Estimated learn time: 10 minutes, 44 seconds

When managing worldwide recurring funds, there are three overarching concerns:

- Staying updated with native tax legal guidelines and transaction rules

- Making it very easy for patrons to make the preliminary buy and join recurring funds

- Guaranteeing every subsequent cost goes by way of

Whereas this may increasingly sound easy, there’s a plethora of things to think about to realize these three targets together with:

- Foreign money conversion charges

- Most well-liked cost sorts

- Fee processing

- Tax assortment and remittance for every nation, state, territory, and many others.

- Fee failure dealing with

- Fraud prevention

- Subscription administration

- Website translations

- Chargebacks

- Dunning course of

- And rather more

Most recurring cost suppliers solely assist you with a number of of those classes and go away the remaining so that you can determine. For instance, some cost resolution suppliers will assist you course of funds in foreign currency however gained’t assist you pay your taxes in these international locations.

In distinction, our resolution, FastSpring, acts because the Service provider of File for SaaS firms which suggests we deal with all of this for you.

On this article, we cowl what it means to be a Service provider of File and the way FastSpring:

Should you’d prefer to see how FastSpring handles all the things from forex conversions to end-of-year taxes for you, join a free account or request a demo right this moment.

What It Means to Have FastSpring as Your Service provider of File

A Service provider of File (MoR) is the enterprise entity that sells items or companies to the client. The MoR is answerable for each facet of a transaction together with gathering and processing cost particulars, safety, taxes, compliance points, chargebacks, audits, and many others. If one thing goes flawed or is finished incorrectly, the MoR will assist resolve the difficulty in your behalf.

Firms can act as their very own MoR and deal with all of this internally or they’ll outsource your complete course of to FastSpring and allow us to tackle full legal responsibility for every transaction. When FastSpring is performing as your MoR, you management the product/service, checkout expertise, and branding — we deal with all the things else, particularly taxes, authorized compliance, bank card community approval charges, dunning, and extra.

Let FastSpring Deal with the Assortment and Remittance of Gross sales Tax and VAT

It was once true that SaaS and software program have been exempt from many tax legal guidelines all through the world (or simply not a significant goal for audits). However tax rules concerning digital gross sales are altering and being extra strongly enforced.

Each nation, state, province, territory, and many others. that you just do enterprise with has its personal legal guidelines concerning the quantity and kind of taxes that have to be collected and when it must be paid. And that’s rather a lot to maintain up with.

Be aware: Study extra about how world tax compliance can affect your organization’s valuation and extra in our deep dive on world software program tax compliance.

Usually, world tax administration requires utilizing a cost processing platform and a tax compliance software program to calculate and accumulate gross sales and VAT taxes on every transaction. Whereas some cost platforms will accumulate taxes for you, you’ll nonetheless be answerable for remitting these taxes. Should you don’t pay the correct quantity of taxes, you could find yourself owing hundreds of {dollars} in penalties and curiosity. However determining methods to pay taxes in every jurisdiction is commonly very time-consuming and usually requires a workforce of accountants and tax professionals.

When FastSpring is your MoR, we accumulate and remit consumption tax (together with GST, VAT, SST, and many others.) for each transaction and file all mandatory tax returns for you.

FastSpring routinely calculates and provides the required taxes to the customer-facing worth at checkout. We additionally help tax-exempt transactions and different particular instances.

Effortlessly Keep in Compliance with Native Legal guidelines and Laws

Identical to taxes, every nation, state, territory, and many others. additionally has its personal legal guidelines and rules for a way recurring transactions happen. For instance, the Reserve Financial institution of India limits automated recurring funds to ₹15,000 INR. If a cost is over that quantity, the client has to manually approve the transaction with further issue authentication (AFA) corresponding to a one-time password (OTP). To adjust to this RBI regulation, you additionally must file an e-mandate that outlines the kind of AFA you’ll use.

This is only one of many examples of the sorts of rules you need to think about when transacting globally.

Staying updated with the native rules of every jurisdiction may be time-consuming and dear. Should you don’t have the right procedures in place, you gained’t have the ability to accumulate funds. Some cost platforms will assist you keep on high of native legal guidelines and rules by notifying you in the event that they study new legal guidelines or rules. Nevertheless, your group is in the end held answerable for figuring out about and following all legal guidelines and rules.

However for FastSpring prospects, this isn’t a priority as a result of as your MoR, we assume full legal responsibility for adhering to native transaction legal guidelines and rules. Our workforce of authorized specialists keep updated on all related legalities and ensure all the required procedures are in place for amassing funds.

FastSpring is absolutely compliant with the EU Normal Knowledge Safety Regulation (GDPR) and the California Shopper Privateness Act (CCPA). Moreover, we renew our stage one certification (which is the very best stage doable) with the Fee Card Business Knowledge Safety Customary (PCI DSS) yearly.

Scale back Involuntary Churn with Computerized Fee Retries and Buyer Notifications

Since involuntary churn is without doubt one of the foremost methods subscription-based firms lose prospects, many firms have a system for routinely retrying failed funds or notifying prospects of failed funds. It is a good place to begin, however the subsequent step is to inform prospects of soon-to-be-expired cost sorts earlier than the cost and to comply with up a number of instances after a failed cost. Nevertheless, it may possibly take a whole lot of worker hours and energy to keep up these programs.

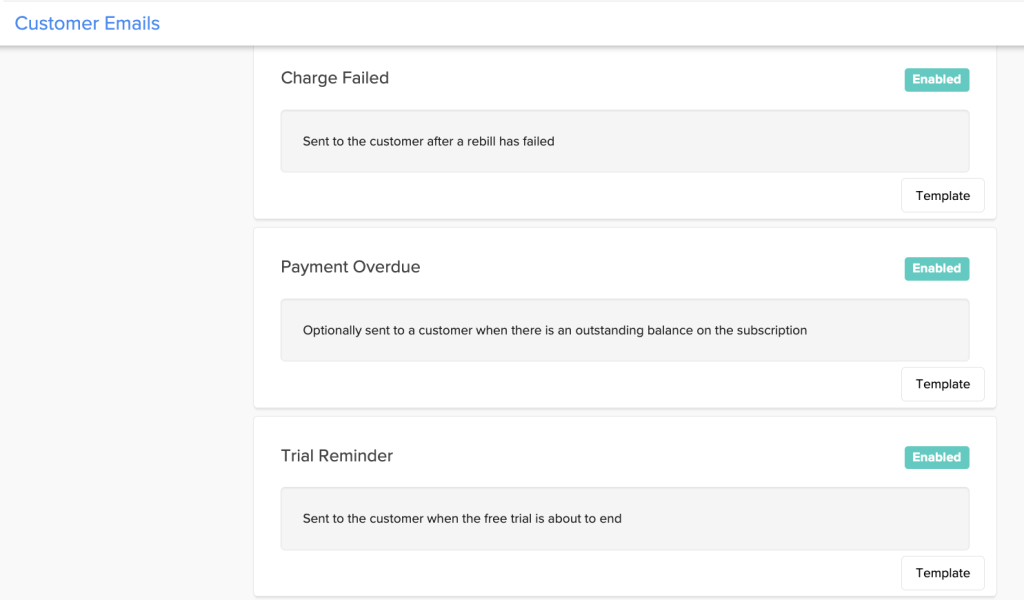

That’s why FastSpring handles all cost failures and buyer notifications for our prospects.

FastSpring sends out electronic mail reminders to cardholders when their card is about to run out to allow them to replace the main points earlier than the cardboard cost goes by way of. FastSpring additionally routinely retries failed funds. If the cost continues to fail, FastSpring will instantly notify the client. You may also select to have us ship out reminder emails two, 5, seven, fourteen, and twenty-one days after their cost technique fails. In our expertise, these alerts and reminders can considerably lower the extent of involuntary churn.

Throughout this time, your buyer’s service gained’t be disrupted. By persevering with the service, the client might be much less more likely to let the subscription lapse and extra more likely to take the time to replace their info.

You may also select to pause moderately than cancel their service in the event that they fail to replace the cost info. This makes it simpler in your buyer to restart their subscription with out the effort of onboarding once more.

Through the use of FastSpring, one in all our prospects was capable of scale back churn by 50%. Study extra about how he did it.

Make It Actually Straightforward for Clients to Purchase with Most well-liked Fee Strategies, Localized Transactions, Translations, and Extra

Friction on the buy step may cause firms to seize much less prospects than they in any other case would have. For worldwide prospects, there may be many causes of payment-related friction. For instance:

- You don’t provide their most popular cost technique

- The textual content at checkout isn’t in a language they perceive

- The worth isn’t listed of their native forex

- The transaction will get declined or takes too lengthy to finish

FastSpring helps you overcome these challenges by:

- Accepting many alternative cost strategies (and managing these cost choices in order that transactions are shortly licensed)

- Translating your checkout web page(s) to many alternative languages

- Changing costs to native currencies

We cowl this in additional element within the following sections.

Most well-liked Fee Strategies

Completely different types of cost are fashionable in several international locations. Should you don’t provide types of cost that sure patrons are used to, you’ll convert much less of them to prospects. That’s why it’s vital to make sure your cost resolution can help all of the types of cost that your goal prospects are most aware of. Nevertheless, many worldwide cost options might be very restricted within the sorts of funds they help.

For instance, some cost service suppliers will solely help debit transactions. In case your goal prospects are used to paying with bank cards or e-wallets (e.g., PayPal), this might be an issue.

Moreover, if you wish to settle for worldwide funds, you even have to think about the selection of bank cards utilized in completely different international locations. For instance, whereas MasterCard and Visa bank cards are generally utilized in the USA, UnionPay is extra frequent in China.

Nevertheless, including and managing fashionable cost strategies is extra sophisticated than including their emblem to your checkout display. Every card issuer has completely different tolerance ranges for fraud and chargebacks and completely different guidelines for a way a transaction takes place. Should you aren’t in compliance with these necessities, the cardboard community could cease authorizing funds altogether.

FastSpring is compliant with main bank card networks world wide, which suggests you’ll be able to simply settle for funds in almost any nation and we handle chargebacks and fraud for you.

FastSpring additionally helps fashionable debit and e-wallet cost strategies together with:

Lastly, card networks usually tend to authorize domestically processed funds the place the client’s financial institution and the vendor are each in the identical jurisdiction (for instance, a purchaser in Germany shopping for from a enterprise additionally in Germany). FastSpring works with a number of buying banks throughout the globe and is all the time working so as to add extra. Since we promote in your behalf as a MoR, extra of your organization’s transactions might be processed domestically which suggests extra funds might be accredited.

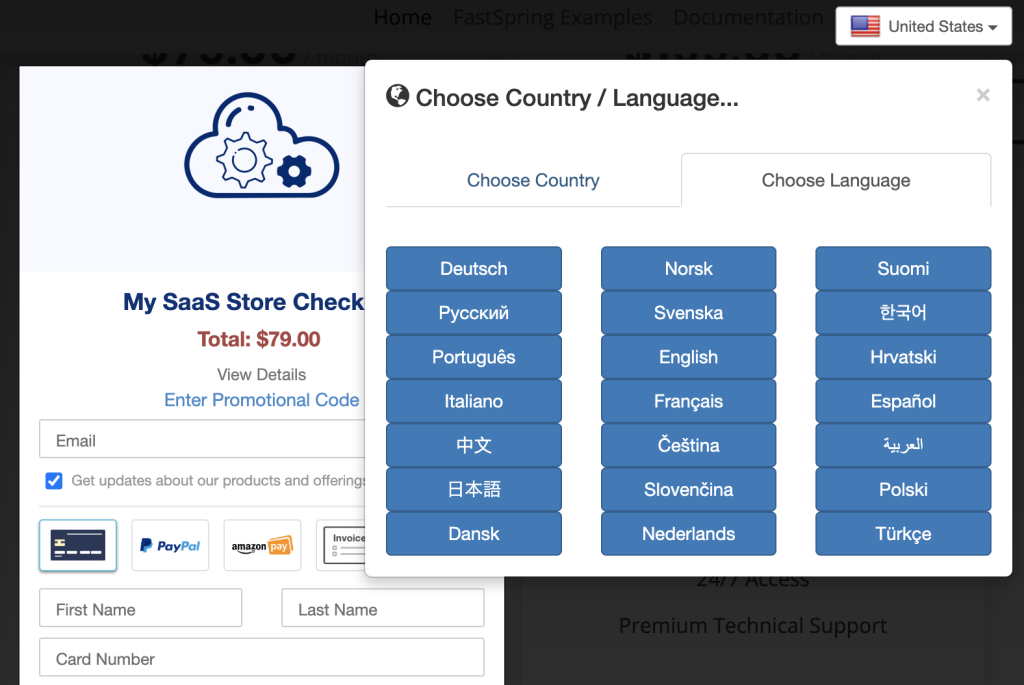

Computerized Foreign money Conversions and Language Translations

Clients usually tend to belief a checkout expertise supplied of their native language and forex. So, for those who haven’t translated your checkout textual content or transformed your costs to the native forex, you’ll seemingly lose potential prospects.

With FastSpring, you’ll be able to translate your purchasing cart into completely different languages and routinely convert the customer-facing worth to native currencies.

For purchasing cart translations, you’ll be able to:

- Let every purchaser choose their most popular language from a dropdown menu.

- Lock the language and FastSpring will routinely choose the suitable language based mostly on the client’s location.

Additionally, you will have two choices for forex conversions:

- Let FastSpring routinely convert costs to the native forex. FastSpring makes use of OANDA for change charges and we replace costs 4 instances per day. (Contact our gross sales workforce for info on markup charges.)

- Set your individual worth for every forex. Our workforce may help you identify what the mounted worth ought to be.

Should you select to let FastSpring convert product costs for you, we match the overall format of the worth. For instance, in case your base worth is $19.99 and the conversion to Euros is €20.29, FastSpring would change it to €20.99.

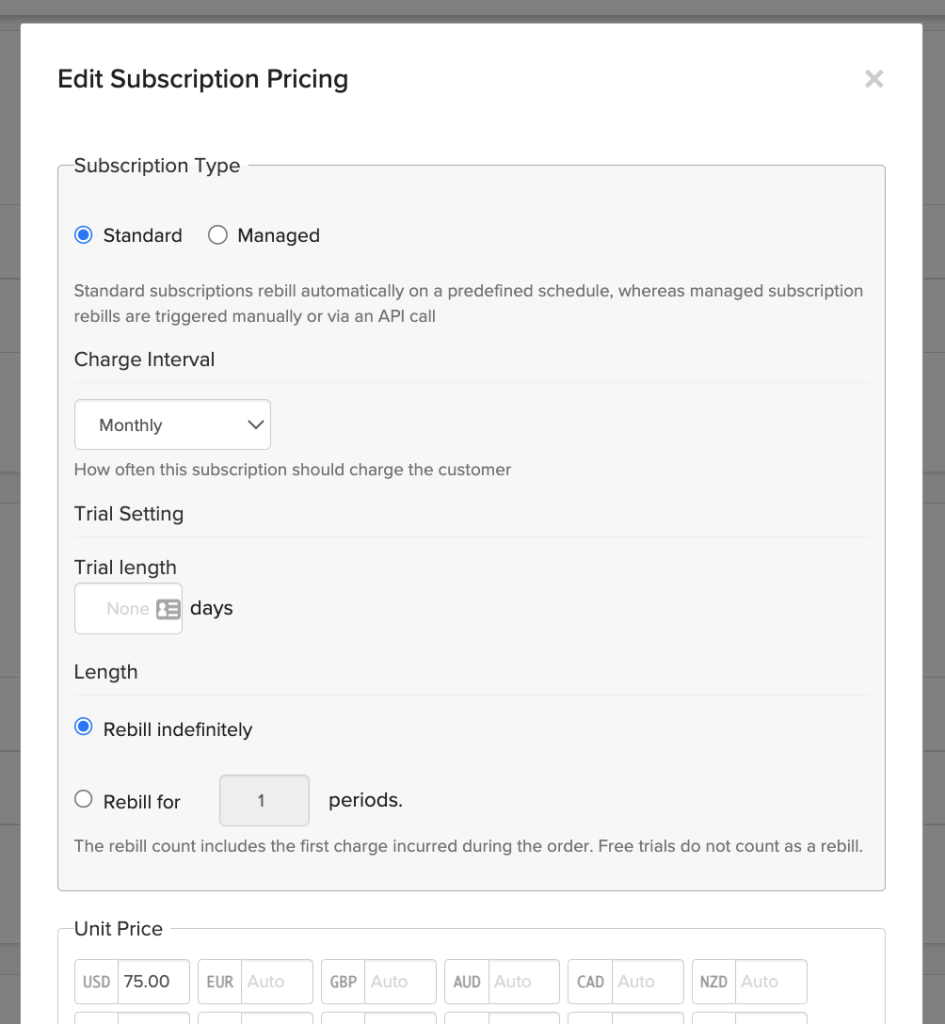

Customise Your Subscriptions and Let FastSpring Handle the Relaxation

FastSpring gives all of the instruments it’s essential create and handle several types of recurring on-line funds. Listed below are a number of examples of the sorts of recurring funds you’ll be able to handle with FastSpring:

- Free trial durations with or with out gathering cost info upfront

- Prorated subscription funds

- Variable billing intervals

- Paused subscriptions

- Improve renewals

- Pay as you go recurring billing

- Subscription bundled with a one-time buy at enroll

- And extra…

It’s straightforward to arrange almost any subscription situation with just some clicks. You possibly can arrange most subscription sorts with none code, however you can even create extra advanced subscription logic by way of our API and webhooks library.

All-in-One Pricing (No Hidden Charges)

Many cost system suppliers will cost a base worth for every transaction after which cost further for every further characteristic (e.g., entry to worldwide card networks, specialised subscription logic, and many others.). Any such pricing makes it troublesome to know what you’ll be paying. It may possibly additionally make it troublesome to scale globally as your corporation grows as a result of the fee will proceed to extend as you want extra options.

FastSpring doesn’t cost further for every characteristic. As an alternative, our workforce will work out a easy, flat-rate worth that offers you entry to each facet of FastSpring. Your worth is predicated on the quantity of transactions you progress by way of FastSpring, and also you’ll solely be charged when transactions happen.

FastSpring is extra than simply subscription administration or cost processing — we’re your Service provider of File. To see how we may help you shortly develop globally, join a free account or request a demo right this moment.