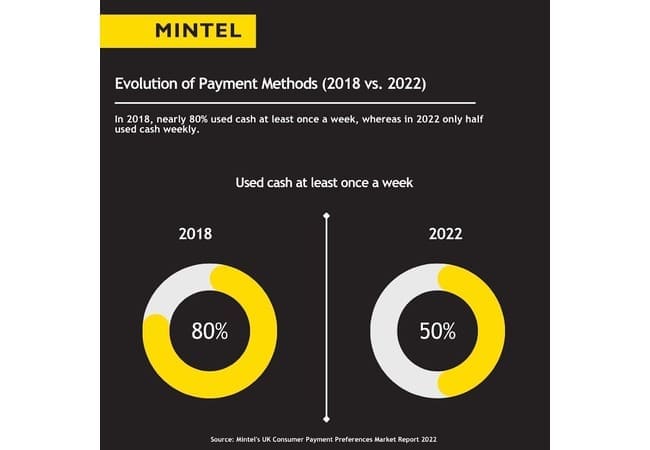

Certainly, digital and digital funds have turn out to be extra accepted into on a regular basis life lately. For instance, in 2018, almost 80% used money at the least as soon as every week, whereas in 2022 solely half used money weekly. Though the chopping fringe of digital fee strategies continues to be handled with some unease, others have gotten accepted as on a regular basis banking choices.

The Impression of FinTech on Private Finance

Unstable financial situations imply that the private finance selections of shoppers are altering, and client behaviours are altering too. Via the price of residing disaster, client spending habits, banking behaviours, and private finance selections have modified. The fluctuating regularity with which we use sure fee strategies, in addition to the reluctance to just accept cryptocurrency on a wider social foundation, alerts that people are conservative and cautious relating to altering their private finance programs.

What We Assume

Although the panorama of fintech at current is brimming with thrilling and revolutionary new fee and banking choices, most people is reluctant and cautious to have interaction with them. That is partially owing to the price of residing disaster, however the wariness extends past momentary financial circumstances. For that reason, it appears uncertain that cryptocurrency will take off within the UK within the massive approach that was as soon as anticipated. Digital and on-line funds could but turn out to be a extra everlasting fixture on the planet of non-public finance, nevertheless it appears as if it can take a bit longer for the broader banking group to return round to the thought.

Discover our intensive Monetary Companies Market Analysis, or fill out the shape under to enroll to Highlight, Mintel’s free publication for unique insights.