Are public advert tech corporations completely screwed?

“Um, would you like the brief reply?” mentioned Rocco Strauss, a companion at unbiased fairness analysis agency Arete Analysis.

“As a result of the brief reply is … sure,” Strauss mentioned.

Though upfront commitments for the second half of the yr could delay the inevitable, platform privateness adjustments and recession fears will begin having a severe impression on advert spending within the close to time period.

Simply have a look at the quite unlucky current earnings experiences from Meta, Snap, Pinterest and Twitter. However smaller advert tech corporations are additionally feeling the stress.

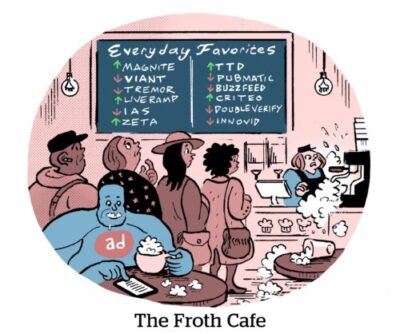

As Arete identified in a current analysis be aware, all 15 of the advert tech corporations that went public since 2020, together with Viant, AppLovin, AdTheorent, AcuityAds, Zeta World, Taboola and Outbrain, are beneath their IPO value, some by as a lot as 90%.

Extra screwed vs. much less screwed

However though public advert tech corporations as a broad class are on a foul highway, there may be some nuance when it comes to how they’ll be affected by the financial downturn, sign loss on cell and the eventual phaseout of third-party cookies.

“There are some outright ‘zeroes’ and a few which have a bit extra time to determine a approach to survive,” Strauss mentioned.

Firms like Criteo and The Commerce Desk may get hammered (though not this previous quarter, to be truthful; TTD’s inventory was up 15% after reporting its Q2 earnings). However the third-party cookie delay in Chrome provides them no less than one additional yr to generate money tied to third-party cookies whereas concurrently doing their finest to vary the wheels on their respective shifting buses.

Criteo’s investments in commerce media could present a security internet, and the corporate can nonetheless rely closely on income from its retargeting enterprise, which stays viable so long as third-party cookies can be found, within the interim.

In the meantime, The Commerce Desk made a lot hay final yr when Wall Avenue briefly rekindled its on-again, off-again (principally off-again) romance with advert tech shares that its worth can fall precipitously and the corporate will nonetheless be principally high quality.

Proper now, The Commerce Desk has a market cap of round $27 billion, which is down by greater than $10 billion since late 2020, but it surely may fall one other 50% to 70% and nonetheless be larger than it arguably must be, mentioned Richard Kramer, managing director and founding father of Arete.

The larger query, Kramer mentioned, is whether or not entire swathes of lesser advert tech – the numerous SSPs, DSPs and information suppliers on the market – will have the ability to survive in the long run.

The larger query, Kramer mentioned, is whether or not entire swathes of lesser advert tech – the numerous SSPs, DSPs and information suppliers on the market – will have the ability to survive in the long run.

“I’d argue that many of those corporations will go extinct,” he mentioned. “It’s going to be a bit like ‘The Starvation Video games,’ the place three or 4 make it by means of to the opposite facet and the remaining simply get … yeah. The long-tail goes to get chopped.”

The ‘different’ headwind

After which there’s the carnage that’s about to go down within the cell ecosystem with the approaching rollout of a beta model of Android 13 later this month.

The primary reduce – Apple’s ATT – was the deepest. Meta and cell advert tech corporations are nonetheless reeling.

However the launch of Android 13, which is able to embrace parts of the Android Privateness Sandbox, will foment additional chaos.

Take the SDK Runtime API, which is able to create a separate surroundings for third-party SDKs to run in, primarily reducing off an SDK’s potential to assemble in-app information that it doesn’t have permission to gather.

For some, the one-two punch of sign loss from gadget IDs coupled with the SDK Runtime API will land a severe if not deadly blow, Strauss mentioned. Utilizing an SDK to suck up information for focusing on functions gained’t be attainable on Android gadgets anymore.

If that’s the case, why aren’t we listening to extra individuals speak about Android 13 as a lot as they discuss in regards to the finish of third-party cookies in Chrome, a subject that has jammed the airwaves since January 2020?

“It’s as a result of this principally impacts a bunch of smaller, shady cell advert networks – they’re those which might be going to get choked off when SDK Runtime is available in,” Kramer mentioned.

However what a few massive public firm like AppLovin, which simply introduced its bid to merge with Unity (and scupper Unity’s deliberate acquisition of ironSource within the course of)?

With out some form of carveout for mediation, SDK Runtime may actually mess with AppLovin’s MAX enterprise, amongst different issues.

Kramer isn’t one to mince his phrases.

“It completely impacts them, however who cares about AppLovin?” he mentioned. “They’re a giant firm, certain, however within the grand scheme of issues, probably not.”

Not impressed

Effectively then, what to make of AppLovin’s supply to purchase Unity for $20 billion?

The bears contemplate it to be a Hail Mary of kinds to keep away from a inventory plunge tied to lowered steering.

“We see AppLovin’s bid for Unity as one other try by cell advert networks to ‘huddle collectively’ and ‘bury the unhealthy information’ of underlying steering cuts,” Kramer wrote in a be aware to traders on Tuesday.

AppLovin reduce its 2022 gross sales steering for its first-party apps enterprise on Tuesday. (The projected vary is now between $1.7 billion and $1.85 billion quite than between $2 billion and $2.15 billion.)

Though AppLovin solely lowered steering for apps and never for software program, Kramer predicts that this might be a harbinger of bother forward for AppLovin’s software program options enterprise.

And the forecast does name for the headwinds to proceed.

AppLovin’s software program biz is uncovered to sign loss from Apple’s privateness adjustments (properly, who isn’t?) and in addition from the APIs underneath building within the Android Privateness Sandbox.