You open up your banking app and see an odd deposit marked “ACH credit score.” Are you being scammed? Can you retain the cash? And do you want to do something particular to get it?

Take a deep breath. Although you may not acknowledge the title, an ACH credit score is definitely one of the crucial widespread types of digital funds switch in America. In truth, yours is certainly one of 29.1 billion funds made on the ACH community per 12 months, in response to Nacha.

As we speak, we’ll check out what ACH credit are, and the way you should utilize them to ship and obtain cash. We’ll additionally cowl how your corporation can lower your expenses by utilizing ACH, and tips on how to get began right now.

What’s an ACH credit score?

An ACH credit score is a sort of digital fee. It makes use of a pc community known as the Automated Clearing Home to “push” cash from the sender instantly into the recipient’s checking account. It’s mostly used for direct deposit paychecks, on-line tax refunds, or peer-to-peer funds.

ACH funds enable banks (or fee service suppliers) to switch cash from one account to a different, with out utilizing checks, bank cards, or money. This makes them extraordinarily helpful for repeat transactions, like payroll or recurring month-to-month funds.

ACH Credit score vs ACH Debit

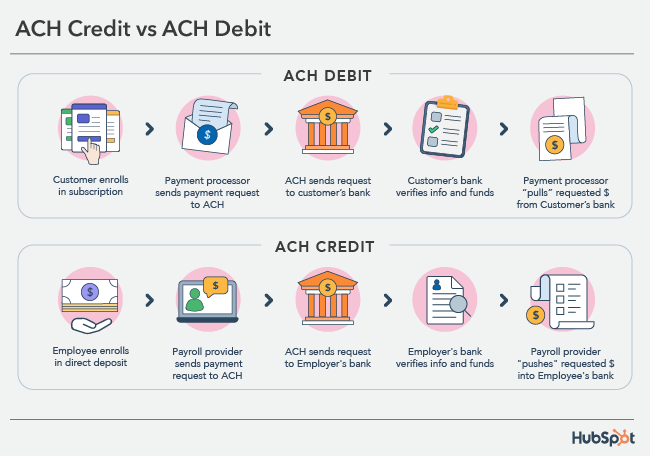

ACH funds are available in two flavors; credit score or debit. The distinction between the 2 lies in who initiates the transaction, and whether or not they’re “pushing” or “pulling” the cash in your account.

- An ACH credit score is initiated by the sender, and “pushes” cash into the receiving account. An instance of an ACH credit score is a direct deposit paycheck.

- An ACH debit is initiated by the recipient, and “pulls” the cash from the sending account. An instance of an ACH debit is an auto-pay invoice or a month-to-month subscription.

Needless to say not all on-line invoice pay or subscriptions are dealt with through the ACH community. They could additionally use bank card, debit card, or wire switch. Why does that matter? ACH funds are typically safer, cheaper, and extra simply reversible.

If the transaction asks on your checking account or checking info, as a substitute of your credit score or debit card, it’s in all probability utilizing the ACH community.

Are ACH credit secure?

It could appear uncommon when a enterprise asks on your banking particulars, however ACH funds are literally one of many most secure types of on-line fee. In truth, the Federal Reserve discovered that ACH credit have the bottom charge of fraud by worth. Which means it’s even safer than coming into your bank card info.

In fact, you need to all the time use warning when coming into your private info on-line. Stick with trusted web sites that use up-to-date strategies of safety.

As a enterprise proprietor, make sure to select a fee processor that gives safe fee entry and retains your prospects’ knowledge encrypted.

What do ACH credit value?

There’s sometimes no value to obtain an ACH credit score, however there could also be charges concerned in the event you’re the one sending it.

The price of sending an ACH credit score is dependent upon the fee processor your corporation makes use of. These prices could embrace:

- A flat price per transaction. These usually run between $0.20 – $1.50.

- A share of the transaction. Usually 0.5 – 1.5%.

- A mix of the above.

For instance, PayPal prices 3.49% plus $0.49 per transaction for ACH invoicing. On the opposite finish, with HubSpot Funds you pay 0.5% of the transaction quantity, capped at $10 max.

Remember that some fee processors can also cost month-to-month service charges or preliminary setup prices. Ensure to check whole prices when contemplating a fee supplier.

How lengthy do ACH credit take to course of?

Should you’re on the receiving finish of an ACH credit score, it’s in all probability already in your checking account by the point you heard about it.

Should you’re the one initiating an ACH credit score, most specialists advocate to finances for 3-5 enterprise days for the standard ACH transaction. ACH guidelines require credit to be processed inside 1-2 enterprise days, however that is dependent upon when the request was obtained. It additionally doesn’t embrace weekends or holidays.

Some ACH credit could also be eligible for same-day or next-day processing, so you need to ask your fee supplier about these providers.

Find out how to Use ACH Credit (as an Particular person)

People aren’t sometimes capable of ship ACH credit. Normally, a person making a fee by way of ACH is definitely authorizing an ACH debit.

To obtain an ACH credit score, you’ll want to supply the sender with the identical info you’d discover on a paper verify. This consists of your:

- Identify

- Routing quantity

- Checking account quantity

Should you’re making a fee as a substitute (an ACH debit), you’ll additionally present an authorization for a sure greenback quantity.

Both approach, the enterprise ought to give you a safe technique to enter in these particulars.

Find out how to Use ACH Credit (as a Enterprise)

To get began sending ACH credit, you’ll want a service provider account or third-party fee processor. Many instances that is already dealt with by your bank card processor, payroll providers supplier, and even your invoicing software program.

Should you’re simply getting began with fee processing for the primary time, there’ll be a brief software course of. For instance, with HubSpot Funds, most accounts are able to to start making funds inside 1-2 enterprise days.

As soon as your account is permitted, you’ll want a method to securely gather the recipients’ banking particulars. That is often dealt with by way of a fee gateway that’s offered by your processor. A fee gateway is a chunk of software program that sometimes takes the type of a fee portal or checkout cart.

After you’ve bought your fee processor and your fee gateway, you’re all set to begin making ACH credit.

Credit score The place Credit score Is Due

As a recipient, you possibly can relaxation simple that the ACH credit score in your account is a trusted type of fee.

As a enterprise, you possibly can lengthen that very same belief to your prospects by providing ACH as an possibility. ACH funds are secure, easy, and may prevent cash.